Origin Investments Review: Tax-Efficient Private Real Estate Funds

When the JOBS Act passed in 2012, it eased many of the restrictions surrounding real estate investing. Perhaps most importantly, it allowed private investments to be marketed to the general public for the first time.

While these changes paved the way for the “real estate crowdfunding” revolution, it also provided a growth opportunity for traditional private real estate investment firms. And Origin Investments is one of the savvy firms that took full advantage of the new landscape.

Origin had already proven itself as a successful real estate investing company before 2012, boasting impressive annual returns. But since then, it’s leveraged its website and technology to reach more investors around the world.

If you’re an accredited investor who’s been wanting to invest in private real estate, continue reading our full Origin Investments review to learn more about its features, benefits, and cost.

What is Origin Investments?

Origin Investments is a private real estate investment firm that buys and builds multi-family investment properties. Founded in 2007 by co-founders David Scherer and Michael Episcope, today the firm has over $1.3 billion dollars in assets under management.

Finally, Origin Investments is unique in that its co-founders lead the way when it comes to providing investing capital. To date, Sherer and Episcope have invested $56 million of their personal wealth into Origin’s funds.

Related: How to Invest in Real Estate Right Now

Features of Origin Investments

Throughout its history, Origin Investments has acquired 60+ properties in 11 of America’s top growing markets. Below, we take a closer look at the funds that it currently offers along with their respective benefits and targeted returns.

Open Funds

Three of Origin Investments funds (Fund I, Fund II, and Fund III) are now closed to new investors. However, as of the writing of this article, Origin has two open funds:

- IncomePlus Fund: A fund designed to combine passive income and asset appreciation.

- QOZ Fund: A fund designed to maximize tax savings.

Both funds are open only to accredited investors. That means you must have a net worth of at least $1 million or annual income of more than $200,000 (or joint spousal income of more than $300,000) per year each of the past two years.

Additionally, each fund requires a sizable minimum investment. To invest in the QOZ Fund, you’ll need to invest at least $50,000. And the IncomePlus Fund minimum investment is set even higher at $100,000.

Markets and Properties

Origin Investments acquires properties in 11 of America’s top growing markets. Those markets are:

- Atlanta

- Austin

- Charlotte

- Chicago

- Dallas

- Denver

- Houston

- Nashville

- Orlando

- Phoenix

- Raleigh

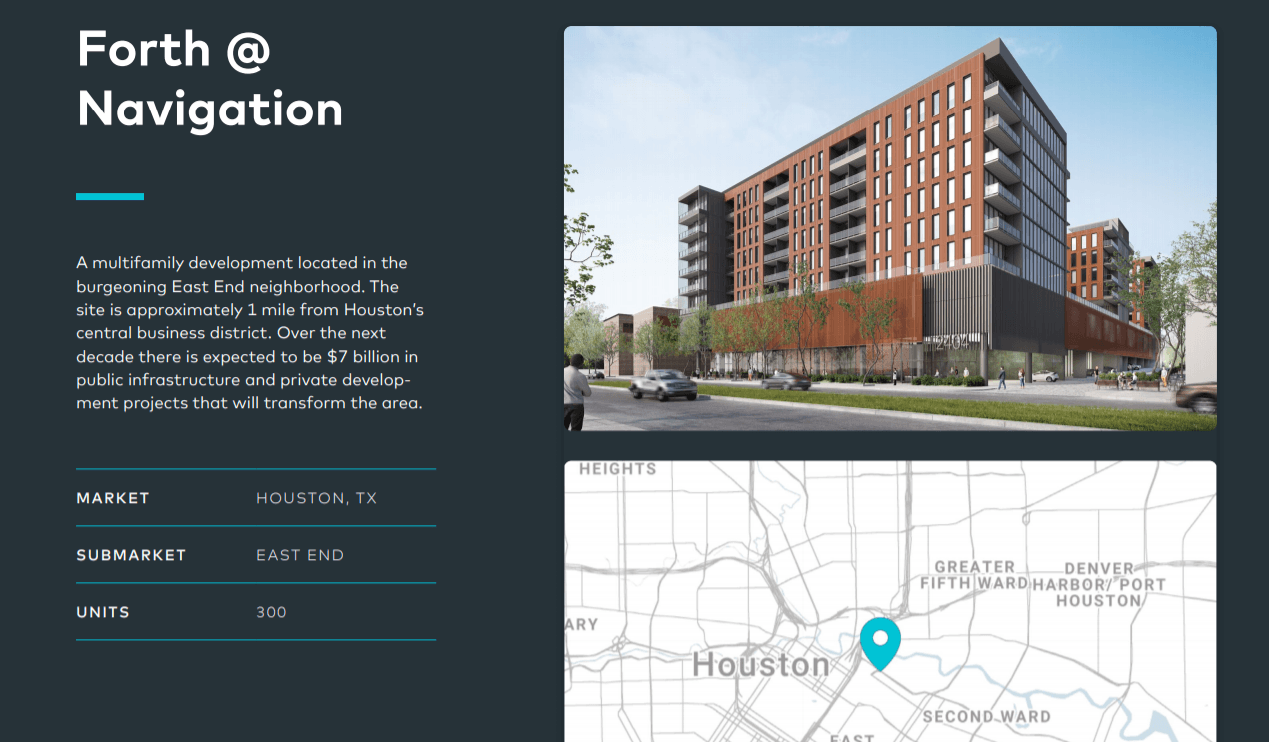

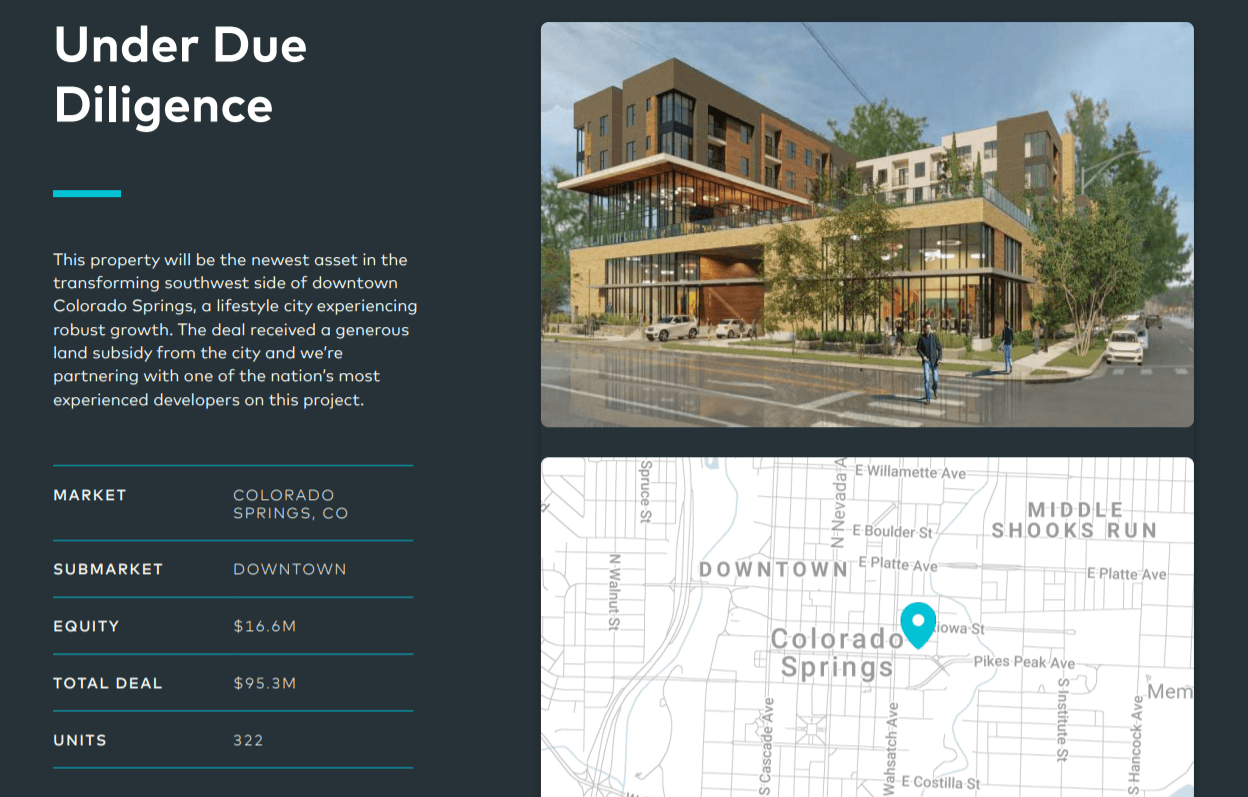

Depending on the fund that you choose, Origin will show you the exact properties that your money will be invested in. Investors are shown a picture of each property along with its key details, as shown below:

Origin spends a lot of time researching properties to evaluate its growth potential before making an acquisition decision. In fact, it says that it evaluated over 900 properties in 2019 alone. If a property is being strongly considered as an addition to one of its funds, it will be added to its fund fact sheet as “Under Due Diligence.”

Related: These Are the Best Cities To Invest in Real Estate

Tax Advantages

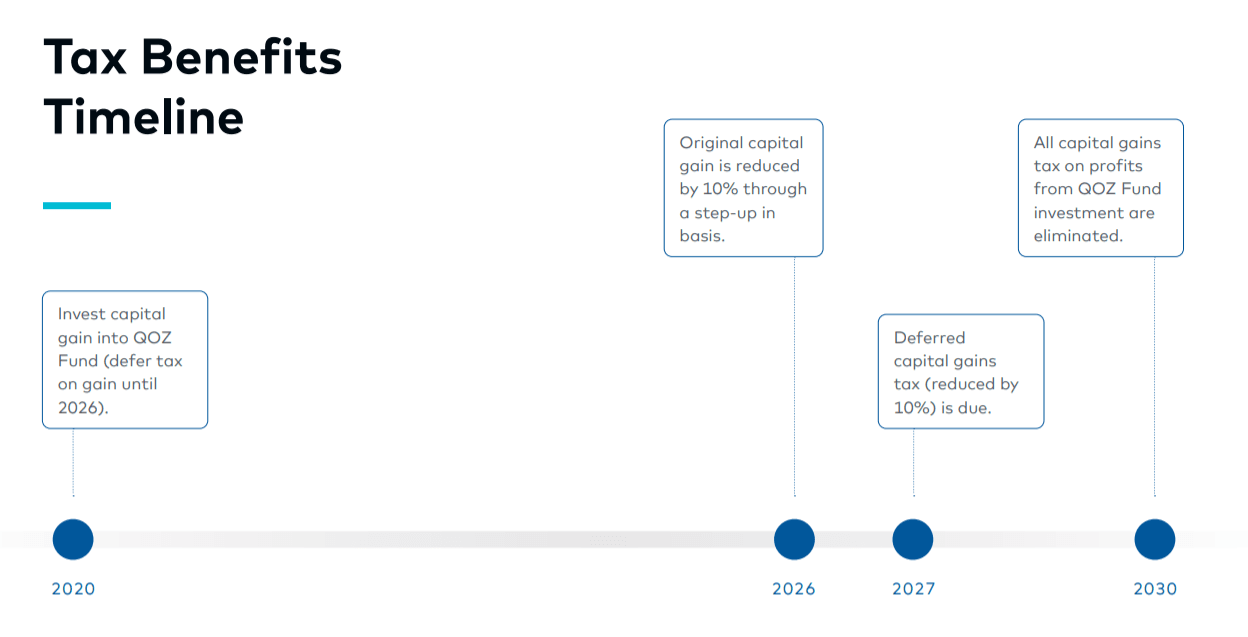

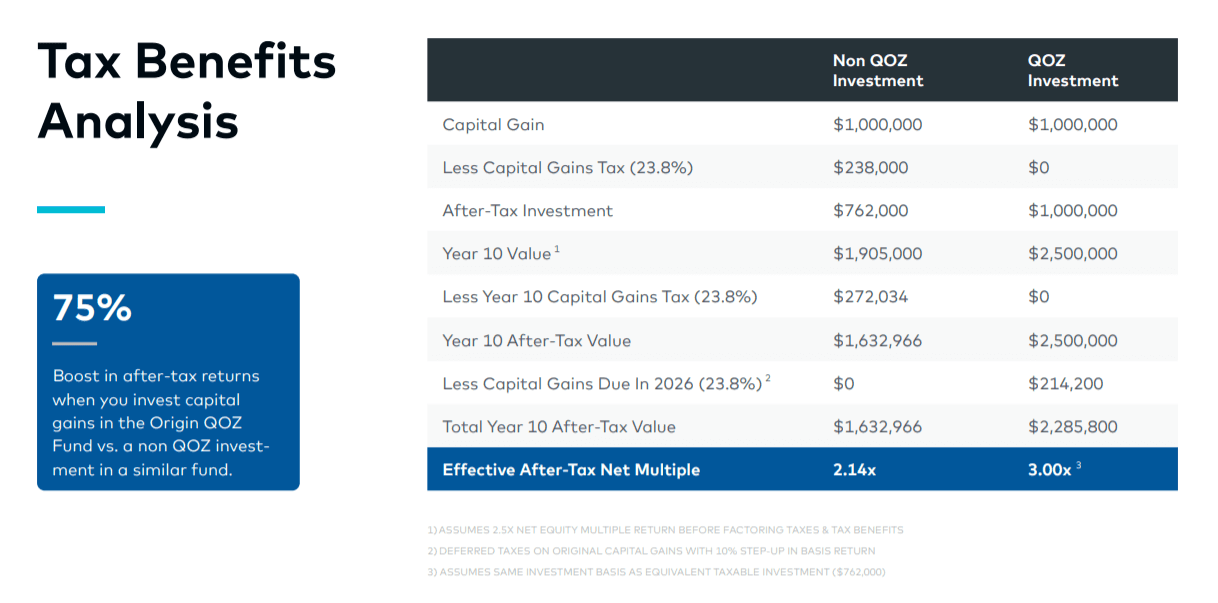

If minimizing taxes is one of your main investing goals, the QOZ fund could be a great option. Due to the Tax Cuts and Jobs Act of 2017, it allows investors to invest capital gains from previous investments into the fund and defer capital gains for seven years.

Further, those capital gains from your previous investment) due at Year 7 can be reduced with a 10% step-up in basis. Finally, there is no capital gains tax on the profits from the QOZ Fund provided that you hold onto your shares for at least 10 years. In these ways, Origin says that it can boost after-tax returns for investors by up to 75%.

However, it’s important to point out that the QOZ Fund can only provide such significant tax savings if you’ll be investing with capital gains.

If you plan to use assets other than capital gains for your initial investment and have at least $100,000 to invest, the IncomePlus Fund could be a strong choice. All of its distributions are shielded by depreciation and capital appreciation gains taxes can be deferred until you decide to sell your shares.

Related: Be Generous Now to Save on Real Estate Taxes Later

Performance

Origin Investments has a strong performance track record. To date, it has earned an average gross Internal Rate of Return (IRR) of 33% across its 20 realized deals since 2014. It also says that its previous funds (Funds I, II, and III) have incurred zero losses.

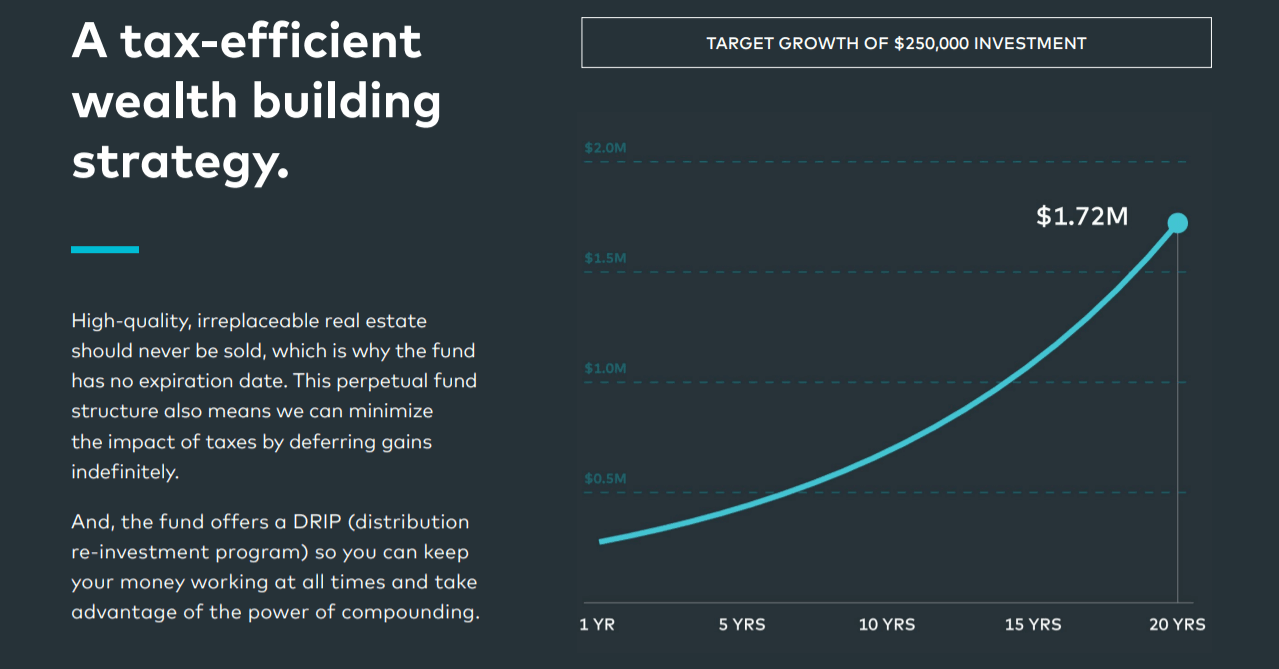

The IncomePlus fund pays a monthly distribution to its shareholders in addition to the capital appreciation of the properties. Currently, it’s target annual yield on distributions is 6% and its target asset appreciation rate is 3% to 5%.

Combined, its expected annual rate of return of 9-11%. Distributions can also be reinvested, further compounding returns over time. With full distribution reinvestment and tax advantages taken into account, Origin says that a $250,000 investment in its IncomePlus Fund could grow to $1.72 million in 20 years.

Related: Investment Strategies: Which Is The Best For Your Money?

With the QOZ Fund, Origin Investments aims for a 3.0x after-tax multiple on capital over a 10-year period. Again, these calculations assume that capital gains are used for the fund investment.

Pricing and Fees

Origin Investments charges an annual management fee of 1.25% of assets under management for both of its funds. It also charges a one-time setup fee of 0.00-2.00%, that diminishes with the size of your investment.

Further, Origin charges an acquisition fee each time it acquires a new property of 0.50% the asset price. With both funds, shares can be redeemed as soon as one year. But with the IncomePlus Fund, units that are held less than 5 years will be sold back at the following discounted rates:

- After 1 year: 10%

- After 2 years: 7.5%

- After 3 years: 5.0%

- After 4 years: 2.5%

- After 5 years: 0.0%

Finally, Origin charges a Performance Fee of all profits that exceed the fund’s preferred return. The performance fee is 10% of profits after a 6% preferred return for the IncomePlus Fund and 15% after a 7% preferred return for the QOZ Fund.

Customer Service

Origin Investments prides itself on the personal care that it gives to all of its clients. It proudly displays the name and pictures of all of its team members on its website.

New or existing customers can call to speak with someone from their investor relations team at (800) 628-8008. Other contact options include email at investorrelations@origininvestments.com or live chat on the Origin Investments website.

Security

All components of the Origin Investments platform are held to the highest industry standards for cybersecurity and data redundancy. The Origin team says that it conducts regular audits of its system to ensure that it’s protecting users’ data as best as possible. And it works with third-party security service providers when necessary.

Signing up With Origin Investments

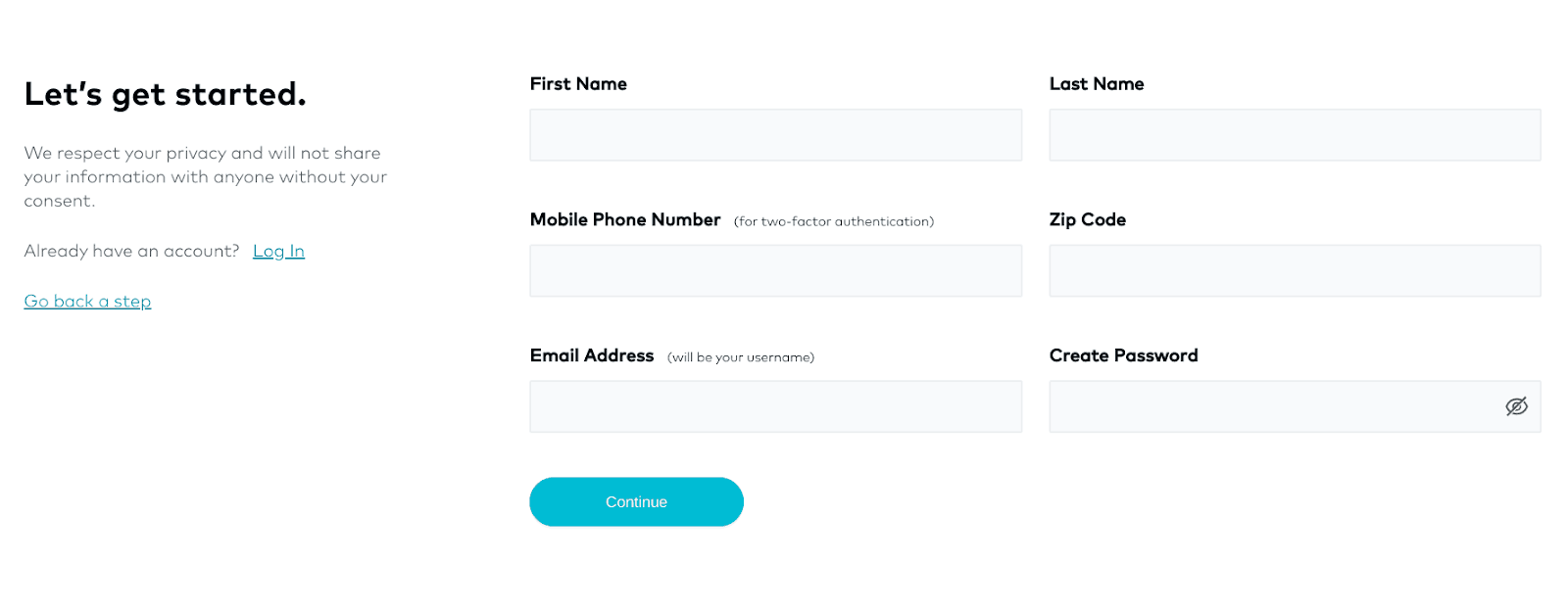

I was personally able to open an Origin Investments account in less than 5 minutes. After clicking “Get Started” from Origin’s home page, I was asked to create my account by providing my name, phone number, email, and password.

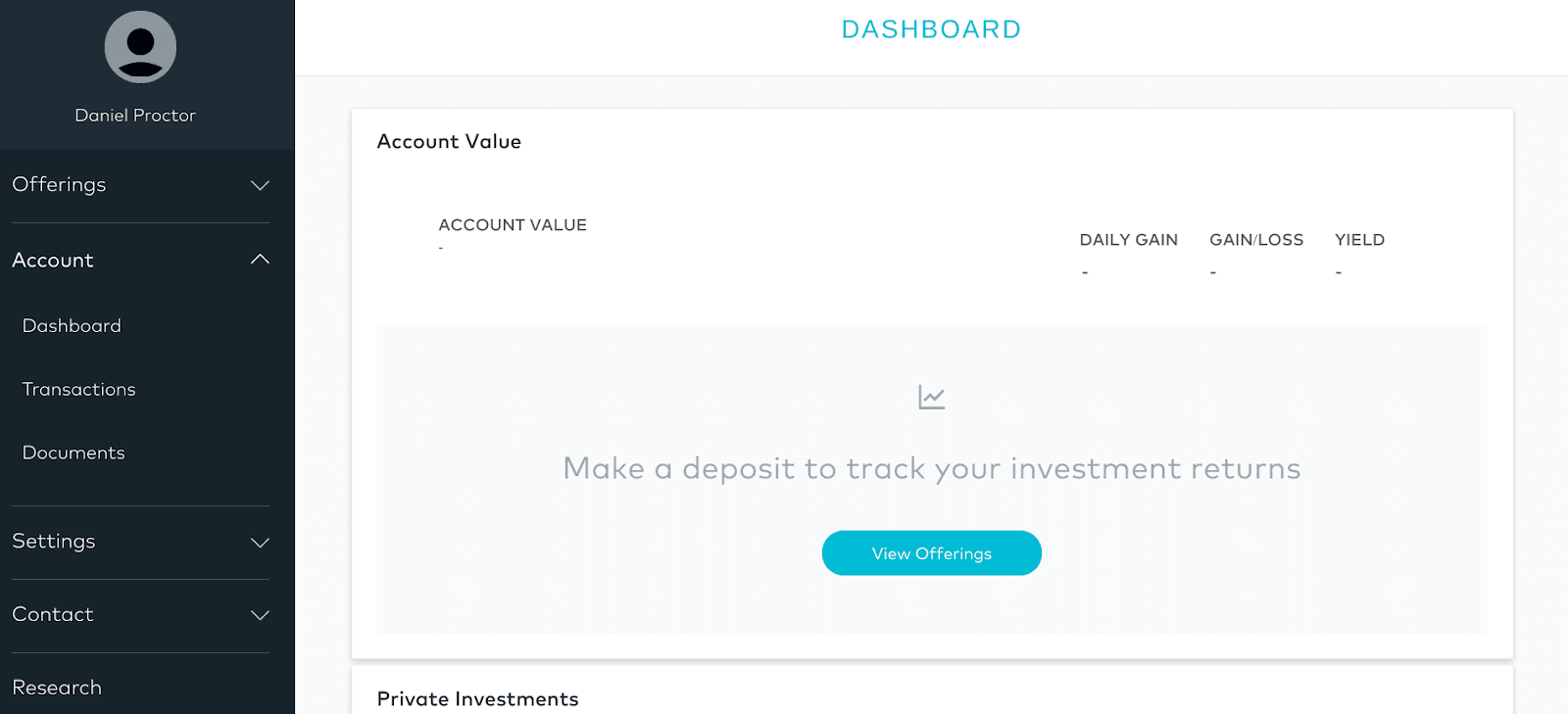

Next, I was sent a confirmation email. After clicking the link inside the email, I was able to finish setting up my account by providing a few more details about my net worth and investing goals. Two minutes later, I was looking at my personal account dashboard.

Next, I was sent a confirmation email. After clicking the link inside the email, I was able to finish setting up my account by providing a few more details about my net worth and investing goals. Two minutes later, I was looking at my personal account dashboard.

While the ease of opening an account with Origin Investments was impressive, it should be noted that you can’t actually invest money into a fund until an Origin team member verifies that you’re an accredited investor.

You don’t have to be a U.S. citizen or resident to invest with Origin Investments. However, international investors will have different income tax obligations that should be considered before making an investment decision.

Pros and Cons of Origin Investments

Pros

- Low-risk investments: Origins says that institutional real estate has never lost money over a period of 10 years or longer.

- Successful track record: The team at Origin Investments have been involved in the private real estate industry for over a decade and have averaged a gross IRR of 33% across their realized deals.

- Tax benefits: The IncomePlus Fund and QOZ Fund both offer strong built-in tax advantages. And their LLC structure allows for those tax savings to be passed through straight to the investors.

- Investor and management alignment: Both co-founders have invested significant sums of their own money into Origin’s offerings and team member salaries are based on asset growth not sales volume. Origin’s staff wins when you do.

Cons

- Limited to accredited investors: Only those who meet the minimum net worth or annual income requirements to be considered an accredited investor can access Origin’s offerings.

- High minimum investments: You’ll need a starting investment of at least $50,000 to $100,000 in order to buy into one of Origin’s private real estate funds.

- Complicated fee schedule: Calculating your total fee cost with Origin’s funds isn’t as straightforward as other investments. In addition to the management fee, other costs to consider include set-up fees, acquisition fees, performance fees, and discounted sale prices on early redemptions.

Should You Invest With Origin Investments?

If you’re an accredited investor with at least $50,000 to $100,000 to invest, investing with Origin Investments could be a smart choice. With Origin’s funds, you get instant access to a diversified portfolio of private real estate properties.

Origin’s historical returns are solid and the tax savings their funds can provide are significant. That’s especially true for those who are able to invest in the QOZ Fund using capital gains.

However, if you’re a non-accredited investor (or can’t meet Origin’s minimum investments), you may want to look at one of the real estate crowdfunding platforms instead. Fundrise and RealtyMogul, for example, both allow non-accredited investors to invest in institutional-quality real estate for as little as $500 to $1,000.

This is a testimonial in partnership with Fundrise. We earn a commission from partner links on Consumerism Commentary. All opinions are our own.

Article comments