An Exclusive Q&A With Entrepreneur And Tax-Guru Carter Cofield From Cofield's Concepts

We sat down with Carter Cofield, the Owner & Advisor at Cofield Advisors, LLC, to get his inside take on how to deal with your taxes like a professional.

As a Certified Public Accountant (CPA) and Personal Financial Specialist (PFS), Carter has dedicated his entire career to helping business owners and entrepreneurs navigate the world of financial in the most efficient and effective way.

According to Carter, these are the most important questions to ask yourself when filing your taxes as a self-employed individual and the answers to those questions.

- Why are taxes more complicated for self-employed individuals vs. employees?

- What are quarterly tax payments and when do I need to pay them?

- What are tax-write offs and how can self-employed people take advantage of them?

- So you’re saying that some personal expenses be business write-offs? If so, can you name a few?

- What is the biggest mistake that you see self-employed individuals make on their taxes?

- Do you have any tips on how to avoid getting audited?

- What is the best business type to help maximize tax savings?

- What time of year is best to meet with your accountant to discuss taxes?

Why are taxes more complicated for self-employed individuals vs. employees?

When you’re an employee, taxes are taken from your paycheck for you, so you don’t really have to do too much. However, when your self-employed, there is no one taking your taxes out automatically, so you have to figure out how much to set aside for your future tax bill.

Self-employed individuals are also required to make estimated tax payments every quarter, and the calculation on how much to pay can be a bit tricky. We will discuss this further in a bit.

What are quarterly tax payments and when do I need to pay them?

Nothing gives entrepreneurs more anxiety than the thought of a huge tax bill in April. However, by making estimated tax payments, you can pay into your future tax bill overtime, so it doesn’t hit you in the face all at once.

Estimated tax payments are required for self-employed individuals because their income is not taxed when it is earned. The IRS requires you to make payments of 90% of your current year’s liability or 100% of prior year’s tax liability.

Thus, in your first year of business, you are generally not required to make estimated tax payments because you don’t have an estimate of what your earnings will be.

Estimated tax payments are due quarterly and the due dates changes every year. but listed below are the 2021 deadlines:

- April 15th

- June 15th

- Sept 15th

- Jan 18th (2022)

What are tax-write offs and how can self-employed people take advantage of them?

As you may know, taxes are a HUGE expense for both employees and the self-employed. The only difference is, as a self-employed person, you can lower you tax bill by utilizing tax-deductible business expenses (aka write-offs).

Fully understanding the items that your business can write off can literally save you thousands!

The technical definition for a write-off is any expense that is ordinary or necessary to operate your business. So essentially, any expense that you need to operate your business you can deduct against you income and therefore lower your taxable income.

The beauty is, a lot of your personal expenses turn into tax deductible business expenses the moment you become self-employed! More on this in a bit.

So you’re saying that some personal expenses be business write-offs? If so, can you name a few?

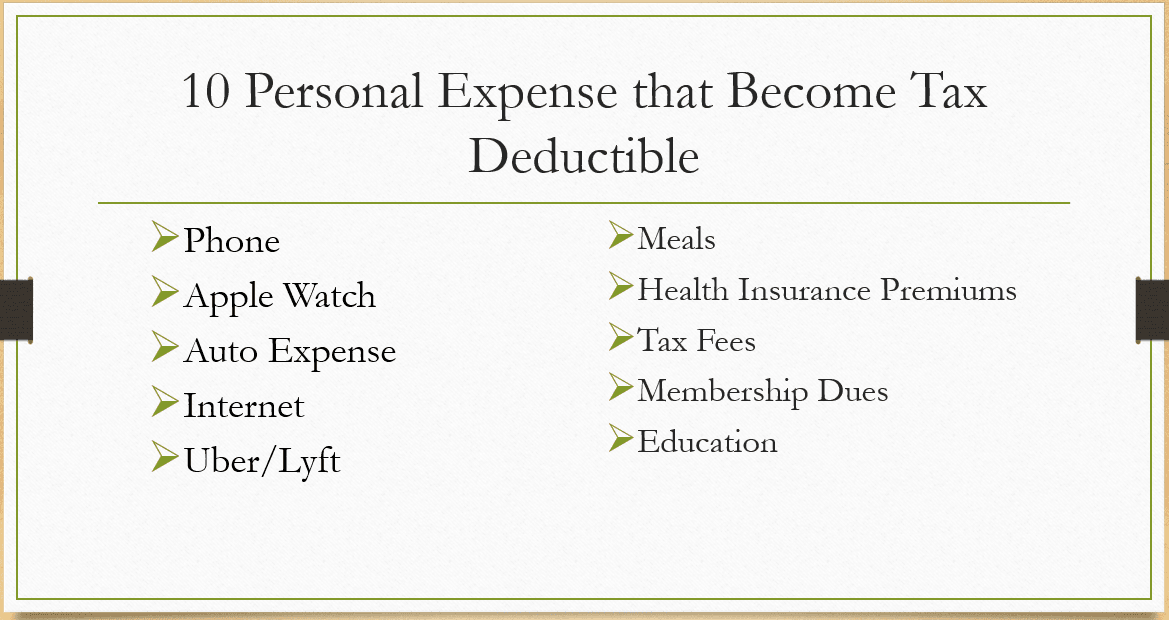

Absolutely! This was my biggest epiphany when I was debating on starting my business. I discovered that they were loads of expenses that I was already paying for that, if I stated as business expenses, would immediately become tax deductible. Below is a list of my top ten:

What is the biggest mistake that you see self-employed individuals make on their taxes?

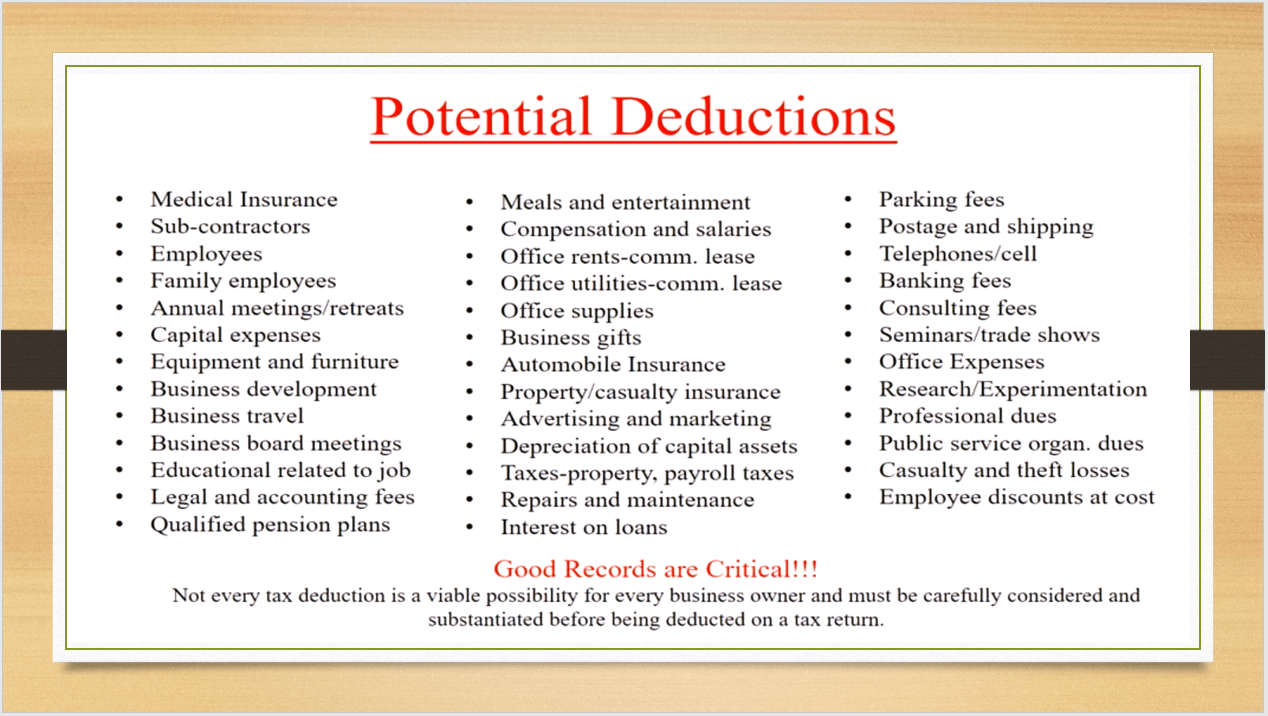

Not deducting enough expense.

Most self employed people don’t understand the myriad of expenses that you can deduct in your business. Below is a list that will give you a great start.

If you want to learn more, you can check out my Tax-Free Living E-book that has a list of 200+ tax deductions that you can utilize.

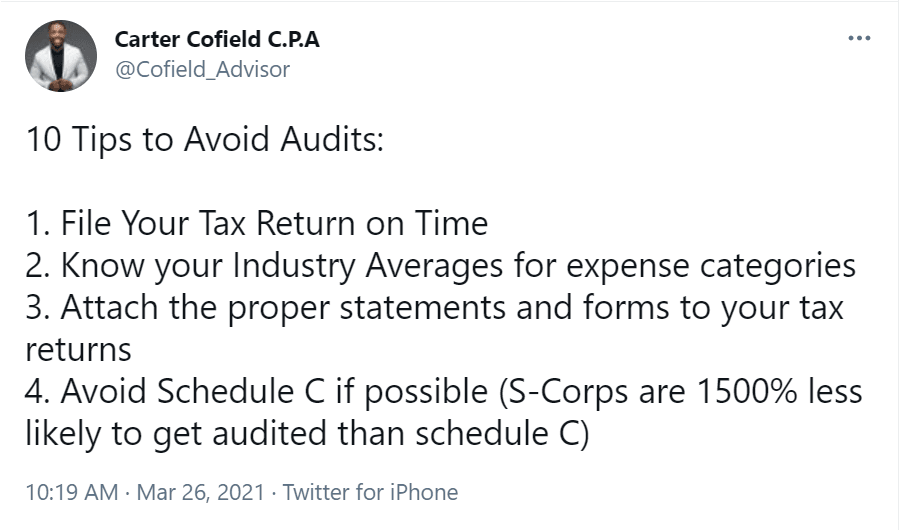

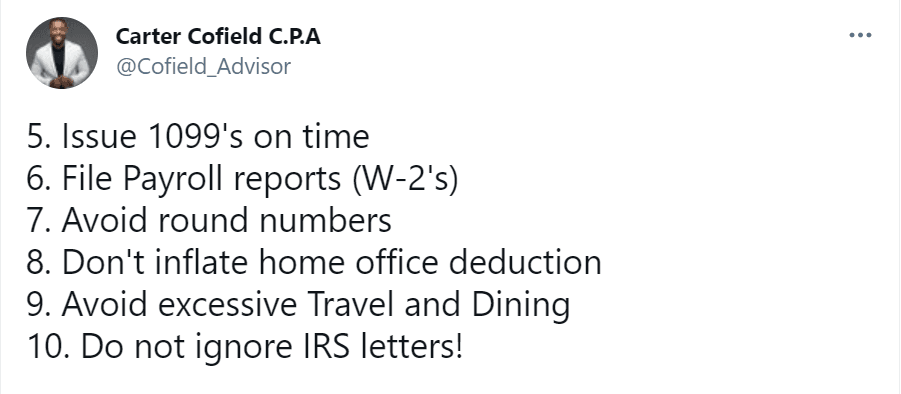

Do you have any tips on how to avoid getting audited?

Receiving an Audit letter in the mail is most people’s worse nightmare! But it turns out, audits can be easily avoided. Below is a list of tips to drastically lower your risk of audit:

What is the best business type to help maximize tax savings?

When you’re just starting out as a self-employed person, an LLC is the best entity type for you. It allows you to properly deduct your expenses and helps shield your personal assets form potential litigation.

However, once you start to make over $40k in Net Income, I recommend that you upgrade to an S-Corporation. S-Corps help you save thousands in FICA taxes which can be up to 15.3%!

What time of year is best to meet with your accountant to discuss taxes?

This is a great question and I love educating people on this!

There are actually two types of tax seasons; tax planning season (Oct-December) and tax paying season (Jan-April).

And If you do the work during tax planning season, you won’t be upset during tax paying season. With that said, you should meet with your account sometime between Oct-Dec to construct a tax saving plan.

If you do this properly, you can reduce your tax bill by thousands!

You can read more about Cofield’s Concepts tax and business courses in our in-depth review, here.

Article comments