Digit Review - An App That Saves Your Money While You Sleep

Saving and investing is easier said than done. And that’s especially true if you don’t have a system in place for working toward your goals.

Digit was designed around the idea that saving and investing doesn’t have to be a challenge.

In this Digit review, we discuss the finer details of this automated savings tool, including the pros and cons along with guidance on how to best use it.

An Introduction to Digit

General Catalyst, a Digit investor, best describes the company:

“Digit is an automated savings tool with an SMS-based UI that uses an intelligent algorithm to identify small amounts of money that can be moved into a Digit account based on spending and income.”

Here are some of the many reasons why the Digit app has become such a big hit:

- Digit does all the work for you; no more forgetting to save or invest

- Machine learning to help you make the most of your savings and investments

- Automatically moves money based on the goals you set

What is Digit?

By now, you should have a better understanding of what the Digit app is and how it can help you with your savings and investing strategies.

Digit is designed to make saving easy, effortless, and fun. With the help of a sophisticated algorithm, it doesn’t take long for Digit to learn more about your financial habits.

With this in mind, the technology saves money on your behalf only when you can afford it. This way, you don’t have to worry about moving money around that you need for specific expenses, such as monthly utility bills.

Who is Digit Best For?

There’s no right or wrong answer to this question, as it’s designed for anyone who wants to save money.

However, it’s geared towards two general sets of people:

- Those who want to put their savings on autopilot

- Those who find it difficult to save money

With a hands-off approach, the most effort you’ll put in is when you open an account. From there, you can check the Digit app as often as you would like to review your transactions, the amount you’ve saved, and how close you are to reaching your goals.

Even if you have a savings system in place, Digit can help by saving you time and ensuring that you stock away every dollar that’s available.

How Digit Works

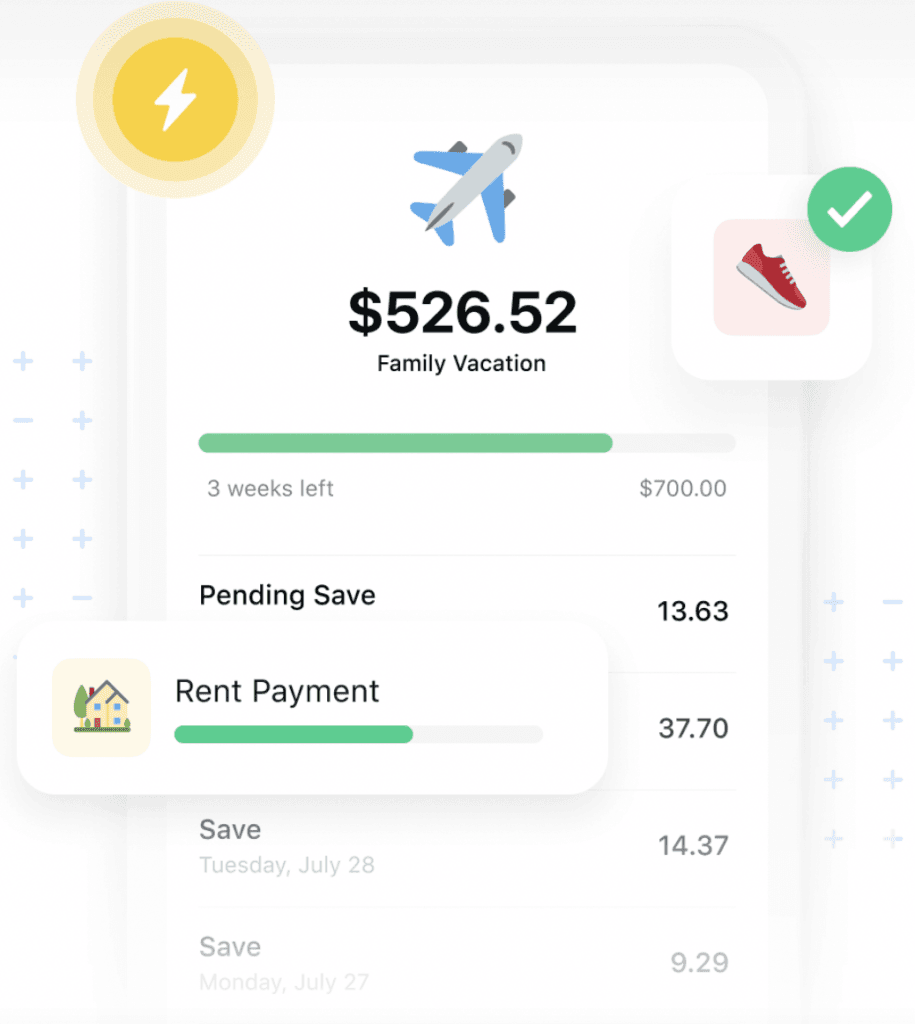

The basics of Digit are simple. It works by withdrawing small amounts of money from your checking account and depositing it into a Digit account. This generally happens every few days.

After you download the app, the first step in getting started is providing Digit with your phone number. From there, you can enter a special code to get up and running.

Note: your phone number is needed because this is the primary way that Digit communicates with you. This way, you can stay current with your account without having to open the app.

The next step in the process is linking your checking account with your Digit account. You can choose from one of many popular, pre-populated financial institutions. You can also use the search box.

Digit currently supports more than 2,500 banks, so it’s not likely that you’ll run into any issues with this step.

Now that you have everything set up, you can customize your goals and wait for the app to do everything else.

Be sure to track your progress week to week to better understand how Digit is working for you.

Key Features

There’s more to Digit than meets the eye. This app is packed full of high-level features that are designed with you in mind.

Here’s a brief list of some of the most popular features:

Digit savings bonuses

Use Digit for three consecutive months and you’ll receive a 0.10% annualized savings bonus.

Digit savings goals

Set goals and track your progress. Examples include saving for a car or home, saving for a trip, or starting an emergency fund.

Automated saving and debt repayment

Hands off savings and debt repayment ensure that you always remain on the right track.

Overdraft protection

Should Digit ever withdraw too much money — which is not likely to happen — you have overdraft protection.

No account minimums

Forget about how much money you have and think about how much you can save.

Unlimited withdrawals

Withdraw money from your Digit account whenever you want, for however much you want.

FDIC insured

Any savings held in your Digit account are FDIC insured up to $250,000.

Digit Fees

When it comes to Digit fees, there are only two things you need to know:

- The first 30 days are free

- After 30 days, you’re charged $5/month to use the service

Pros and Cons

When it comes to any financial tool — especially those associated with saving and investing — it’s critical that you understand both the pros and cons. This can help you make an informed and confident decision.

Pros

- Automated savings: This is what Digit is all about. It allows you to automate your savings so you never forget to put money aside.

- Track your goals: It’s one thing to save money, but another thing entirely to track your short and long-term goals. Digit makes this simple.

- Simple to get started: It only takes a few minutes to download the app, connect your bank account, and set your first savings goal. And from there, you don’t have to do anything more than track your savings.

- Savings bonus: There’s nothing better than free money, and Digit gives you just that if you use the service for three consecutive months. This allows you to earn a 0.10% annualized savings bonus.

- Manage your debt: With the credit card debt reduction feature, you can set up automatic payments to your credit card with money in your Digit account.

Cons

- Monthly fee: There’s not much that will scare you away from Digit, but there is a monthly fee that comes into play. After your free trial period of 30 days, you’ll begin to pay $5 per month to use the app. To many, this is counterintuitive, as your goal is to save money as opposed to spending.

- No interest rate: On the plus side, you will receive a cash bonus if you use Digit for three consecutive months. However, the money that you hold in your Digit account does not earn interest. So, as your account grows, you’ll want to consider moving it somewhere where it can make you money.

Alternatives to Digit

In today’s world, there’s no shortage of saving and investing apps. Furthermore, there’s a new one popping up on what seems like a daily basis.

If you’re interested in Digit, you should also turn your attention to these competing services:

With over seven million customers, Acorns is one of the largest companies in this space. It allows you to automatically invest your spare change, in a similar manner as Digit. With plans starting at $1/month, it’s cheaper than Digit.

While you’re able to set goals as part of your overall budget, there is no automated savings feature. Instead, you have to do the work yourself. It costs $9.99/year to use.

A powerful savings app, but just the same as CountAbout, it doesn’t have an automated savings feature. On the plus side, it’s free to use the basic account.

Even if you’re convinced that the Digit app is best for you, compare it to the features, pros, and cons of the three services above (among any others that you come across).

Bottom Line: Is Digit Right for You?

With this Digit review, we hope that you have a clear understanding of what the app can and can’t do for you.

If you’re on the fence, take advantage of the 30-day free trial. This allows you to take the app for a test run, which will help you make a final decision.

Digit may not be the biggest service in this space — as measured by the number of users — but its feature set is second to none. It’s worth taking the time with a free trial.

Article comments