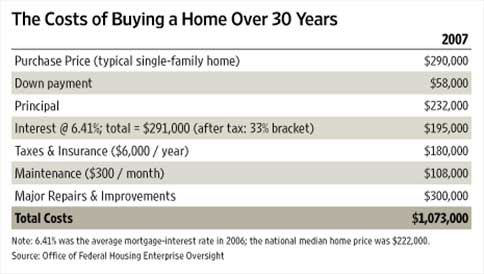

The Cost of Buying a Home Over 30 Years

So you think it’s such a great decision to buy a house? Well, you need a place to live, and it’s better to own, right? Well, the cost of owning a home is something rarely described by proponents. Buy at $300,000, sell at $1,000,000 thirty years from now (an average 5.66% annual growth rate) for a total of a 233% increase.

The Wall Street Journal says this simplification not only doesn’t tell the real story, it’s grossly misleading.

Banking Deal: Earn 1.55% APY on an FDIC-insured money market account at CIT Bank. See details here. CIT Bank. Member FDIC.Would invest $300,000 in an index mutual fund — averaging anywhere from 8% to 10% over 30 years — if over that 30 years, you had to pay $710,000 in fees? Well, that’s what you’re doing when you buy a house.

This graphic comes from the Wall Street Journal article. Your friends who like to boast about the return on their real estate generally take into account only the purchase price and the sale price. As you can see, if you actually take all the costs of maintaining that house into account, the “investment” doesn’t look nearly as good.

The figures above also ignore the selling cost. If you want to realize any profit, you have to sell your house, and going through a real estate agent may cost you 6% of your selling price.

The article rebuts all of the familiar arguments about the supposed almost-guaranteed return of real estate. The bottom line is you can’t count on real estate — especially primary real estate, the house in which you live — as your only method of investing for retirement. If you want to realize any of the profit when you retire, if there is any, you’ll have to find a way to downsize your living significantly.

By the way, if you plan on moving within 7 years like the average homeowner, renting and investing the funds you would have otherwise used for a down payment would be a better financial decision. Not only that, but with a long-term mortgage in which you’re paying almost exclusively interest to the bank on your mortgage, you’re just renting your house from the bank. And you still have to pay all the maintenance costs, taxes, and everything else outlined in the chart above.

There are more detailed figures in the Wall Street Journal article.

Article comments

1. The owner of a stock makes typically 8-9% per year after inflation, which is better than owning real estate. Thus it is better to rent and invest the difference.

2. Typical consumers of any business do the same so your argument applies just as much to buying stock as it does buying real estate.

3. By that argument, if everyone owned Bugatti Veyron’s and little else , it would mean a car is an investment. Just because one asset is the biggest does not make it the best in terms of yield!!!!!

You are committing a local fallacy known as special pleading.

1. The owner of rental houses/apartments typically makes somewhere around 7% a year.

(After subtracting inflation from his rental returns.)

2. What this means is that the typical renter is overpaying maybe 7% a year, for the owner’s

profit.

3. Another consideration; upon retirement, the largest part of a families net worth, for most

homeowners, is their equity in their house, which could be tapped in a number of ways.

So what does all this mean? If you are not going to move in the next 5 – 10 years,

then you are probably better off buying. Just don’t get too extravagant with improvements.

If I had it to do all over again I would just rent. A home is a money drain in many ways. Bought my home in 2001, but recently spent $7,000+ to get a new roof, getting ready to drop about $4,000 on new carpeting, spend a few hundred dollars each year to maintain landscaping and pay about $5,000/yr on taxes and insurance and this doesn’t include the usual maintenance fixups that pop up frequently. Meanwhile the every 5 day headache of mowing the lawn in upper 90s with high humidity because the grass just grows that fast in the spring and summer.

I didn’t do the roof and not planning the carpet because I want to. It’s just the house was built in 1990 and these things are popping up now. The roofing, carpet and landscaping along have eaten up any equity I gained by monthly payments over the nine years. Meanwhile, in that time, I could have rented for $400/mo cheaper and that $400/mo would be over $40k in cash even if I would have stashed it in my mattress.

That’s one reason I was reading this. Our house was built in 94′ and we have lived here 3 yrs. So far, we have replaced the roof, the heat and air system, and we recently had a leak in our house when we were away for the weekend that caused all our floors to have to be replaced. Sure there’s insurance but we had a big out of pocket premium plus all the aggravation of moving things, having to pick out all new floors, and much more. Not to mention we had just had the floors redone before we moved in so we could have what we wanted and not have to worry about it before we moved in. Taxes are only $1200 here a yr but that is actually expensive from what I was used to. Always remember when you buy a house that a roof usually lasts between 15-20 yrs and an heat pump about the same. I’d say renting is way cheaper until you get the house paid off. If you can buy a house and not a mortgage…wonderful. Any debt is bad if you ask me.

This article to me makes no sense. Perhaps someone could explain it to me. Always seemed pretty simple to me. If you rent a house vs buy a house and you compare total expenses (and you compare are comparing rent vs buy for SAME size home, locale/neighborhood, furnishings, yards, etc.), then it would logically seem to make sense that buying would be the better deal. Every time I have rented, the rent goes up each new contract (for the same place), usually 5-10% each year. And, if the local utilities, taxes, etc go up, the rental property owners I have dealt with pass on those additional costs to me IN ADDITION TO the yearly 5-10% rental increases. Buying, the prices remain much more stable (i.e. your loan payment stays the same). Also, the rental property expenses will be greater, as the rental property owner is almost always charging enough to cover ALL his expenses (mortgage, repairs, taxes, etc) and on top of that, a bit more in most cases, so he/she can make a profit on top of all those expenses. The renter pays rent, but the rental prop owner gains equity each month. The renter gets no equity, only shelter. The property buyer, he also gets equity. And, potentially, may even make a profit when he/she sells. Also, when buying a house, the buyer (owner) can decide to rent out a room or floor of his/her house. Most all rental contracts forbid renters to sublet.

Finally an article that tells the truth about home ownership. If renters tend to have lower net worth it is either because they tend to have lower incomes, or they didn’t invest the money they would have been putting into a house.

The only reason to own a home (assuming you have the proper means to do so) is because you want to be a homeowner . Maybe you have kids, you enjoy maintaining a house, pride of ownership. All good motivations. But I don’t, I don’t, and I don’t care.

Homeownership is like having kids is that it is something that many people aspire to for fine reasons – and both cost a lot of money. The problem, besides not having the proper financials and a plan in place, is that there is a great stigma against renting. People think there is something wrong with you if you don’t own. Even Suze Orman, who would be the first person to tell you not to buy if you shouldn’t, will sigh with exasperation with a “Why Not??” when someone tells her they don’t own.

The societal pressure to own is tremendous, and as we have seen, hard to resist. From a societal standpoint, we wouldn’t want a nation of landlords ruling the “rental class” would we? This isn’t Russia!

That’s a good point , but as in individual you have to do what is right for you. As a renter, (and no kids) I have an enormous amount of time do well on my career, do volunteer work, and pursue interests that benefit me and the economy. Some will call me selfish, but I would rather that than be a very unhappy home owner. There will always be plenty of people who want and can own (well at least until now).

aFTRE RENTING COMPARED TO OWNING: aFTER 30 YEARS WILL YOU AS A RENTER STILL BE PAYING RENT AS OPPOSED TO OWNER NOT HAVING A HOUSE PAYMENT?

I TOTALLY agree. In addition, most people tend to compare rent vs own with different types of properties, for example a 3 bedroom/bathroom home with a 1 bed/bath rental. Yes, then renting CAN be a better deal if you squirrel away the difference in some stock market investment, but then you’re really not making a fair comparison. If you compare THE SAME property types, the buyer will come out on top near every time. Why? Because the rental prop owner will factor in ALL his expenses (his mortgage, repairs, maintenance, etc.), plus a nice extra profit on top, into the cost he charges his renters. So, the renter is ACTUALLY paying more each month, for the same house, then the buyer is. And, the renter gets ZERO equity. Just shelter. The buyer gets shelter AND equity. And, if the buyer chooses, he can further reduce his expenses and rent out a room or floor in his house. A renter, in most cases, is contractually forbidden to sublet.

Toby’s comment made the most sense, there is no need arguing about this. If you can afford it, you are better off owing a house than renting one. Shelter is a necessity and shouldn’t be confused for an investment, your mortgage is equivalent to your rent in most places and you still have to pay one of them; whereas your mortgage also count towards your principal. If you are fortunate enough to pay the mortgage ahead of schedule with reduced interest, just consider the other costs such as insurance and maintenance costs as your rent. In broader sense, the sense of security,peace of mind and joy of owing a home out weighs the costs.

My home is my kids future investment. Too many time i run into people whoes parents left them a home and now they are rent free.

Haha, this article makes me smile. If you had purchased a $300,000 house in 1970 in Arizona (where I live) it would be worth approximately $600,000 in 2000 (and that’s pre-bubble!) Now from 1940 to 1970 avg home prices quadrupled! This is not short term spikes, but slow and steady 30 year growth. In that case a $300,000 home would be worth 1.2M. Not to mention the interest expense you listed of $195k is tax deductible, as well as the $180k in taxes. Aaand if you had rented it, as you most certainly would with an investment, you could also deduct the $108k in maintenance. In the end Real Estate has a proven ROI of around 13% usually, which is comparable to the stockmarket (10% I think). I just depends on which venue you have the time to learn about.

I knew this woman who refused to contribute any money to her 401k (which matched dollar for dollar until investing 6% of her income) and instead bought and sold houses with her husband.

“So you’re telling me you can beat an instant return on you money by taking it all and investing it in real estate?” I said. She just stared at me, all stupid like.

Stupid woman.

Honestly this is the wrong way to think of the investment.

I bought a house and fortunately – nothing has needed much maintenance. So my costs are mortgage, insurance and $300 for upkeep.

This turns out to be $900 than renting for me. So this is an easy win.

Additionally the first number of years are all interest for a mortgage so you get to write of $20k a year (ever hear of a tax shelter – this is the key)

Next while the market will increase or decrease I am still “earning” money on my house and money to write off of taxes. Renting can’t do that for you.

Now if you want to make money – sell your house in 5-10yrs… Thats where you earn money on the principle from the bank. and protect your assets via your shelter…

sell, upgrade and move along – after doing this a few times you’ve increased your credit and worth.

FYI: That house where I live would be more like $8000-$10000 year for taxes.

Add that noise up!

you cannot put a price on your HOME.

however,if you cannot afford to get a 30 yr loan with 10% down, you’re probably better off renting.

if you’re going to speculate and buy a house you cannot afford, with a short term ARM you will be in trouble.

thats the only difference which most people didn’t get – but i guess they’re getting now!

In my housing market (formerly hot now cool), you’re not selling your home any time soon or for a decent price without a realtor (they stick together), so even if I could get $230k the example +$12,476 becomes -$1,324. There are monthly carrying costs associated with hanging onto a house just to get your price not to mention living in a fishbowl.

Second, there are other considerations against renting, though they are not necessarily financial – who wants to rent to someone with a couple large dogs? What happens when the market heats up and the landlord decides to sell (out you go, add moving costs)? Also, I got sick of living with white walls and no garden and someone telling me how many pictures I could hang. If not renting Single Family homes, add ‘shared wall/floor/ceiling’ problems. How do you quantify the value of quality of life and security?

You forgot to include gain on investing difference between mortgage payment and rent. Investing in a stock market index fund would have returned additional funds. You also left out cost of selling your house – commissions, etc. Can you sell your house for $230,000 today?

BUY ONLY WHEN THE LAND IN UN BUT SOON TO BE INDERSDEVOPLED. TAKE 40K INVESTMENT 10YRS LATER 250K RETURN..MEANTIME RENT.

Personally, I was supprised at how expensive it was to own a home even when paid off. You still have taxes, insurance, home owners association fees, repairs and other misc. & sundry costs. When considering all that is involved in homeownership, an argument can certainly be made for renting.

I completely agree.

thats why i sold my condo(for a tidy profit) and now rent it back!

As we’ve been deciding where and when to buy a home, I started considering the true costs of home ownership. The above comments are correct – it’s very difficult to compare without creating a spreadsheet.

So I made one comparing 10% down on a $350K property vs. renting using the same total monthly payment. Since renting an equivalent home in Colorado costs far less than purchase, the extra money is put into an investment fund along with the initial 10%.

Even with pretty agressive appreciation of 5% annually and dirt-cheap property taxes (about $2K in Colorado), I couldn’t reach breakeven in under ten years. And there’s no way we’ll be at the same address even half that long.

The standing advice to buy a home and “build equity” comes from circa World War II. And that was passed down from a time where people bought their homes (or built them) outright without a mortgage. It was fully expected that a family would not only stay for thirty years and own the home, but it would be passed down another generation or more. With the typical family moving every 5-7 on average, that advice simply isn’t as relevant as it once was.

IMHO, the advice to buy a home is supported by the huge real estate industry which takes 5-6% of every transaction plus the mortgage companies.

Re: “that big tax writeoff” that everyone loves. Both renters and homeowners get both standard and personal deductions. For a married couple, call it $10K. The only *additional* benefit to writing off mortgage interest and property taxes is after you exceed that threshold and are willing to itemize.

And it’s only a deduction from gross income, not off your net taxes. If your 2006 mortgage interest was $15K, your actual tax advantage is only the taxes payable on the extra $5K above and beyond the standard deduction everyone gets.

That’s about $1,250 for most people (25% tax bracket). To me, spending $15,000 or more in annual interest to save $1,250 in taxes doesn’t make sense.

I emailed David Crook, the author of the aforementioned WSJ article, and asked for some of the details behind the calculation of $300,000 for remodeling and upgrades. I am satisfied with his answer, and I think you will be, too.

I’ll share the gist of his comments on Wednesday, so if you’re interested in this topic, check back.

https://consumerismcommentary.com/the-cost-of-buying-a-home-projected-improvements/

This is where the follow-up on this subject ended up if anybody runs across this in the future and is curious.

Adventures: I don’t know anyone who has actually lived in a house for 30 years, but that’s what the article is talking about, not income-producing rental properties, in which owners are less likely to upgrade.

Remember that these figures are over 30 years, and for remodeling, consider that most people take out a home equity loan, so the numbers would include interest paid on that loan…. and that interest can last until the mortgage is paid off (if ever). So that $300,000 could easily be $150,000 in repairs/upgrades plus interest.

My husband’s parents have lived in their house for 30 years and, incidentally, spent $300K on a massive remodel a couple years ago. But their original mortgage was only $35,000 (and long since paid off) and their home was built by a noted Southern California architect and is now probably worth a million dollars or more. They also sucked at maintenance and part of their remodel included replacing the original linoleum tiles (that they had tried to tape down), shower tile, speckled laminate countertops, et. al. Preventative upgrades along the way would have probably reduced their costs significantly.

i read that article and found the $300k in improvements laughable.

i don’t know anyone who’s done 300k in repairs/upgrades on a 290k house.

Dorky Dad is correct in his numbers. WSJ is off.

I currently own 6 rental properties and I have bought and sold a dozen more. I think i know more than the average journalist when it comes to calculating costs.

Drogo: The tax write-off *is* included in the figures in the article. See the chart above. The fourth line takes the tax benefit of mortgage interest into account, assuming a 33% bracket.

What about the huge tax write off each year?? No one even mentions that!!!!

I think that one of the overlooked benefits of buying rather than renting is to stabilise housing costs as noted by hamburger flipper. My rent is liable to increase roughly every three years, whereas my mortgage payment is at worst roughly constant. This also means that the cost of my housing is partially eroded by inflation.

@saving advice: I think you have to assume renting a house v. buying a house or renting an apartment v. buying an apartment. I pay a monthly maintenance fee to my condo association but don’t have to mow the lawn, and my condo is very small, so furniture costs and utilities are no higher than an equivalent rental apartment would be.

Oh, and I have followed the numbers for quite a while…in the 1980s, median renter income was about 55 percent of median homeowner income. The last numbers I have seen (data from circa 2005) suggest median renter income has fallen to about 45 percent of the homeowner median. IOW, renters are becoming relatively poorer compared with homeowners. Which makes sense to me since the low interest rates and subprime lending of recent years has allowed millions to buy who would not have previously qualified for financing. So there has been more “creaming” of the renter pool, skimming off the top level(s), as those people bought homes and left the renter pool, resulting in a poorer pool of remaining renters.

As a low income working person, I look at homeownership through a defensive lens. That is, I’m not looking for huge appreciation and a cap gains windfall down the road. (Nice if it happens but I don’t expect or feel entitled to it.) I’m looking at stabilizing my housing costs, protecting myself from inexorable rent increases beyond my ability to pay. I also see the ability to supplement my income by renting out spare bedrooms, plus being in the happy position of choosing who I live with. (As a student I once got into a summer situation, sharing a house witb other students whom I did not choose – landlord remodeled one house in summer and put those tenants into “my” house for the summer.) Having said that, no I do not own a home, I only wish, but I think I’m looking at it the right way.

Dorky Dad — you made one *HUGE* mistake with your numbers at the end. You compared owning ending bank balance versus rental total costs. Absolutely not the same thing. Instead, the correct final number should be:

Owning equity: $12476

Renting equity: $0

And this calculation only holds true if you the renter either paid more for rent or blew the difference. If the renter saved the difference in 4% CDs from 99-07, you end up with the following after-tax numbers:

$100 diff: $9195

$150 diff: $13792

$200 diff: $18390

The cutoff point where renting matches your $12476 number is $135/month less than owning.

Dorky dad and Mossysf,

I found both what you wrote interesting. I took this finance class and really dove into the numbers renting compared to owning and when I share my results it gets mixed reviews based on mainly if people own or rent.

When it comes down to it you really just need to look at what it would cost to rent and own similar places. What I found was before the housing market bust it was way way better to rent, and take the difference of what it cost of renting and owning and invest it. Now that the houses prices have come down I would say it’s better to own. I think this article is way off as far as cost of owning a house.

A few things 300/month on maintaining a house? That’s just crazy to me, from moving from renting to owning there has been little to no changes as far as general bills go. The only difference in maintaining a house compared to renting is a yard and if something breaks down pretty rare maybe its just me. I would guess I would spend less then 300 a year much less a month. So everything else you would spend if your renting a place anyways.

Now the 300k for major improvements seems even more crazy to me. There are other myths as well the tax right off, come on the actual cost of paying the tax is not close to what you get back. If you spend 7k on taxes then depending on how much you make and what tax bracket it bumps you down to your talking about a couple hundred dollars.

I would argue that the costs are even higher than those mentioned. A house is bigger and therefore requires more things to fill it. It has a yard that needs to be maintained. It uses more utilities than an apartment. When you start adding all the little things a house can be a lot more expensive.

And you’d sleep on the floor in a house you rent? While not mowing the lawn?

Savings Advice’s point is that if you rent a smaller place than you would own — which could be the case for some, a realistic situation, but may not be a fair apples-to-apples comparison — you need less furniture. Rather than a house with a master bedroom and a spare bedroom, an apartment with just one bedroom. And most places, if you’re paying rent, the landlord takes care of lawn maintenance (and all the other maintenance you’d have to do yourself or pay for in a home you own).

Yes, Flexo, the WSJ article approaches and addresses the home in which you live as an investment just as Ben Stein did.

My point is that the alternative to buying a home isn’t the purchase of another investment; it’s to rent a place to live. Therefore the critical analysis should be between buying and renting.

In the WSJ article, it indicates that the national median home price in 2006 was $222,000, and yet they chose $290,000 as their “typical single family home” which is 30% higher than the median!

If you’re wanting analysis, I’ll give you my real numbers (living in Metro Atlanta). This isn’t for bragging rights; this is simply evidence that the WSJ doesn’t represent the norm for me or most of those I know.

Original purchase (7/99) price: $163,000

Down payment: $16,300

Other closing costs: $2,887

Interest thru 3/07 on 30-yr 1st mtg @ 6.67% = $63,542.86

Interest thru 3/07 on 10-yr 2nd mtg @ 7.28% = $6,249.46

Total interest thru 3/07=$69,792.32 (after 33% bracket) = $46,760.85

Taxes & insurance @ $1860/yr x 9 yrs = $16,740

Maintenance* @ $385/yr x 9 yrs = $3,465

Major repairs & improvements** = $6,175

Total cost thru 3/07 = $93,497.85

Today I’d be able to sell my home for $230,000 (much of the appreciation is because of improvements) without a broker. The payoff on my 1st and 2nd mortgages is $122,025.49, so my gross would be $107,974.51 – $2,000 in random fees/costs = $105,974.51 – $93,497.85 (from above) = $12,476.66 net proceeds from sale of home today.

Compare that with renting a single family home in Metro Atlanta. Using a cost of $1100 per month for the 1st 5 years and then $1250 per month thereafter (since 7/1/04), you’ll arrive at – $105,300.

So I calculate the difference as:

+ $12,476 (own) vs – $105,300 (rent)

No, the rate of return in owning a home isn’t the greatest, but the difference of $117,776 means that it sure beats renting.

* 2 lawnmowers @ $200 each/9 yrs = $45 per yr + $20 gas per year + pressure washing @ $120 per year + $200 misc per year

** new bamboo floors = $1800 + tankless water heater = $425 + paint & drywall mud = $500 + new lighting = $200 + carpeting = $2000 + french doors = $250 + repair front stairs =1000 + low-e insulated windows (sash replacement kits) = $1200 (ALL work done myself)

I found that to be a very thought provoking article considering that I am still renting for at least a few more years.

The question I have is why do they publish this article now when we are seeing weakness in the real estate market and not 3 years ago when everyone was trading up to the biggest house they could afford?

Hindsight is always 20/20. Perhaps they figured their readers wern’t ready to accept reality at the time when their house was appreciating 10-20% a year.

I also agree with LazyMan, $300,000 is a bit on the high side for improvements even over 30years.

Dorky: While your comment above provides less analysis of the WSJ article than my comment above, I clicked through to your blog to see what point you would like to make.

You’re talking about something completely different than the WSJ article. You are talking about single family rental properties, and the WSJ article is discussing the home in which the owner lives.

Also, 15 years isn’t long term, and one person’s experience is anecdotal evidence at best, while the numbers in the WSJ article summarize many persons’ experiences.

Again, the WSJ article is dealing with lived-in, non-cash-flow-generating properties that owners mistakenly believe to be sufficient retirement investments while the comments in the post you linked to are about the benefits of owning several cash-flow-generating rental properties.

I’m disappointed, Flexo. Where is the critical analysis of this piece?

Ben Stein made many of these same arguments in his Yahoo! Finance column titled, “A Home Truth about Real Estate Investing” back on January 19 of this year. The Wall Street Journal is just as wrong just as Ben Stein was.

And if you think that “renting and investing the funds you would have otherwise used for a down payment would be a better financial decision” [if you plan on moving within 7 years], then Flexo, you’re doing something wrong… like overpaying for your house in the first place.

A lot of people are fed with the belief that real estate investing is far superior than everything else due to the power of leverage. While that might be true in some cases, it does not become the norm as Flexo points out above. In my situation as a first time homebuyer living in the expensive suburbs of Northeast, “investing” in a home at this present time would hardly qualify as a good idea. That is why I, along with many others who are priced out, am waiting on the sidelines to see how this whole real estate market played out or maybe move to somewhere like Atlanta where houses are still relatively reasonable.

I find the $300K in major improvements to be on the very high side. Sure a lot of improvements probably go into a place in 30 years. However, the value of a dollar is less each year, so if you have to spend $100K at year 25, it’s not the same as spending $100K at year 1.

I think that the statistic that homeowners are so much richer than renters is a bit misleading too. If you look at the demographic of renters I bet you’d find that there are a disportionate amount of lower income people renting. Certainly there is also a large group of people that mismanage their money and live paycheck to paycheck as well.

What I think makes a huge difference is whether the individual has the discipline to invest the difference/savings from renting. I would argue that a large majority would not invest the difference and therefore would have a lower net worth over time. Sure, there are some people that would manage their money well and invest aggressively and they would probably have a comparable net worth to a homeowner. I actually have a good friend who is a lifelong renter, works at an average job and is a multimillionaire because he has had the discipline to invest and minimize his material purchases.

I think home ownership is almost a forced savings vehicle for many. I know lots of people that aren’t very good with their money and own a house. The only reason that they have a positive net worth is that they couldn’t take out home equity loans fast enough or couldn’t afford the monthly payment to borrow their equity.

I guess my point in all of this is that for many people it isn’t strictly about the numbers. Their individual personalities and decision making processes will affect their outcome more than choosing either one of these options.

Considering your primary residence an investment is a mistake that I see too many people make. I have never considered my home as an investment (so much so that I do not even include my equity when calculating my Net Worth). It’s a place for my family to live. Period. I consider the interest I am paying on my mortgage the “rent”. Whether I am renting or buying, the money disappears either way, right? But comparing the money you pay for “shelter” to returns you could be making in the market is absolutely silly. As Jeremy pointed out previously, you can’t live in a mutual fund. People should stop considering their primary residence an investment and instead, see it for what it is, a place to live.

Debt Free and LAMoneyGuy: I agree, in this world where soundbites are mistaken for truth and over-simplification rules, it’s easy to forget that there are other variables at play when you’re comparing statistics about homeowners with those about renters.

Jeremy: What would be fair would be to compare a $58,000 down payment (hesitate to say investment) in a $300,000 house with a $300,000 investment in a mutual fund, $242,000 of which is on the margin (which I can’t imagine most people would do).

Still, if you’re calculating your return based on the down payment/cash and the selling price, you’re not taking the total cost into account. For the mutual fund, that would include interest you pay on the margin just like the interest you pay to the bank for the mortgage.

Leverage helps, but you’re not really buying a $300,000 house/mutual fund for $58,000.

Let’s be fair, you can’t live in your index mutual fund.

So, I think that you should take the cost of renting over the same time period and subtract that from the total, and then compare. Also, comparing a $58,000 investment in a house, and a $300,000 mutual fund investment is not fair either.

Obviously you guys live on the coasts, because in the midwest I pay $2,000 in taxes/insurance a year, not $6,000, you can get a decent house for $150,000, and if your house needs $300,000 in improvements you just buy a different one.

The tradeoff, of course, is that you have to live in the midwest.

Great article. To Trainee, you’re right that there is not a universal answer. It depends on the market conditions and each individual/family circumstance. That’s what annoys me about David Bach and others who make statements like, “homeowners are rich and renters are poor.” Like you are either one or the other for life.

The disparity between homeowner vs. renter net worth is a fairly worthless stat. It doesn’t kee age or income into account. Also, there is a bit of a survivorship bias going on. There are many who have bought a house, only to find that they cannot afford it. This will become more common in the next year or two. They either sell or get foreclosed on, and find themselves renting once again. Were they better off buying?

Very interesting. I would have to agree with some previous posts that in most instances it depends. When you compare rental costs with ownership costs, numbers may vary wildly, and in most instances will also depend on the security of the area.

When I lived in Louisville, we looked at renting a 2/1 apt in the area we bought our 3/2 home and the monthly payment difference was negligible. I could have found something cheaper but would have been sacrificing personal security for a lower monthly payment. How do you put a price on that?

Flexo,

I agree with trainee, there is a statistical net worth advantage enjoyed by homeowners that is hard to ignore. However you may want to examine this in a little more depth. Is this due tp home ownership or a consequence of other factors typical to homeowners? They are, on average, older than renters and have higher annual incomes. Doubtlessly, these statistics both influence the net worth of the individuals as well as home ownership.

Nice, Flexo. I’m working on a “pay off your house early” type post (still doing research). I’ll have to point back to this. It’s fascinating…

As I am not a WSJ subscriber, I cannot read the full article so my comments are qualified accordingly.

While it is right to identify all the costs of home ownership ($300,000 for major repairs and improvements seems a bit arbitrary), that is not an answer to the question of whether it is better to rent or own. The only way to do a comparison is to prepare two spread sheets looking at all the numbers in both situations. The answer really depends on specific numbers – in particular future assumptions about house prices, rental levels, return on investments, interest rates, tax treatment and other matters.

I doubt if there is a universially “right” answer to this question. I have done this exercise several times. When the property market in Hong Kong was very weak (2001-2004) for the properties I looked at buying was a lot better than renting making it an easy decision. In some cases, I could actually assume a decrease in property values and still show buying to be better than renting (prices were very depressed then). Now it is a bit harder to make the numbers stack up.

I keep coming back to the statistical difference in net worth between home owners and non-owners. There are explanations for this statistic but it does make a good case for home ownership in the right circumstances.

One other point, I strongly agree that it is not sensible to rely on your home as your sole or a major source of retirement income. I tend to view our home as an emergency fund.

Thanx for publishing this! A lot of people don’t realize what the REAL cost of a house is. Anyone that looks at a house more as an investment and less as a place to live need to do some more math.

Of course, if you pay for a house in full, then things tend to shake out better investment-wise, but that’s tough to do. Of course it’s a bit more possible w/ the current housing market.