Money in Excel: A Fair Replacement For Your Budgeting App?

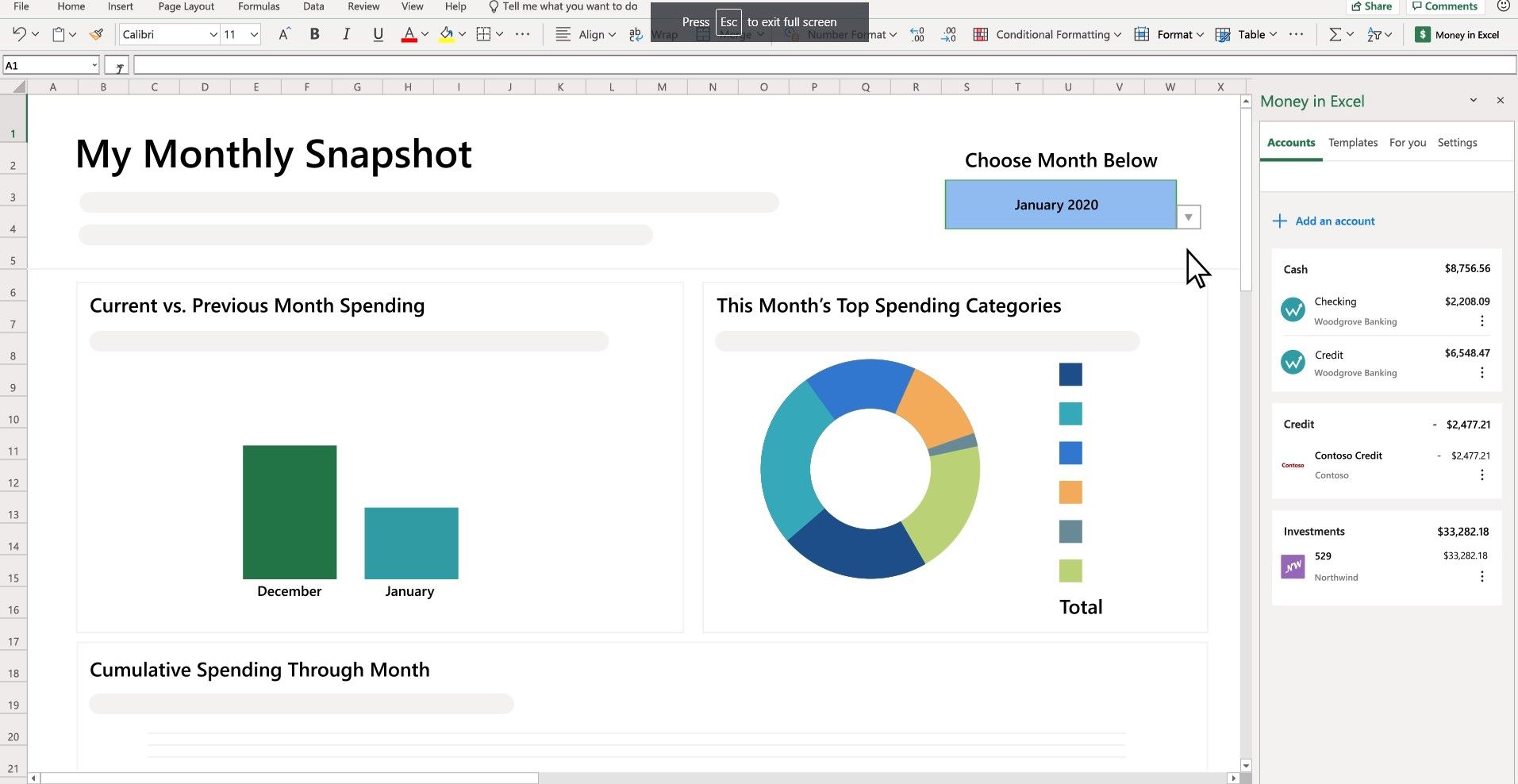

Spreadsheet lovers rejoice! Microsoft is launching its “Money in Excel” feature that will help you tackle your personal finances and track your budget using spreadsheets.

In essence, it’s a template and add-in that will help you connect to your financial accounts–think bank, credit card and loan accounts–and it’ll import all the information directly in there. That way you can use the spreadsheet to track what’s going on with your money.

It may sound like the answer to your prayers but is it the best choice for you? Or is it better to choose one of many other online budgeting tools out there? Let’s find out.

How Can I Get Money in Excel?

Right now, the Money in Excel template is only limited to U.S. users and you can only link U.S. financial and bank accounts right now. To access it, you’ll need to be either a Microsoft 365 Personal or Family subscriber to start connecting your financial accounts. Luckily, most major ones are supported and help you automatically import transactions.

To subscribe to Microsoft 365, pricing is $6.99 each month on the individual plan or $9.99 per month for a family plan that’s good for up to six people.

How To Use Money in Excel

To use Money in Excel, you’ll need to download the template–make sure you’re a current Microsoft 365 subscriber first. Then open the document and use the on-screen prompts to guide you so you can connect to all your U.S. financial accounts. Money in Excel uses a secure third-party plugin that’s supported by Plaid, so you’re safe. Plaid also supports many major financial institutions in the country.

Once you verify all of your account information, Money in Excel will automatically import your financial data so you can start using the template. Whenever you want to update your transactions or accounts, you can click on the “update” button.

With this information, you can track your spending habits to see whether you’re on track. Click on the “snapshot” tab to see what you’re spending in different categories such as transportation, housing and food–you can also customize categories.

There are also charts to see your recurring expenses and cumulative spending.

Who Money in Excel is For

Money in Excel is a great tool for those who want the basics in a budgeting tool–meaning no bells or whistles. It’s also for those who want something that’ll import transactions and to be able to see simple results such as how much was spent on certain categories.

However, that’s about it. If you think about it, what’s the point of a budget? Sure, you need to track your spending and see where it’s going, but there’s more than that. The idea is to use those numbers to guide you toward more intentional decisions like saving money by cutting down on unnecessary expenses (such as unused subscriptions) or to see how much more you need to save in order to reach a certain financial goal.

That’s why intuitive budgeting tools are probably more effective. Many of these budgeting tools also link to retirement accounts, giving you a more holistic view of your finances. That way, you can see what’s happening in the short term (your daily spending habits and short term savings goals) and long term (your retirement and other major purchases). Plus, some offer more tools to take charge of your money so you’re squeezing as much value as you can from every dollar.

What Are Some Other Personal Budgeting Tools?

You probably know that there are a lot of online budgeting tools out there. It feels overwhelming. Frankly, a lot of them don’t really live up to the hype, even the paid ones. That’s why we’ve gone ahead and done the research to show you some popular ones we think pass the test. So if you are not planning to get Microsoft 365 subscription any time soon, you should check out the budgeting tools below.

Empower

(Personal Capital is now Empower)

There’s a reason why this free tool has gained so much notoriety among personal finance enthusiasts: it has one of the best holistic tools out there. In addition to tracking your spending across common categories, you’ll be able to link all your accounts, including your investment and retirement ones. That way, you can track your net worth down to the penny.

What’s even cooler is that you can use their retirement tools including the fee analyzer to see how much you’re paying for your retirement and investment accounts. Plus, Empower also has tools to see whether you’re on track for retirement based on your goals. You can learn more about Empower here.

Money Patrol

Money Patrol allows you to link all your financial accounts and the app will then use the data to provide an analysis of how you’re doing. You’ll be able to see what you’re spending and make immediate adjustments as necessary. There’s also the ability to look at patterns over a one-year timeframe. You can learn more about Money Patrol here.

Empower

For $6 a month, Empower offers a lot with their monthly fee: an interest-bearing checking account, intuitive budgeting tools, help with reducing recurring expenses and more. The app will run reports of your spending and tell you where you can save money, and even help negotiate bills on your behalf. Plus, Empower offers human coaches who you can speak with one on one about almost all personal-finance-related questions. This person will walk you through what you can do based on your specific situation. You can learn more about Empower here.

CountAbout

CountAbout helps sync present and past financial data by seamlessly migrating from your Quicken or Mint accounts. That way you can get a clearer snapshot of your spending patterns for a longer period of time and use the data to inform your actions moving forward. Learn more about CountAbout here.

YNAB

YNAB stands for You Need a Budget and people have raved about how it has saved them thousands of dollars just by tracking their budget. What’s great about this tool is that you create a budget based on last month’s paycheck, so you’re not spending more than you’ve earned. Since you’re forced to budget every penny, you’re essentially making sure that all your money is doing what it’s supposed to.

Summary

Each of the tools listed here can do the job of keeping you on budget. It may just come down to choosing the one that perfectly fits into your budget. The good news is all are affordable, so you can feel great about spending your money on a budgeting tool that’s going to keep you on track to reaching your financial goals.

Article comments