Even Financial Review - Get the Best Online Personal Loans and Refinance Rates

If you are looking for a personal loan, you understand the frustration that the process can bring. You’re typically forced to sift through various lenders to not only find the one that will approve your request and meet your requirements, but also snag the loan with the lowest rates. It can be time-consuming and you might not even come across the lender that would be best for you.

That’s where Even Financial comes into play.

Even Financial is a personal loan aggregate website, which has set out to connect potential borrowers with their ideal lenders. Not only will you be linked up with banks offering the loan types, amounts, and terms that you need, but you’ll also have the chance to rate shop various lenders before committing to one… all in one place.

The best parts? There is no impact to your credit until you pick your lender and decide to move forward with the loan, and Even Financial’s service is entirely free.

Let’s take a look at exactly what Even Financial does, and whether this lender-comparing website is right for your next personal loan.

Features

There are many reasons to look for a personal loan. You might want to fund an exciting trip or big purchase, pay off a high-interest credit card, refinance other loans, or make improvements on your home. No matter the reason, though, shopping around can be a pain.

Even Financial seeks to make the entire process easy and quick, by giving you access to dozens of lenders and competitive rates, regardless of the exact loan you need.

Personal loans are available in amounts ranging from $1,000 all the way up to $100,000. You can also search for loan repayment terms anywhere from two years to seven years, depending on how long you need, and rates start as low as 4.99% APR. No matter your search terms, you’ll be connected with lenders that meet your criteria and have the most competitive rates available.

The loan search not only takes less than 3 minutes, but it also won’t affect your credit. Even Financial will conduct a soft inquiry on your credit in order to offer you the most applicable rates. However, you won’t actually see any impact on your credit history until you choose a lender and proceed with finalizing your loan.

You’ll get offers from popular lenders including LendingClub, Prosper, Best Egg, and SoFi. You’ll also have a chance to view offers from other small partners, who you might have never come across without an aggregator like Even. Depending on your credit history and your loan needs, the rates and terms offered may vary.

Of course, one of the best parts of using Even Financial to search for your next personal loan is the fact that it’s entirely free.

Loan Refinancing

You can use Even Financial to refinance an existing loan, too, albeit indirectly.

When first applying through Even, you’ll be asked the purpose of your personal loan. Simply choose “debt consolidation” if you plan to refinance one or more existing loans with your new personal loan.

Pricing

There are no fees involved with using Even Financial. Your only added expenses will come in the form of interest rates, which will be determined–and charged–by your chosen lender.

Your interest rate will be contingent on your personal credit history, the loan specifics requested, and your repayment terms.

The Process

It’s quick and easy to price out personal loans through Even Financial. The entire process took me less than a minute, and I had a number of offers posted right after clicking Submit.

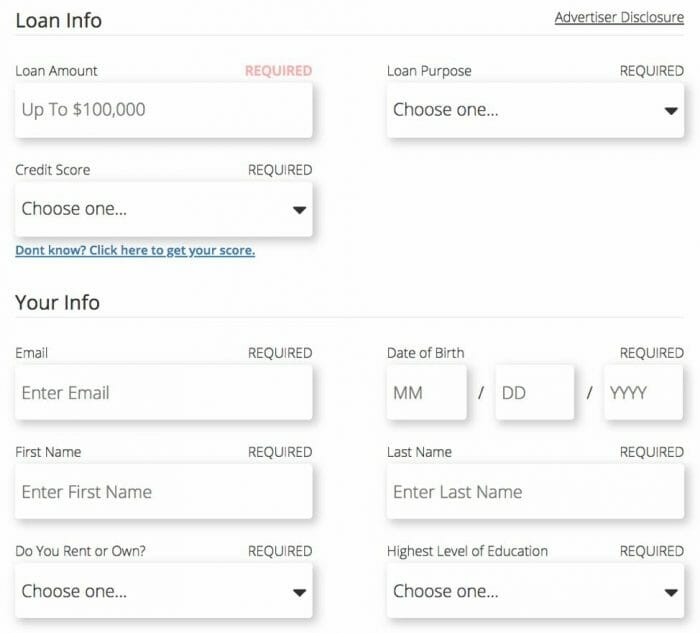

First, you’ll need to enter the details for the loan you want. This includes the amount you’re looking to borrow, why you want to borrow it, and your current credit score range. Even Financial will verify this with a soft credit pull, though it will have no impact on your credit until you proceed with your chosen lender.

Next, you’ll be asked to enter your personal information, including your name, address, date of birth, phone number, whether you own your home, and your education history.

You’ll need to accept Even Financial’s terms and then click Submit to have your loan request shopped through the lenders who partner with Even. This search took about 20 seconds, and I had four offers available to me immediately after.

Give It a Try Now: Compare Customised Personal Loans/Refinance Offers With EVEN

The results will show you which lender is offering a loan to match your terms, as well as their proposed interest rate. You’ll also see how much your monthly payment will be and the total cost of your loan if it’s paid according to schedule at the rate shown.

I didn’t notice right away, but there was a “See More Offers” button at the bottom of my lender results. Once I clicked on that, two more lender offers popped up, bringing my total to six lenders.

If any of your results pique your interest, you can click on Get Your Loan to begin the finalization process. This will direct you to the lender’s own website, where you will enter additional information. The lender you choose will also run a hard inquiry on your credit as part of the finalization process.

Security

Even Financial understandably requests quite a bit of your personal information in order to provide tailored loan offers. And considering the prevalence of IT hacks and the sale of personal info these days, this can be a bit unnerving.

According to Even Financial’s privacy policy, they make an effort to protect any of your information that you submit through the site. Of course, no electronic transmission is entirely foolproof and information theft is always a possibility. Even Financial will notify you if a breach occurs that may impact your information.

They claim that they will not sell your information, though they will “share” info that you provide with their “partners,” whose products may be of interest to you. I will say that within 30 seconds of clicking Submit for my loan request, I received a call on my cell phone. It was from a number in my home state so, even though I didn’t know the caller, I picked up.

It was a loan services company who identified as an Even Financial partner, offering me a loan alternative to help me with my financial needs. Even though the loan I applied for was for $10,000, the caller claimed that he could offer me as much as $25,000 if I needed it.

Honestly, it felt a little uncomfortable to me, especially since the call happened literally seconds after my information was submitted to Even Financial. While the lender calling might have been an excellent option for my financial needs, I was put off by the obviously-instant transmission of my information to a “partner” company.

Customer Service

If you need help from Even Financial, your options are a bit limited. You are welcome to contact the company via email, and through a contact form on their site. However, there are no live chats available, and I was unable to find a phone number to help me with any questions I might have had.

Luckily, most of your questions will probably be directed to the lender you choose. Depending on which loan offer you go with, you should be able to reach them directly.

Pros and Cons

If you are looking for a new personal loan, Even Financial is probably worth a look. The site can make your search faster and easier, providing you with a number of offers in mere seconds.

When searching for a loan through Even, you can get offers for loans ranging from $1,000 to $100,000 in size, meeting whatever financial needs you may have. You can also shop around without any impact to your credit, getting pre-approved for loans of various terms and with a range of interest rates, all without any commitment or negative impact.

Using Even Financial was quick and easy. I was able to fill out the application and get results from lenders in less than a couple minutes’ time. It was definitely faster than visiting each of the big lenders’ websites directly and filling out all of the same information in duplicate.

There are a few downsides to using this personal loan aggregator, though.

First, you’re limited to loan offers from the lenders that already partner with Even Financial. While this list is growing everyday, you may also miss out on a company though could offer a better rate or terms that are even more ideal for your needs.

I was a bit miffed to notice a “See More Offers” button tucked away underneath my featured four offers, too. I didn’t see this the first time I looked and, had I not eventually noticed it, I wouldn’t have found two other offers available to me. One of them was actually the lowest interest rate of the whole list of six (from SoFi), making me question why it was hidden.

Perhaps certain lenders are featured above others, but it would have been nice to have the best loan for me at the top of the list, rather than hidden. The top loan on my list was actually the most expensive of all the options!

The other downside is that Even Financial obviously shares your information with partner lenders. Obviously, this is the case when providing you with the loan offers featured in your results, but your personal information will also be shared with lenders who will solicit you. The phone call that I received 30 seconds after applying is evidence of this, and was a bit off-putting.

Alternative

There are plenty of other personal loan aggregators to choose from, if you’re looking for a new personal loan. They are all very similar in features and the lenders that they work with, and they all use your information in approximately the same way.

Some other personal loan aggregator companies include Credible and PickALender.com. You can also post your loan preferences on a peer-to-peer (P2P) lending site and have individual lenders “bid” to fund your loan.

If you have an idea of the lender you’d prefer to work with, you can also apply for your loan through their site directly. Some of our favorite lenders include SoFi, Best Egg, and LendingClub.

Is Even Financial Right for You?

If you’re looking to take out a personal loan, you have a number of options. Whether you’re looking to take a vacation, make a big purchase, pay off high-interest debt, consolidate other loans, or even cover upcoming medical/dental bills, you want to pick a loan with the lowest interest rate. Plus, you need a lender who offers repayment terms that fit your budget.

Even Financial can help you find the best lender for your needs, all in one place. You’ll be matched up with a number of different companies, all competing for your business. You’ll see rates and repayment totals, and it won’t impact your credit to get these quotes.

Whether you need a loan from $1,000 to $100,000, and want terms ranging from two years to seven years, Even Financial can connect you with the right lenders. Results only take about two minutes to get, too, making it both easy and fast.

Compare Competitive Personal Loans/Refinance Offers With EVEN Financial

Summary

The next time you’re shopping around for a personal loan, don’t waste time visiting individual lender websites for rates. By checking out Even Financial first, you’ll get rates from some of the leading lenders in the market– like Prosper, LendingClub, SoFi, and Best Egg–with one quick application.

You’ll also avoid any negative impact on your credit by rate-shopping with Even. The soft inquiry they’ll pull doesn’t affect your credit report, but still allows you to get pre-approved for some of the best loans.

To learn more about Even Financial, or start shopping for your next personal loan, visit their website here.

Article comments