The Best Term Life Insurance Companies

There can be a lot to consider when shopping for life insurance. Cost and ease of application might sway your initial decision but does that make it the best choice?

When it comes to life insurance, the concept might seem so complicated that you may not feel like shopping around. Maybe you just take the policy your company offers, and call it a day. But here’s the deal. Employer life insurance coverage is not likely enough to cover your family’s actual needs.

So you may need to shop around for additional life insurance coverage of your own.

And that brings us to today’s topic. What are the best life insurance companies? Before answering that question, let’s first look at factors you should consider when making your choice.

From there, you’ll choose whether to purchase your term life insurance through an online life insurance provider or a traditional brick-and-mortar life insurance provider. There are advantages and disadvantages to each. But if you fit within the specializations of the policies offered by online providers, you can purchase a very large policy at the lowest premium rate–often without a medical exam–in a matter of just minutes.

| Online Life Insurance Providers - Summery | |||

| Company | Key Feature | Quote | Full Review |

| Bestow | No doctors, no hassle, no agents. Starting at $16/month | Get Quote | Learn More |

| Policygenius | No hidden fees, smart customization algorithm | Get Quote | Learn More |

| Leap Life | Only top A-rated insurers | Get Quote | Learn More |

| Haven Life | No medical exams, quick and friendly process | Get Quote | Learn More |

| Ethos | Simple and affordable life insurance policies | Get Quote | Learn More |

- Term vs. Whole Life Insurance

- What is Term Life Insurance?

- How Does Term Life Insurance Work?

- What Does Term Life Insurance Cover?

- At What Age Should You Buy Life Insurance?

- Term Life Insurance Rates

- Our Picks for the Best Life Insurance Companies

- Online Life Insurance Providers

- “Brick n’ Mortar” Life Insurance Companies

- Which Life Insurance Company Should You Choose?

Term vs. Whole Life Insurance

This guide is obviously about term life insurance, but the best way to understand that type of policy is by knowing how it compares with its popular cousin, whole life insurance.

Term is sometimes referred to as pure life insurance. That’s because it provides a life insurance death benefit only. By contrast, whole life insurance comes with a cash value accumulation provision. You’ll pay a much higher premium for whole life, with some of that premium going toward the cash value. As the cash value grows, you can borrow against it. And if it gets high enough, you can even use it to pay the premiums on the remaining years of your policy.

As you might expect, whole life is a lot more expensive than term. And not just by a little. The typical premium on a whole life policy can easily be 10 times higher than for a comparable amount of term life insurance.

Whole life insurance is best suited to those who want to combine life insurance coverage with a savings provision. However, nearly every expert on the subject will readily admit whole life insurance is a poor investment choice. You can do better by purchasing low-cost term life insurance and investing the difference in index funds (“Buy term and invest the difference”).

But whole life does have one advantage that term doesn’t – it’s permanent coverage. As long as you make your premium payments, your policy can never be canceled. Term, on the other hand, expires at the end of the stated term. But many term policies also offer various renewability options.

What is Term Life Insurance?

Term life insurance is the simplest form of life insurance coverage. You’ll pay a small premium and get a death benefit in exchange. Most term policies don’t provide the features typically available with whole life insurance or other cash value life insurance products.

It can be said that term life insurance is for those who cannot afford cash value life insurance. Since it’s so much less expensive than whole life, you can purchase a lot more coverage.

For example, you may be able to buy a $1 million term life insurance policy for less than half what it will cost you for a $250,000 whole life policy.

The cost advantage is a big one for young families and those with large debt obligations, like a mortgage. Though term life insurance is temporary, the terms are generally long enough to cover times of maximum insurance need, such as when you are raising your children or paying off the mortgage on your home.

How Does Term Life Insurance Work?

There are various terms available. The shortest is usually five years, and the longest is 30 years, though there are some shorter-term policies available.

Most term life insurance policies have level term premiums. That means your premium will remain fixed for the entire term of the policy.

At the end of the term, the policy can expire. But many, perhaps most term policies offer renewability options, at least up to a certain age.

One of the disadvantages with that renewability is that the cost of the new premium will be based on your age at the time of renewal. If you take a 30-year term policy with a low premium at the beginning, the cost will be much higher when you renew.

That’s not a scary prospect for many of the people who purchase term life insurance. After all, the need for life insurance can rise and fall during your life. For example, the parents in a young family will need a very large life insurance policy to provide for their children upon their death. But once their children reach adulthood, the need for life insurance declines dramatically. A 20- or 30-year term policy may accomplish their goal of being covered during the time of maximum need in life.

What Does Term Life Insurance Cover?

Term life insurance provides only a death benefit on the life of the insured. There are none of the other benefits that come with whole life insurance or universal life insurance, such as cash value accumulation or loan provisions.

But those provisions come at a cost, which is why so many people favor term life insurance over cash value policies.

What’s more, term policies are very flexible. In addition to purchasing a policy on your own life, you can add one for your spouse and even for your children. The low cost will make it much more doable than cash value policies.

You can even set up a term policy to match a specific obligation. For example, if you have 20 years remaining on your home mortgage, you can set up a 20-year term life insurance policy specifically to pay off the loan upon your death. And when the mortgage is finally paid off, you can simply let the term policy expire and save yourself the money on future premiums.

At What Age Should You Buy Life Insurance?

The age at which you should buy life insurance will be different for everyone. It’s mostly based on need, which can vary by age.

But as a general rule, you should buy life insurance as early in life as possible. Since your age at the time of application is a major factor in determining premiums, the younger you are when you apply, the lower your premium will be. In addition, you should apply when you are healthy, which is typically when you’re young. If you wait until later in life, and you develop one or more health conditions, the premiums will be much higher. And depending on the level of a health condition you have, it’s even possible you won’t be able to get coverage at all.

But apart from the general rule, there are times in life when buying life insurance is more important.

For example, you should purchase coverage anytime there’s a change in your family status. If you get married, you’ll want to purchase a policy to cover your spouse upon your death. And you’ll certainly want to purchase coverage upon the birth of one or more children.

There may also be certain financial events that trigger the need for life insurance. One common example is a mortgage. But that can be any type of debt, such as a private student loan or a business debt. And just the act of going into business itself may require the purchase of a new policy. At a minimum, additional funds may be needed to wind up the affairs of your business after your death.

Term Life Insurance Rates

One feature that characterizes term life insurance–and makes it such a desirable alternative to cash value life insurance, like whole life insurance–is much lower premiums.

Since term life insurance policies cover only a limited timeframe, and since they don’t involve the accumulation of cash value, they’re typically only a fraction of the cost of whole life.

Generally speaking, you can assume a term policy premium is only about 10% to 15% of a whole life policy premium with an identical death benefit.

Not only does that result in a more affordable policy, but it also allows consumers to purchase a much larger amount of coverage.

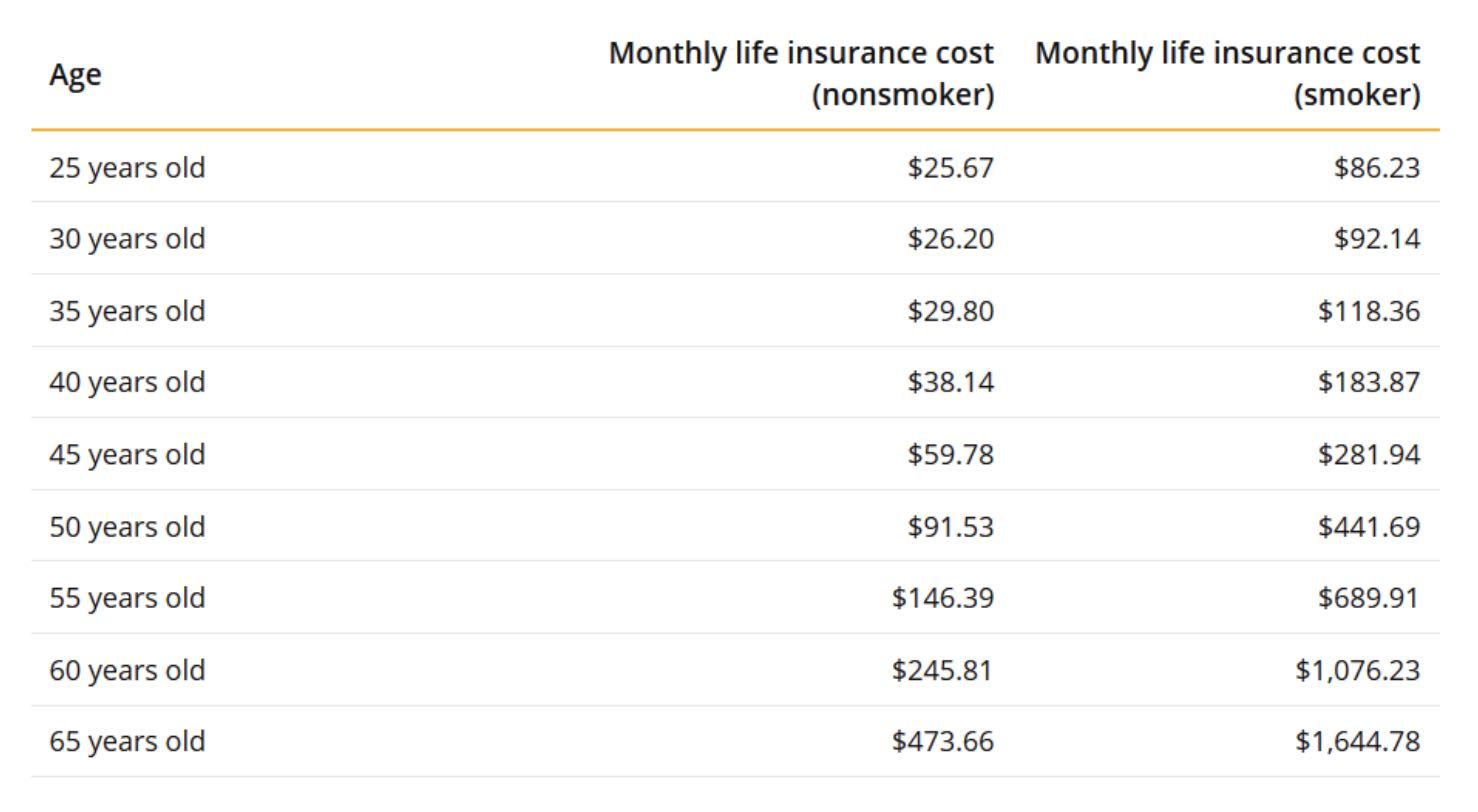

The following screenshot from Value Penguin is a sampling of term life insurance for a $500,000 death benefit on a 20-year term life insurance policy:

The above premiums are samples only. They’re for applicants who are in excellent health. The actual premium quotes you’ll receive from any insurance providers will be based on the factors unique to your own personal profile.

Our Picks for the Best Life Insurance Companies

Online life insurance providers specialize in making the application process simple and quick. You can complete the entire process online by filling out a questionnaire, then getting the results back in minutes.

Online life insurance providers do this by using artificial intelligence and third-party information sources to underwrite your policy. For example, they rely on the medical information provided by the MIB database, as well as your driving history from the Department of Motor Vehicles and income information from the Social Security Administration.

The use of technology and third-party sources enables quick decisions, often without the requirement of a medical exam. And because the application process is so streamlined, premium rates are usually lower than they are for traditional life insurance companies.

Traditional, brick-and-mortar life insurance companies typically take longer for their application processes and almost always require a medical exam. However, the advantage they provide is that they offer a full range of life insurance policies, including whole life (online providers are typically limited to term insurance only), and have the ability to provide policies for those in less than perfect health. By contrast, online providers tend to favor younger applicants in good or excellent health.

With that in mind, you’ll be best served by using online life insurance providers if you’re young and in excellent health, but turning to traditional life insurance companies if you’re older and/or have pre-existing health conditions.

Online Life Insurance Providers

Bestow

Bestow is an online life insurance platform that began operations in 2016. As an online provider, you can make an application and purchase a policy in just a few minutes.

Bestow is an online life insurance platform that began operations in 2016. As an online provider, you can make an application and purchase a policy in just a few minutes.

Policies are offered in terms of two-, 10- or 20-years, and are available for up to $1 million in coverage. The two-year policy is particularly interesting since it represents temporary coverage. This is a policy offered to bridge the gap between employer-sponsored life insurance policies when you are in between jobs. The policy can cover you from a minimum of $50,000 to a maximum of $500,000.

The limitation is that Bestow does not offer whole life insurance policies, and there are age limits for applicants, ranging between 45 and 54. In addition, you must generally be in good health, and all policies expire at age 65.

Read our full bestow review, for more information.

Policygenius

Policygenius is unique on this list because it’s not a direct life insurance provider. Instead, it functions as an online insurance marketplace. That means it includes participation from multiple life insurance providers. This will give you an opportunity to get premium quotes from several companies by completing a single online application. You’ll be able to do a side-by-side comparison of the policies offered, as well as determine the best premium for the policy offered.

Policygenius is unique on this list because it’s not a direct life insurance provider. Instead, it functions as an online insurance marketplace. That means it includes participation from multiple life insurance providers. This will give you an opportunity to get premium quotes from several companies by completing a single online application. You’ll be able to do a side-by-side comparison of the policies offered, as well as determine the best premium for the policy offered.

Policygenius is a recommended life insurance source for any consumers who have a chronic health condition, a history of major illness, or any other unusual factors in their personal insurance profiles. Many online life insurance providers specialize in providing low-cost term life insurance to younger applicants who are in good or excellent health. But those same low-cost providers aren’t usually the best choice if you don’t fit the target profile.

The insurance industry offers policies for many different types of health conditions that were not available just a few years ago. But the only way to find those policies will be to solicit quotes from multiple providers. Policygenius is very likely the single best source for such policies in the entire industry.

Just as important, Policygenius isn’t limited to life insurance policies alone. It also an online marketplace for homeowner’s insurance, renters insurance, auto insurance, and even disability insurance.

Read our full Policygenius review, for more information.

Leap Life

Leap Life is an online life insurance broker. That means your application will be matched with several participating companies on the platform, providing multiple quotes. Those companies participating on the platform are some of the biggest names in the industry.

Leap Life provides term policies, for 10, 15, 20 or 30 years. Policy amounts range from a minimum of $100,000 to as much as $5 million. Also, you’ll be eligible for coverage up to age 75. Additional coverage options include accidental death and universal life.

Though it isn’t guaranteed, there’s an excellent chance you won’t need a medical exam on a policy of less than $1 million. But you’ll usually pay a lower premium if you do agree to submit to the exam.

One of the disadvantages of Leap Life policies is that they cannot be converted to whole life insurance policies, and they are not renewable at the end of the term. And as is typical with online life insurance providers, you must generally be in good health to qualify.

Read our full Leap Life review, for more information.

Haven Life

Haven Life is another online life insurance provider that limits coverage to term life insurance only. If you need less than $1 million in coverage and you’re under 45 years old, you can apply and get a decision in under an hour.

Haven Life is another online life insurance provider that limits coverage to term life insurance only. If you need less than $1 million in coverage and you’re under 45 years old, you can apply and get a decision in under an hour.

If you are in excellent health, you can apply for their InstantTerm policy, which will not require a medical exam. It’s also possible no exam will be required even if you’re a smoker.

Haven Life term policies are renewable up to age 65, though you can still renew at higher premium rates. You can apply for up to $3 million in coverage if you’re under 60, and up to $1 million if you are over 60. Policy options include a waiver of premium for disability and accidental death. Policy terms range between 10 years and 30 years.

One of the advantages of Haven Life is that they do take applicants with pre-existing conditions. Naturally, the premiums you’ll pay for such coverage will be higher than if you were in excellent health.

Still another advantage is that Haven Life is part of MassMutual, which is one of the strongest life insurance companies in the country.

Read our full Haven Life review, for more information.

Ethos

Ethos is an all-online life insurance provider. You start by answering questions about your health and lifestyle, then the company uses data analysis from third parties to provide policy quotes in just minutes. Like other online life insurance providers, Ethos offers only term life insurance.

Ethos is an all-online life insurance provider. You start by answering questions about your health and lifestyle, then the company uses data analysis from third parties to provide policy quotes in just minutes. Like other online life insurance providers, Ethos offers only term life insurance.

For policies under $1 million, no medical exam is required for most applicants. Policies are available in terms ranging from 10 to 30 years, and for applicants up to age 65. But if you have a policy in force before turning 65, you can be insured up to age 94. The smallest policy you can apply for is $25,000, but you can go all the way up to $10 million, which is a very high policy amount for an online provider.

Ethos provides a $250,000 policy starting $11 per month, $500,000 starting at $15 per month, and $1 million starting at $23 per month. (These are 10-year term policy quotes for a healthy 35-year-old female, non-smoker).

One major advantage of Ethos is that they can provide coverage for applicants who are in less than perfect health. But on the downside, coverage is not available in New York or Florida.

Read our full Ethos review, for more information.

“Brick n’ Mortar” Life Insurance Companies

Northwestern Mutual

Northwestern Mutual makes the cut because of its incredibly high financial rating and consistently good customer service ratings. A.M. Best gives it an A++ financial rating. And consumers consistently rate it well for customer service. What that means for you is that in the event of your death, your beneficiaries should be able to quickly and easily file your life insurance claim.

Northwestern’s customer service is good in part because it’s not completely automated. This, though, can make the application process a bit hairier. For instance, you can’t get a quote online or apply online.

However, this does mean that you won’t get an incorrect ballpark quote. The price you get when you apply with an agent in person or on the phone is what you’ll pay if you qualify.

Northwestern offers a good variety of policy types, including different term lengths. It also offers annually-renewable policies. If it turns out that you eventually need permanent life insurance, Northwestern is a good option. Its term policies are convertible to permanent life insurance.

And as is typical of brick-and-mortar life insurance providers, Northwestern Mutual offers cash value life insurance policies, like whole life and universal life, in addition to term life policies.

State Farm Life Insurance

State Farm has a great customer satisfaction rating and a strong financial rating. But what really sets it apart is its robust online quote and application process. This tool walks you through every step of the process, including deciding how much coverage you actually need.

One of the strengths of this quote system, too, is that it gives you visibility into State Farm’s different life insurance policies. Once you put your information into the quote tool, you’ll be able to compare different policy lengths and types. You can also look at various riders, including a child life insurance rider or adding a second adult to your policy.

You can apply online after you get through the quote process and choose the life insurance product you want to purchase. You’ll still need to talk to an agent after your application goes through, but it does make the beginning part of the process simple.

State Farm offers term policies starting at $100,000, and for terms ranging from 10 to 30 years. They also offer a waiver of premium for disability and return of premium, where your premiums will be refunded at the end of the policy term. It’s a way of getting some benefit from a term policy you never collect on. However, there will be an additional premium paid for the return of the premium rider.

State Farm also offered the ability to convert a term policy to permanent coverage up to the later of the anniversary when the insured reaches age 75, or five years after issue. The conversion is possible regardless of the state of your health.

MassMutual

MassMutual operates a couple of subsidiaries, including Haven Life and ValoraLife. These two entities are set up specifically to move the life insurance application process online. Haven Life has consistently gotten excellent ratings since its launch, and it offers a user-friendly quote and application tool. Both Haven Life and ValoraLife offer medically underwritten life insurance, which can make your insurance cheaper if you’re in good health.

MassMutual also offers strong policies under its own name. You can get quotes directly from MassMutual online, as well, and then apply online.

Some of the term policies offered by MassMutual are convertible to permanent life insurance.

MassMutual and its subsidiary companies offer a wide variety of term life insurance products. Between them, you can likely find the one that best fits your needs. Plus, they are rated A++ by A.M. Best and have high customer service ratings.

Mutual of Omaha

This company underwrites policies by United of Omaha Life Insurance company. The company has an A+ financial rating from A.M Best. And they have generally good customer service ratings online.

One of the good things about Mutual of Omaha is that you can get a relatively small policy. Theirs start at $25,000. You can also get 10, 15, 20 and 30-year terms. When you want a smaller policy–under $100,000–you can apply online. But if you need a bigger policy, you’ll need to connect with an agent by phone.

Term policies are available for applicants up to age 80, and you can convert your policy to permanent coverage. The company also offers accidental death insurance.

Mutual of Omaha has a nice online quote tool. And you can apply online, again, if you’re purchasing one of the smaller policies.

Which Life Insurance Company Should You Choose?

There are scores of life insurance companies to choose from. On the one hand, that gives you more policy options than ever before. But on the other hand, it can be confusing.

As a general rule, you should favor applying with online providers if you are young–under 45 or 60–and in good health. You’ll not only get a policy quickly, but you’ll get the lowest premium possible, often without being subject to a medical exam.

But if you are an older applicant, or you have one or more pre-existing health conditions, you should go with traditional brick-and-mortar life insurance providers. That’s also the case if you’re looking for a more specialized type of policy, like whole life or universal life.

While online providers are set up specifically to provide low-cost term life insurance in the shortest time possible, traditional insurance companies are the better choice if you believe your application will need special handling.

Article comments

You mention in your article, “Mutual of Omaha has a nice online quote tool. And you can apply online, again, if you’re purchasing one of the smaller policies.”

Have you a link to where one may apply online? I visited their website, found their quotes attractive for term life policies for my wife and me, yet could find nowhere the means to apply for this coverage. I submitted information to be contacted by an agent, but after several days continue to await their response.

Thank you for an informative piece and for your assistance.

Hi Chris,

We really appreciate your comment.

I have looked into your inquiry and updated a link to this tool.

Mutual of Omaha quote tool

Cheers,