Unifimoney Review - Save, Spend, and Invest All In One Place

Gone are the days of managing your money with nothing more than a pen and piece of paper. Online money management platforms — such as Unifimoney — have changed the game forever.

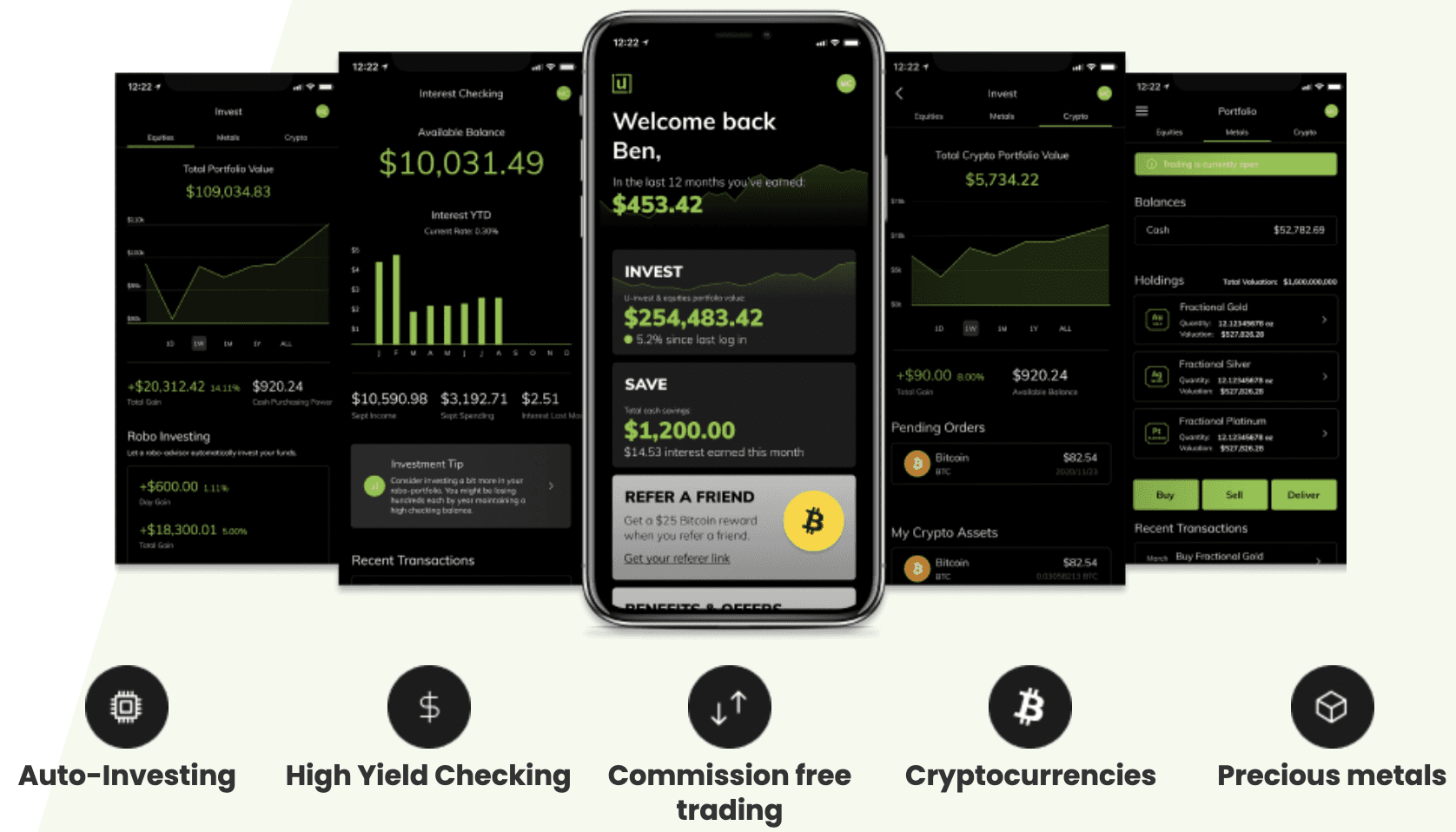

Even though Unifimoney is a new premium digital money management platform, it’s picking up steam in a hurry. And here’s why: it’s a one-stop-shop for all your financial needs. This includes but is not limited to banking, credit, insurance, and investing.

Best yet, with a powerful and convenient app, your entire financial life is always at your fingertips.

Some of the many reasons to use Unifimoney include:

- All-in-one solution

- Technology-driven

- Auto-investing each month

- Multiple ways to invest including passive and active trading of stocks and ETF’s, over 30 cryptocurrencies including Dogecoin and precious metals – Gold, Silver and Platinum.

- Next day account funding and programmable auto fund transfers (new this month)

In our Unifimoney review, we provide an overview of the platform and its many features. Continue to read so you can decide if it’s right for you.

What is Unifimoney?

Unifimoney is an all-in-one solution that allows you to effortlessly manage your finances via a single app.

Here’s what Unifimoney has to say about its service on its website:

If there’s one thing that sets the company apart from its competitors, it’s the all-in-one approach. Not only does this save you time, but it also allows you to make more informed financial decisions.

Unifimoney Services

When you download the Unifimoney app, you’ll immediately realize that there’s no shortage of services for you to take advantage of.

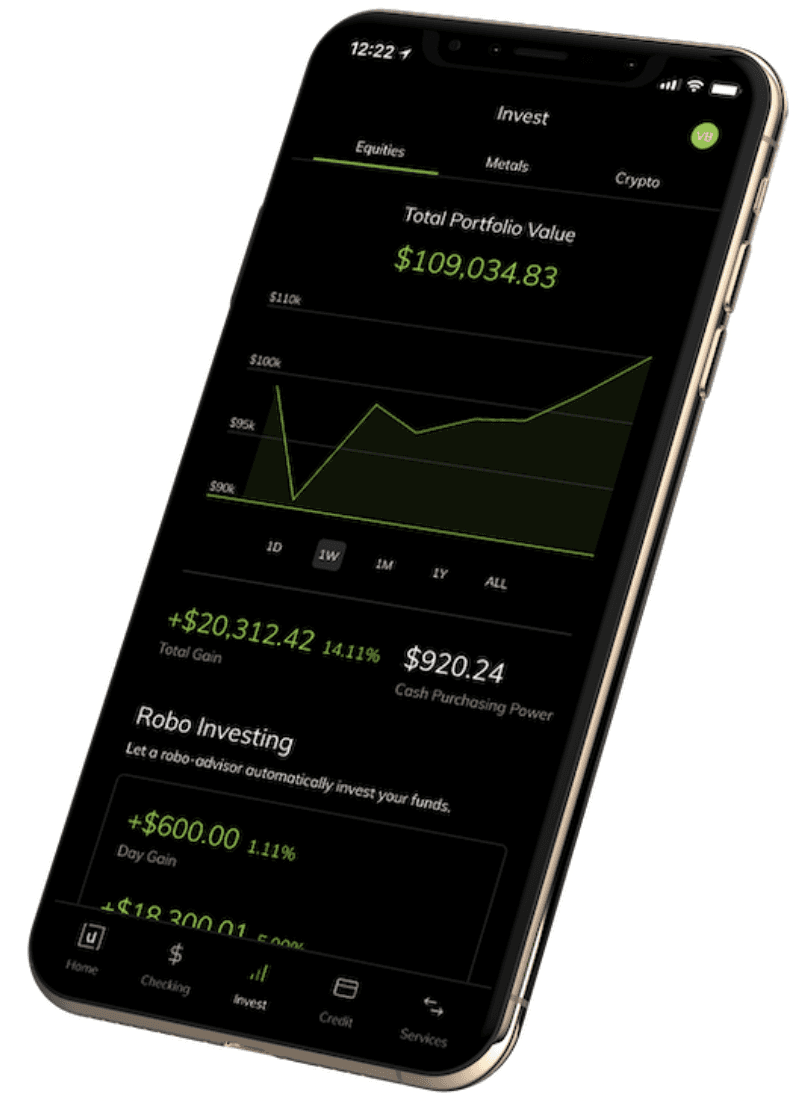

Unifimoney Investing

A big part of your financial plan is investing. However, if you don’t have the right platform on your side, it can be challenging to make the right investments.

Unifimoney has a variety of investing tools designed to help you build and manage your investment portfolio. From stocks to bonds to cryptocurrencies, there’s no shortage of investment opportunities.

Unifimoney is the only multi-asset investment app in the market. That means it offers investing opportunities such as: passive and active investing, crypto, metals, and more. It also offers Bitcoin Rewards upon signing up up to $1,000 depending on deposit amount.

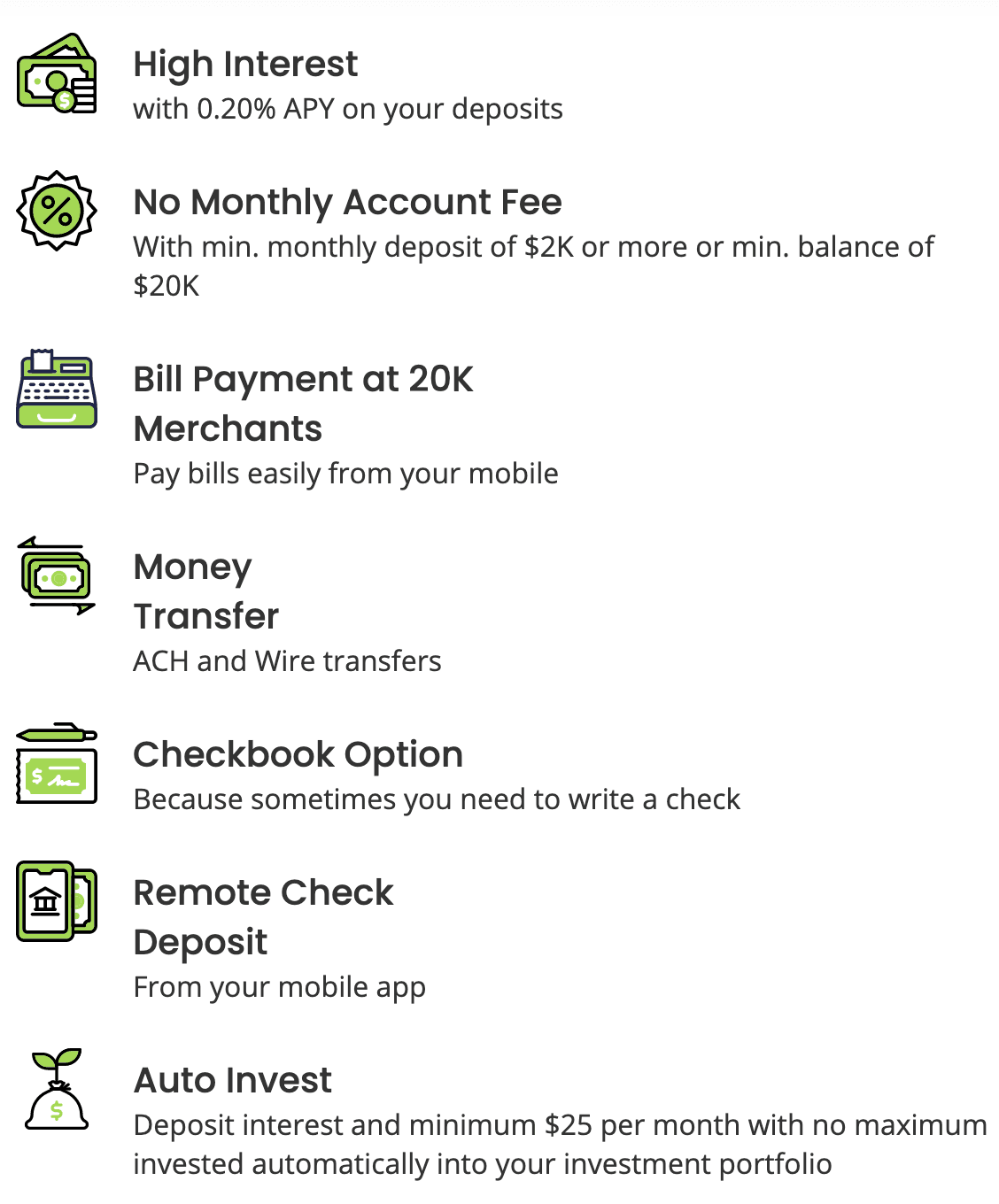

Customers automatically and passively drip feed contributions into their personalized Robo fund every month from deposit interest, credit card, cash back, and a minimum $25 monthly autoinvest contribution. You can set this as high as you want but the minimum is $25 per month.

Customers can trade cryptocurrencies and precious metals in real time, up to the maximum deposits in their account. Unifimoney supports over 30 cryptocurrencies (including all the most popular ones including Dogecoin) and gold, silver and platinum trading. The precious metals trading allows customers to invest in physical gold on an allocated basis – this means you actually own the metal itself. The metals are held in secure storage until you sell them or if you want have them delivered to your home (there is an additional charge for delivery).

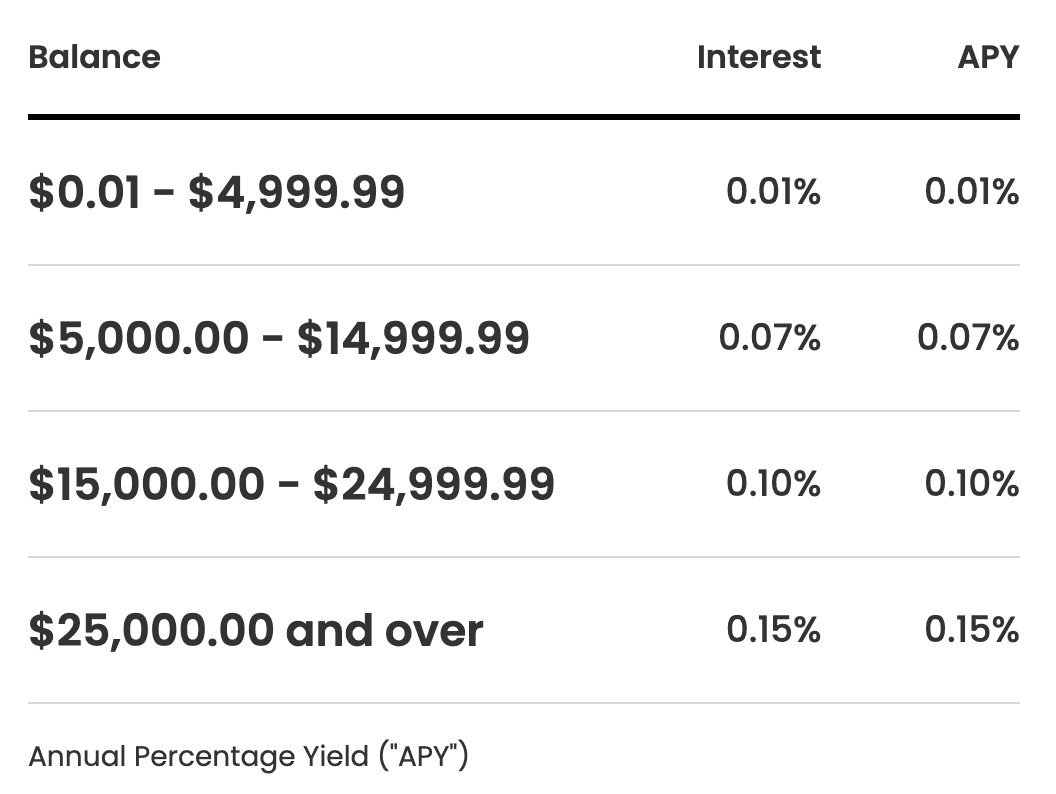

High Yield Checking Account

Unifimoney offers a High Yield Checking account – this comes with all the bells and whistles you would expect from a checking account – Debit Card, Money Transfers, Bill Payment, Checkbook but it pays savings levels of interest – currently 0.20% APY. The deposit interest is automatically used to fund your Robo fund each month.

The Unifimoney Visa Debit card is made of recovered ocean bound plastic and helps support The Ocean Foundation each time it is used.

Unifimoney recently introduced next day account funding so transfers of funds into your account from a 3rd party bank will be in your account next business day. This is due to be enhanced in the near future with the ability to set up automated rules to move money between accounts e.g. on pay day to move a fixed amount from your old bank account to Unifimoney. This means you can easily set up automated investments using both the auto transfer and auto invest functions.

Credit Card

Due to be launched in August this year and exclusively available to Unifimoney customers the Unifimoney Visa Signature Credit Card will uniquely pay rewards as Bitcoin, Gold or as a contribution to your Robo fund. Customers can change which asset class they want to receive their rewards each month. The exact cash back rate is not yet publicly available but sources including Business Insider have been quoted as saying it will be around 2% – an industry leading rate.

Unifimoney Insurance

Unifimoney has partnered with Gabi to provide users with real-time auto insurance quotes. Customers who successfully apply for a quote receive a $15 Bitcoin reward. Furthermore, they’re in the process of adding other insurance lines including Life Insurance and Home Insurance.

Unifimoney Student Loan Refinancing

If you’re paying too much every month on your student loans, it may be time to refinance. Unifimoney makes this process easy. Specifically designed for higher value loans Unifimoney offers a 1% variable cash back bonus up to total loan size of $250,000 – that’s a max. $2,500 cash bonus.

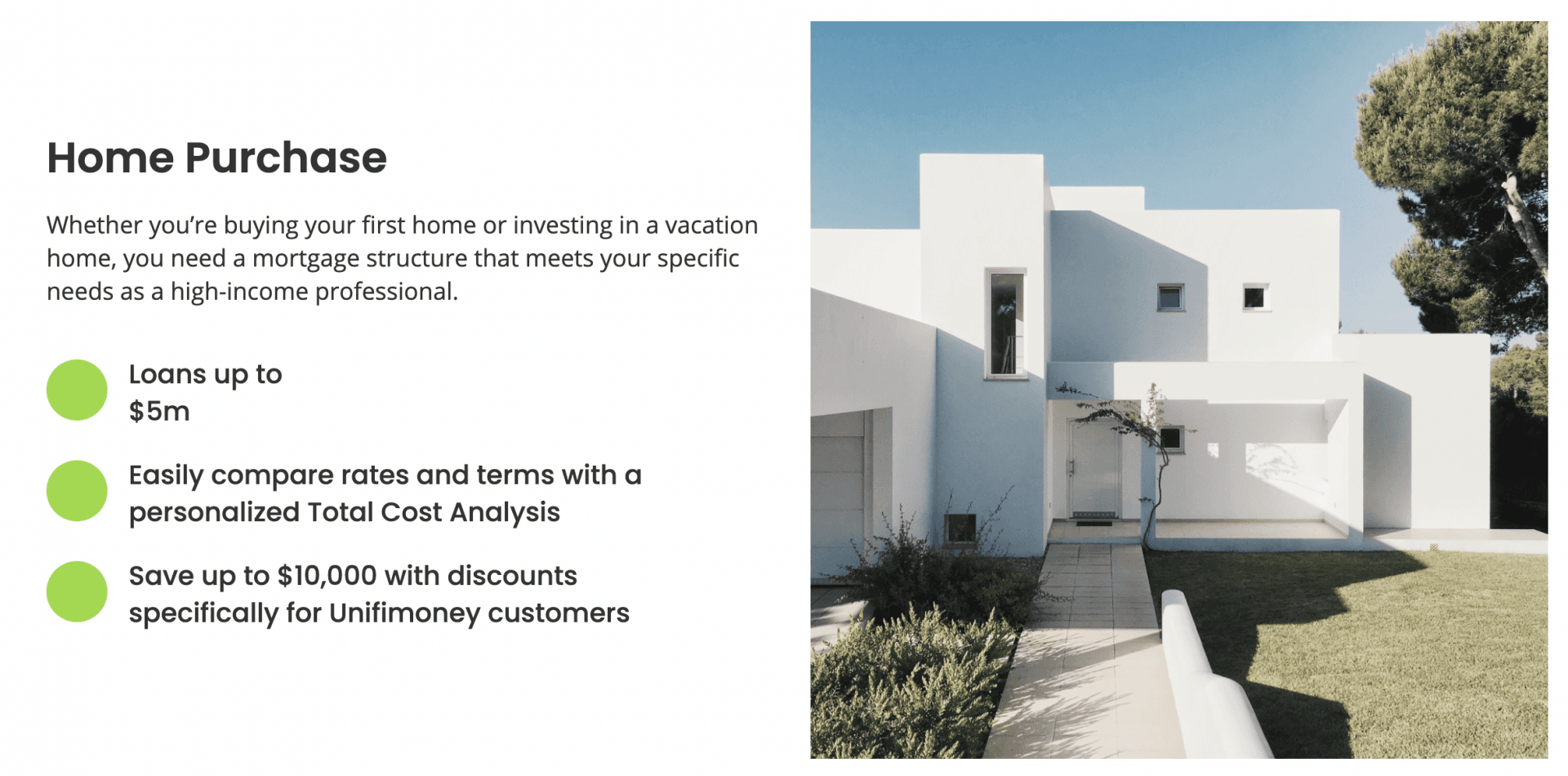

Unifimoney Home Loans and Refinancing

Securing a mortgage to buy a home used to be a complex process, but Unifimoney has taken all the challenges away. The same holds true if you want to refinance your current loan. Also, if you use Unifimoney, you’ll gain free access to a home-management platform.

Unifimoney Vehicle Loans

Unifimoney customers have access to a variety of lenders, thanks to a robust partner program. This allows you to secure a loan at a competitive interest rate, thus saving you money.

Unifimoney Home Improvement Loans

With a home improvement loan, you can install a pool, finish your basement, or remodel your kitchen — and that’s just the start. When you apply for a home improvement loan through Unifimoney, you can receive up to a $1,000 bonus.

Unifimoney HSA

If a health savings account is right for you, Unifimoney has you covered. Through a partnership with UMB Healthcare Services, you can easily manage your HSA through the app. Also, there’s no monthly fee and you will receive 1% cash back on your first transfer.

How To Get Started With Unifimoney

One great thing about Unifimoney is that it gives you the ability to get started within a matter of minutes.

The first thing you have to do is enter your phone number on the Unifimoney website. That will send you a link to download the app.

Alternatively, you could search the App Store to find the Unifimoney app.

From there, follow the prompts to set up your account. Some steps are required, while others you can revisit in the future.

Once your account is set up, you can then experiment with the many services and features. Take the time to learn more about each one.

Key Features

There is no shortage of Unifimoney features. After all, it’s designed to be an all-in-one solution.

Here is a list of some of the top features available to every user:

- Auto-investing: Never again forget to invest your money. With auto-investing, you can choose the amount and interval at which you invest. And of course, you can decide how you invest your money. With “set it and forget it” investing, it’s much easier to reach all your goals.

- High-yield checking account: With a Unifimoney checking account, you can receive direct deposits, pay your bills, and even earn money on your balance.

- Commission-free trading: Don’t pay a commission every time you buy or sell a stock. Unifimoney offers commission-free trading, which gives you more money to invest.

- Cryptocurrency investing: Cryptocurrency, such as Bitcoin, is all the rage in today’s day and age — and there’s no reason to believe it’ll slow down. Not every platform offers cryptocurrency investing, but Unifimoney does. And thanks to Unifimoney Gemini, you have access to more than 30 cryptocurrencies.

- Unifimoney app: You don’t need a computer to manage your Unifimoney account. You can do everything with its app, thus allowing you to manage your money from anywhere.

Unifimoney Fees

Generally speaking, Unifimoney is free to use. However, there are some exceptions to this rule.

Unifimoney is fee-free as long as you use it as your primary bank account, which allows you to meet minimum activity levels. This includes a minimum direct deposit of $2,000 per month within four months of opening an account. You can avoid a monthly fee if you maintain a minimum balance of $20,000.

Also, if you use its robo-investing service, you can expect to pay an advisory fee between 0.15% and 0.30%.

Pros and Cons

There are pros and cons of Unifimoney and understanding them is critical to deciding if it’s the right service for you.

Pros

- Auto-investing to help you reach your savings and investing goals

- Competitive fee structure (fee-free for many users)

- All-in-one solution

- Easy to use app experience

- Access to a variety of services

- Sign-up bonuses associated with many services

Cons

- Fees for robo-investing and in some cases the use of a Unifimoney checking account

- Most services are offered through partner companies

- You may not qualify to use every service

Alternatives to Unifimoney

While Unifimoney is an industry leader, there are alternatives to consider. Here are two of the best:

Wealthfront

With Wealthfront, you gain access to many of the same services and features as Unifimoney.

If you’re interested solely in the best robo-advisor service, you should turn your attention to Wealthfront. For balances under $5,000, there’s no management fee. And even when your balance is higher, you’ll only pay 0.25%.

Wealthfront is also well known for its low ETF expense ratios, automatic rebalancing, and daily tax-loss harvesting.

Add all this to an easy-to-use online system and app, and it’s easy to see why Wealthfront has millions of users.

Chase

Chase is one of the biggest names in the finance industry, and for good reason: they’ve been in business for more than 20 years.

The first thing you should know about Chase is that you can invest with them in three distinct ways:

- Invest with the Chase robo-advisor

- Trade on your own

- Trade with the help of a dedicated advisor

You may decide to start with one option and transition to another as your financial circumstances change.

When compared to Unifimoney and Wealthfront, Chase’s app is not nearly as comprehensive. It offers all of the standard features you’ve come to expect — such as the ability to transfer money — but lacks the high-end functionality of many competitors.

Overall, if investing is what you’re most interested in, Chase is a strong choice. Their experience alone will give you peace of mind.

Who is Unifimoney Best For?

With so many services and features, most people can find a way to use Unifimoney. If you’re on the fence, here’s an overview of the type of people it’s best for:

- Young professionals who are seeking an all-in-one financial management solution

- Those who want to save money on fees, when compared to traditional financial institutions

- Those who are interested in auto-investing

Of course, even if you only use one or two Unifimoney features, it could still make sense.

Bottom Line: Is Unifimoney Right For You?

Just the same as any online platform or financial service, Unifimoney isn’t the right choice for everyone.

However, with so many services and features, Unifimoney is definitely worth a closer look.

The only true way to decide if Unifimoney is right for you is to personally give it a try. So, download the app, customize it to suit your personal finances, and see what it can do for you.

There’s a good chance you’ll find that Unifimoney is the solution you’ve been searching for.

Article comments