MorningStar Review: Premium Independent Tools For Investors

Morningstar is one of the biggest names in the financial industry, providing independent investment services for individual investors.

Although the company has a bit of a hefty price tag for its premium service, we say that’s it’s totally worth the cost. (There’s also a free basic version if you want to get a feel for it before purchasing).

Here, we’ll take a detailed look at the company as a whole, as well as the services and tools that make Morningstar a great option for active investors.

What is Morningstar?

Morningstar is a financial services company that provides investors with the tools they need to reach and exceed their short and long-term investing and personal finance goals.

With approximately 8,000 employees and $215 billion in assets under management, Morningstar is one of the largest and most well-respected financial services firms in the world.

Quick Feature Highlights

- Analyst Reports

- Best Investments and Fund Analysis

- Portfolio Manager

- Portfolio X-ray

- Screeners

- Article Archive

Pros and Cons

Pros

- Ratings regularly reviewed and updated to ensure accuracy

- Variety of tools designed for investors of all experience levels

- Comprehensive list of all costs and fees associated with every fund for clarity

Cons

- Higher monthly subscription fee for Premium than competitors

- Less information related to individual stocks and exchange-traded funds (ETFs)

- Free version is missing important features like analyst reports and ratings

How Much is Morningstar?

If you’re interested in taking Morningstar Premium for a test-drive, there’s a 14-day free trial that provides full access to all its services, tools, and features.

From there, if you like your experience, you’ll have a question on your mind: how much is Morningstar premium?

The answer is simple: you can pay a monthly subscription fee of $29.95 to maintain access.

There are ways to save money, including:

- Paying $199 for an annual subscription

- Paying $349 for a two-year subscription

- Paying $449 for a three-year subscription

By paying in advance, you can save as much as $12/month.

There are many Morningstar premium features, including but not limited to the following:

Analyst Reports

Morningstar’s analyst reports provide a detailed summary of what its analysts think about a comprehensive list of investments.

With a focus on the investment’s prospects, you gain a better understanding of what they believe will happen in the future. This information is then compared to its benchmark and other investments in its category.

Here’s what you get in each analysis report:

- Analyst note

- Business strategy and outlook

- Economic moat

- Fair value and profit drivers

- Risk and uncertainty

- Stewardship

Best Investments and Fund Analysis

It’s natural to have concerns about choosing the right investments. Fortunately, this feature provides access to a list of the best investments as outlined by 200+ independent analysts.

You can search by category, including:

- Starter funds

- Target-date funds

- Bond index funds

- US index funds

- Foreign index funds

- High-yield bonds

- Foreign bond funds

- Core bond funds

- ETFs

If you require guidance, this tool will point you in the right direction.

Portfolio Manager

The Morningstar portfolio manager is one of the most used tools, as it allows you to track your investments, review and tweak your strategy in real-time, and keep your eye out for fresh opportunities.

By including links to reports, you have easy access to the information you need to make informed investing decisions.

This Morningstar portfolio tracker review doesn’t do the tool justice. You need to experiment with it yourself—such as during your 14-day trial—to really understand what it can do for you.

Also, the Morningstar app provides access to your portfolio—as well as other features—on your mobile phone and/or tablet.

Portfolio X-ray

After building your portfolio, use this tool to evaluate your investments. It can help you answer questions such as:

- What sectors are you investing in?

- What does your asset allocation look like?

- Are you investing too much in one sector or the same type of company?

The portfolio X-ray feature is exactly what it sounds like. It looks inside your portfolio to help you answer key questions.

Screeners

With so many investments to choose from, making a final decision is never easy. The Morningstar fund screener helps with this by allowing you to search and filter mutual funds by:

- Performance

- Ratings

- Category

There is both a basic fund screener and a premium fund screener. The premium screener provides access to additional filters, such as tax cost ratio, trailing returns, annual returns, and load adjusted returns.

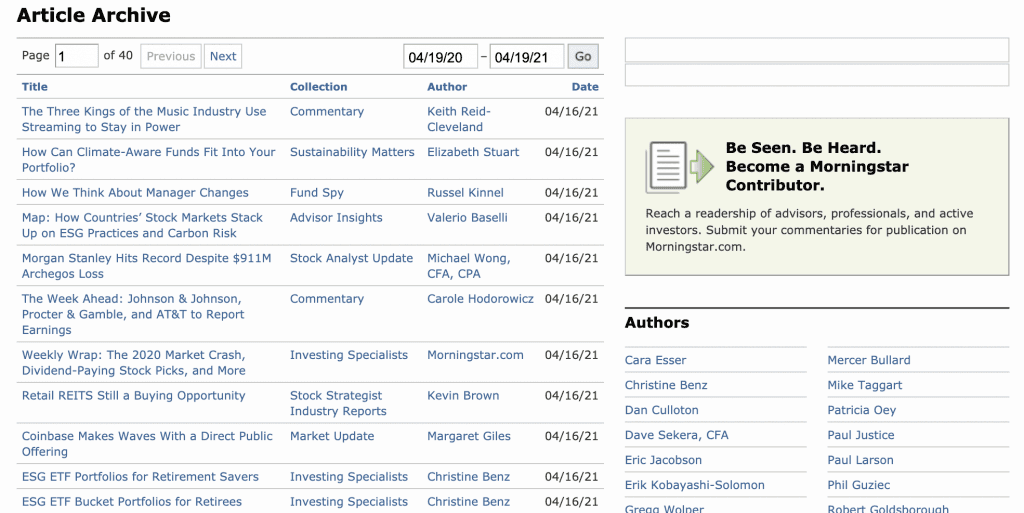

Article Archive

One of the top Morningstar premium benefits is its article archive.

This is where you’ll find a variety of articles related to specific investment activities, such as tax planning, retirement planning, education planning, and personal finance.

Similar Funds

Maybe you’ve found a fund that you want to invest in. But before you do so, you want to learn more about similar options. This is where the similar funds tool comes into play.

It allows you to quickly find funds that are similar to your target fund, with a focus on details such as allocation and performance.

Personal Capital Tie-in

Upon signing up for Morningstar Premium, you can request a free personal financial review with a Personal Capital advisor.

Note: you must have a portfolio of $100,000 or more to qualify.

At this time, you can ask a variety of questions as they relate to your portfolio, personal finances, and Morningstar services. For example:

- Am I on track to retire by my target date?

- Am I invested too heavily in one sector?

- Are there any investments in my portfolio that are too risky?

- Is it a good idea to follow Morningstar independent investment research?

- Can you provide a brief Morningstar portfolio tracker review?

- What’s the best way to get as much value as possible out of my Morningstar subscription?

- What is Morningstar rating and should I let it guide me?

- Should I pay close attention to the Morningstar risk rating before investing in a fund?

- Do you consider Morningstar ETF ratings to be accurate and insightful?

- Are Morningstar stock reviews and Morningstar mutual fund reviews insightful?

As you ask these questions, others will come to light. Don’t be shy about discussing your situation in its entirety.

Morningstar Basic Membership

A Morningstar basic membership may not be as powerful as premium membership, but it still has plenty to offer.

The primary difference between the two is that a premium membership gives you access to independently researched analyst reports and ratings. Without the Morningstar report for a fund, you’re short of some of the information you need to make an informed investment decision.

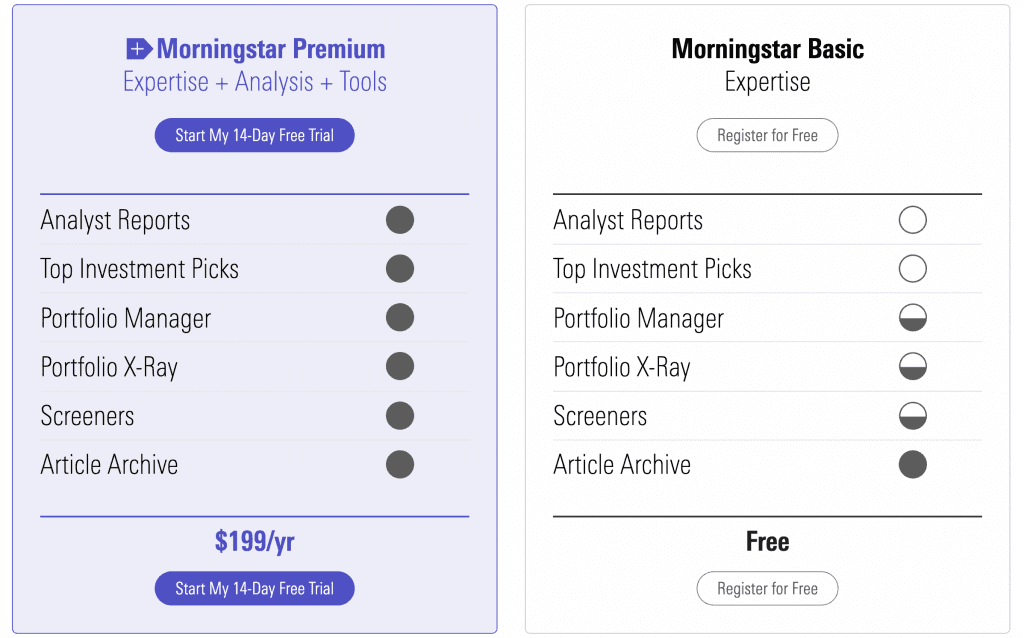

Here’s a table of what’s included in each membership level:

| Features | Basic | Premium |

|---|---|---|

| Analyst Reports | Not Included | Included |

| Top Investment Picks | Not Included | Included |

| Portfolio Manager | Limited Access | Included |

| Portfolio X-ray | Limited Access | Included |

| Screeners | Limited Access | Included |

| Article Archive | Included | Included |

Ease of Use

Many financial tools are challenging to use, as there’s a lot of information, data, and numbers to consider.

This isn’t an issue with Morningstar premium or basic, as both versions are designed with user-experience in mind.

It doesn’t matter if you’re searching for a Morningstar risk rating or need to use the Morningstar portfolio tracker, it’s simple to find your way around the dashboard.

Who is Morningstar Best For?

Morningstar is the best choice for investors who are actively managing their own profiles, and who want to understand the nitty-gritty details of each and every investment.

Unlike some who choose to be more passive about their investments and let brokers or robo-advisors do the thinking for them (which is also ok), Morningstar users gain the knowledge and information needed for making confident investment decisions on their own.

The great thing about Morningstar, is that it is designed for investors of all experience levels.

For example, experienced investors may be more interested in Morningstar independent investment research and Morningstar financial reports.

Conversely, although beginners may be scared away by the Morningstar premium cost, they find that the basic package is more than enough for the time being.

Morningstar doesn’t discriminate based on knowledge, experience, or portfolio size. There’s something for everyone.

Morningstar Alternatives

As a company that’s been in business for nearly 40 years, it’s safe to assume that there’s plenty of competition.

It never hurts to learn more about Morningstar alternatives, with both Betterment and Wealthfront among your top choices.

While these services don’t provide the same level of in-depth, professional guidance and ratings, they’re well known for being easy to use and full of features. Furthermore, they possess a modern interface geared toward today’s investors.

The short answer is yes, definitely.

While there is a slightly higher monthly fee to pay, most seasoned investors agree that Morningstar premium is one of the best services in its space, thanks to its in-depth information and professional guidance.

If you’re unsure if Morningstar Premium is worth the cost, start with the basic membership to get a better feel for the product.

From there, you can focus more on Morningstar Premium benefits to help you understand if an upgrade makes sense.

Tip: Read as many Morningstar managed portfolio reviews as you can find, as this helps you understand what others think of the service.

Conclusion

It’s our hope that this Morningstar premium review provides you with everything you need to make an informed decision.

Remember this: either Morningstar subscription is better than none at all, as you gain access to tools that can help you better invest and manage your money.

With this information, you should be closer to deciding if Morningstar is right for you. If you’re ready to proceed, sign up for a Morningstar basic or premium membership and get started.

Article comments