FICO® Score vs. Credit Score: Different Credit Scores, One Purpose

Consumers, it seems, sometimes have a love-hate relationship with credit scores. On the one hand, they love high credit scores and are often fanatical about doing what’s necessary to increase them. But on the other hand, they’re often not so happy about the influence credit scores have over their lives. Which is the main driver causing people to regularly monitor and work to improve their scores.

But while we may think of a credit score as something singular, that’s hardly the case. In fact, there are many different credit scores.

The most official is the FICO® Score, which is something of the official set of credit scores used by lenders. There are even several different FICO® Scores, which is another fact generally unknown to most consumers. And to complicate the picture, there are other credit scores, best described as educational scores. Those are the scores typically available through free credit scoring services. The fact that they’re not used by lenders is the major reason why they’re free.

So, let’s take on this FICO® Score vs. credit score topic, and give you some idea how diverse the credit score universe really is. In point of fact, there are many different credit scores, but they all have the same purpose–to give consumers and lenders an accurate snapshot of personal credit profiles.

- FICO® Score vs. Credit Score: What’s the Difference?

- Which Credit Monitoring Company Uses Each Method?

- Which Method is Used by the Main Credit Cards Issuers?

- Which Method is Used by Car Dealers?

- Which Method is Used by Mortgage Lenders?

- Which Method is Used by the Main Banks and Financial Institutions?

- Which Credit Score Do Lenders Use?

- Summary: FICO Score vs. Credit Score

FICO® Score vs. Credit Score: What’s the Difference?

In many consumer’s eyes, a credit score is a credit score. Nothing could be further from the truth. But before we get into that, let’s first discuss the basics of what a credit score is.

Let’s start with FICO® Scores. These were first introduced back in 1989, and they’ve since become the gold standard of credit scores provided by the three major credit bureaus–Equifax, Experian and TransUnion. Not surprisingly, they’re used by the vast majority of lenders.

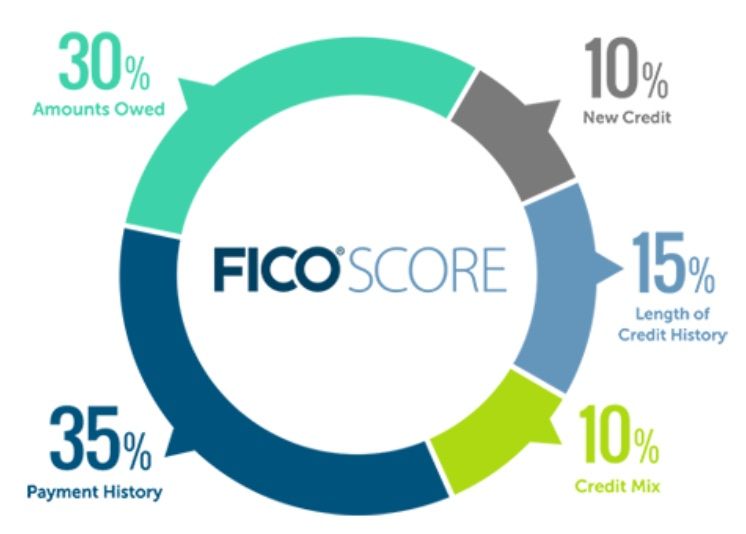

A credit score is generated by an algorithm that attempts to reduce a person’s credit history to a single number. The breakdown of how a FICO® Score is calculated is as follows:

Most consumers actually have three different FICO® Scores, in whatever variation of the score is used. That’s because your scores are calculated by each of the three credit bureaus, with each issuing their own score. Since the information in each of the three credit bureaus is usually a little bit different, you can have–literally–three different credit scores. That’s true even though each of the three credit bureaus use the same FICO® algorithm to calculate the score.

But even a FICO® Score isn’t a single score. In fact, there are at least 16 active versions of the FICO® Score, and more are being added to the list all the time. For example, the latest iteration of the FICO® Score is the FICO® Score 9. But rest assured it won’t be the last.

The reason there are so many is that separate FICO® Scores have been developed for each sector of the lending industry, which we’ll cover in more detail as we go forward.

But one factor you should be aware of when it comes to credit scores is that if you’re getting a free credit score, it’s probably not a FICO® Score. Since FICO® Scores are used to make lending decisions, there’s a cost to obtain them.

Other Credit Scores

Aware that consumers are anxious to not only see their credit scores, but also to track them on a regular basis, educational scores have been developed to keep people informed. These are sometimes referred to as “FAKO scores”, which is a play on “FICO” that emphasizes the non-official status of those scores.

What’s interesting however is that non-FICO scores use similar algorithms, as well as the same credit report data, in calculating the scores. But since they have a different emphasis, they generally vary from FICO® Scores. This variation can sometimes be just a few points, but in other cases, it can be more substantial. A difference of 50 or more points from a FICO® Score isn’t unusual.

Perhaps the most popular non-FICO score is the VantageScore. It closely parallels FICO® Scores, and because it’s free, it’s commonly offered by free credit score providers.

Much like the FICO® Score, VantageScore has a point range that can vary from a low of 300 to a high of 850. But there can still be significant differences between the two score sets.

In addition to VantageScore, there are several other non-FICO scores, though they’re less commonly used. These include TransUnion Credit Score, Experian Credit Score, and Equifax Credit Score.

But just because none of these scores are used by lenders doesn’t mean they don’t have value. Since they track the same credit information as FICO® Scores, they can provide a valuable measure of where your credit is at.

For example, if you’re being provided with a free credit score, like VantageScore, and it drops by 30 points from one month to the next, that should tip you off that there may be some negative information that recently arrived on your credit report.

Since the whole purpose of monitoring your credit is to fix what’s broken, carefully track your score and be prepared to do what’s necessary to improve your score.

Which Credit Monitoring Company Uses Each Method?

To help you monitor your credit on a regular basis there are a number of free credit score sources.

Two of the most popular are Credit Karma and Credit Sesame. Both provide you with your credit score based on VantageScore 3.0 (like FICO® Scores, VantageScore also comes in different iterations, with 3.0 being the most popular).

It’s also become very common for banks to provide free credit scores, whether you have deposit accounts or credit cards. However, banks are more likely to provide you with scores based on your TransUnion Credit Score, Experian Credit Score, or Equifax Credit Score, though some will also use VantageScore.

Apart from free credit score providers, you can also get access to your actual FICO® Scores, though you will pay a subscription fee for the service.

If you want to go right to the source, you can subscribe to myFICO.com. You’ll get a free trial period to “test drive” the service. But once that free trial is over, you’ll be charged a subscription fee.

Still another way to get your official FICO® Score is to take out a subscription with one of the three major credit bureaus. For example, by subscribing to Experian Credit Services you’ll not only have access to your actual FICO® Score, but also your monthly credit reports from all three major credit bureaus. It will give you an opportunity to look at the same credit score lenders will see when you apply for a loan.

As far as the general FICO® Scores issued by the three major credit bureaus, what you’ll typically see is your score calculated using FICO® Score 8. It’s the single most widely used general credit score in the lending industry as well.

Which Method is Used by the Main Credit Cards Issuers?

Each area of the lending industry has its own unique set of FICO® Score models. That includes the credit card industry. The reason each industry uses a different set of scores is that specific factors predicting loan performance and potential for default are unique to each industry. For example, in the credit card industry, the scoring model may put greater emphasis on a consumer’s performance on their credit cards, and slightly less on other types of loans.

Common FICO® Scores used by credit card issuers include the following:

- FICO® Bankcard Score 8

- FICO® Bankcard Score 2

- FICO® Bankcard Score 4

- FICO® Bankcard Score 5

- FICO® Score 3

To obtain credit scores based on those calculations, credit card issuers will order credit reports from the three major credit bureaus that use those scoring models specifically.

As a result of the unique calculations for credit card-centric FICO® Scores, these scores may look different than your FICO® Score 8, and even FICO® Scores commonly used by other lending industries.

Which Method is Used by Car Dealers?

Credit card issuers, car dealers and auto lenders have their own specialized FICO® Scores. Those most commonly used in the auto industry include:

- FICO® Auto Score 8

- FICO® Auto Score 2

- FICO® Auto Score 4

- FICO® Auto Score 5

Like FICO® Scores for credit card companies, those used by car dealers and lenders look more closely at specific issues related to car financing. They may emphasize a consumer’s performance on previous or current car loans, or even other installment type loans. The emphasis is always on attempting to predict the likelihood of default on a specific loan type.

Which Method is Used by Mortgage Lenders?

Mortgage lenders use a narrower range of FICO® Scores. In fact, they rely primarily on just three:

- FICO® Score 5

- FICO® Score 4

- FICO® Score 2

Why not use a more updated FICO® Score version, like FICO® Score 8? Industries tend to get comfortable with certain scoring models. If it’s been determined that earlier versions get the job done, they may see no need to upgrade to more recent models.

Once again, FICO® Scores used by mortgage lenders are specific to that industry. They choose the scoring models they do because they’re more reflective of the risks associated with mortgages. This may include a greater emphasis on a consumer’s performance on current or past mortgage loans.

Which Method is Used by the Main Banks and Financial Institutions?

Exactly which FICO® Score any bank or financial institution will use will depend on the purpose of pulling the score in the first place. For example, if the bank is considering a customer for a mortgage, car loan, or credit card, they’re likely to use the FICO® Score versions designed for that specific lending sector.

However, if they’re pulling credit for the purposes of opening a new account or a different type of loan, they may use FICO® Score 8, since it’s the most commonly issued and relied upon. But it’s equally possible they’ll use some other FICO® Score version that has become the norm for that institution.

As well, some financial institutions–including banks–have their own proprietary credit scoring models. They may not be exactly like FICO® Scores, but rather incorporate criteria the bank or financial institution sees as more relevant to their particular business space.

Still other financial institutions will use both FICO® Scores and an in-house proprietary credit scoring model. That might make it slightly more difficult to gain loan approval, but it may also help to explain why it’s not always easy to get a loan from a bank. After all, even though banks and other financial institutions primarily earn revenue from the interest paid on loans, they lose it if a loan goes into default. The objective then is always to make loans to the most qualified borrowers, who simultaneously have the least likelihood of default.

Which Credit Score Do Lenders Use?

There are many other different types of loan categories, including personal loans, student loans, and business loans, among others. While there may not be specific FICO® Scores for those industries, many lenders making such loans will rely on FICO® Score 8, since it is the lending industry standard as well as the base for all other credit score models.

But there may also be other credit evaluation tools and criteria beyond FICO® Scores. For example, a business lender may be primarily concerned with the Dun & Bradstreet Score of a business, which is a completely different scoring model. At the same time, they may also rely on FICO® Scores for each of the principals in a business, particularly in a small, closely-held entity.

Student loan

Lenders may use any of the various FICO® Scores, though they may rely more heavily on other factors, like profession, job tenure, college transcripts, and income. It’s not that they’ll ignore credit scores, but rather they recognize the credit of a recent college graduate won’t be as deep as that of other consumers and rely more heavily on non-credit factors.

Personal loans

Those fall into their own category. Banks certainly make personal loans, and are likely to rely on FICO® Scores–most likely FICO® Score 8–in making their determination. But there are also a large number of dedicated personal loan lending platforms, like LendingClub and Prosper, that rely primarily on credit grades they assign to each borrower. A credit score, such as a FICO® Score, might figure into that mix, but it will only be part of the overall evaluation.

Summary: FICO Score vs. Credit Score

Whatever credit score you’re monitoring or anticipate a lender will use to make a decision on your loan application, you should always do everything possible to maximize your score. This is especially important when you’re not applying for credit. That’s when you’ll have time to deal with any credit problems that may arise. For example, you’ll have the time you’ll need to dispute errors on your credit report, pay off past-due balances, or pay down or pay off open credit lines, all of which can improve your credit score.

These are much more easily accomplished when you don’t have the pressure of applying for a loan. And that’s really the whole purpose of credit monitoring–to pre-position yourself to be ready when the time comes to make an application for credit.

Even though there are many different credit scores–that can look significantly different from one another–they all have value. Even non-FICO scores are helpful, because they a) allow you to monitor your credit score for free, and b) closely parallel FICO® Scores.

To help you be aware of the differences between FICO® Scores and other credit scores, the summary table below can serve as a quick reference guide:

| Category | FICO® Scores | Other Credit Score |

|---|---|---|

| “Official” Credit Score | Yes | No |

| Used by Lenders? | Yes | Rarely |

| Provided free to Consumers | No | Yes |

| Best Use | Obtaining Financing | Monitoring Your Credit |

| Credit Score Range | 300 – 850 | 300 – 850 |

| Lending Category Specialization | Yes | No |

| Variations | GENERAL: FICO® Score 8 LATEST UPDATE: FICO® Score 9 series CREDIT CARDS: FICO® Bankcard Score 8 FICO® Bankcard Score 2 FICO® Bankcard Score 4 FICO® Bankcard Score 5 FICO® Score 3 CAR LOANS: FICO® Auto Score 8 FICO® Auto Score 2 FICO® Auto Score 4 FICO® Auto Score 5 MORTGAGES: FICO® Score 5 FICO® Score 4 FICO® Score 2 | TransUnion Credit Score Experian Credit Score Equifax Credit Score VantageScore 3.0 In-house lender scores |

Article comments