Personal Capital Looked Into US Retirement Plans Since COVID - And The Findings Are Encouraging

It’s been more than a year since the COVID-19 pandemic took the world by storm. While it’s altered the financial course of tens of millions of Americans, a new study shows that retirement savings habits are stronger than ever before.

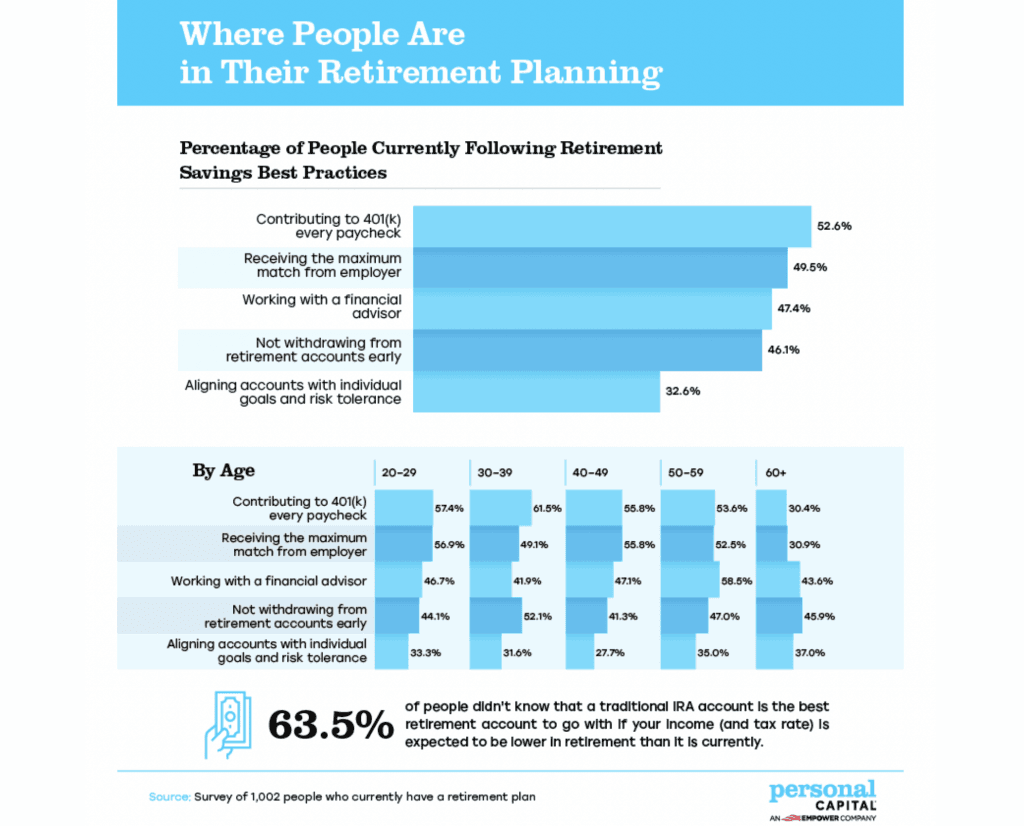

According to a recent Personal Capital survey, more than 50 percent of Americans state they are contributing to a 401(k) retirement account with each paycheck. Furthermore, they also note that they have continued to do so throughout the pandemic.

But that’s not all the survey unveiled. Here are some additional data points of interest:

- 49.5 percent of respondents are receiving the maximum match from their employer

- 47.4 percent of respondents are working with a financial advisor

- 46.1 percent of respondents are not withdrawing funds early from their retirement accounts

These numbers back up the overall sentiment that the majority of Americans are regularly contributing to a 401(k) retirement account.

It’s Not All Good News Though

Even though a large percentage of Americans have held steady with their retirement contributions since the onset of the pandemic, this doesn’t hold true across the board.

Many people are finding it difficult to manage their retirement savings during the pandemic. Consider the following:

- 23.8 percent of respondents have decreased retirement contributions

- 20.8 percent of respondents have altered their plans to retire at a later date

- 19.8 percent of respondents discontinued their relationship with a financial advisor

- 18.1 percent of respondents withdrew from retirement accounts early

- 15.9 percent of respondents postponed retirement contributions

While these numbers are smaller than the data points above, when you consider the American population as a whole, it’s easy to see how many people are struggling financially.

For example, roughly one in five Americans have decided to retire later than planned, likely as a result of the inability to save enough during the pandemic.

It’s Time to Take Action

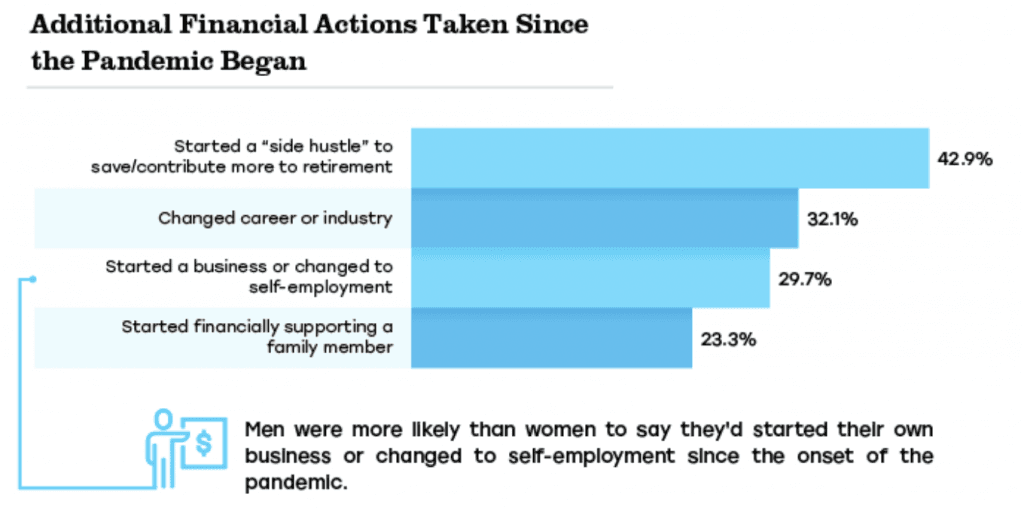

Rather than sit back, hope for the best, and wait for the pandemic to end, many people are taking their financial future into their own hands. Here’s how:

- 42.9 percent of respondents started a side hustle with the goal of saving more money for retirement

- 32.1 percent of respondents changed their career path

- 29.7 percent of respondents started a small business or opted for self-employment

It’s encouraging to see that so many Americans have taken action with the goal of continuing to save for retirement.

Speaking of action, Personal Capital is doing its part in helping its customers reach their retirement savings goals.

Starting on April 12, 2021, Amin Dabit, Vice President of Advisory Services at Personal Capital will be available to discuss these survey findings and offer additional tips on how to save for retirement during the pandemic.

Final Thoughts

The COVID-pandemic has affected everyone differently, but most have found themselves more closely managing their finances.

Now’s the time to review your retirement accounts, set short and long-term goals, and obtain as much advice and guidance as possible.

If you’re interested in how your retirement savings stacks up against other residents of your state, this Personal Capital blog post has you covered. While this data is helpful, keep in mind that everyone is running their own race.

Should you require assistance with any aspect of retirement planning, Personal Capital has a variety of services available — many of which are free. From a retirement calculator to the ability to plan for different scenarios, it’ll give you a big picture view of your current status while helping you best plan for the future.

Article comments