2017 Federal Income Tax Brackets and Marginal Rates

As tax year 2016 comes to a close, your focus is probably on filing that tax return after the new year (remember that your deadline is April 17, 2017). The IRS may end up confusing some people, though, as they just released the tax brackets, deduction limits, and marginal rates for tax year 2017.

Keep in mind that these numbers are not what you will be using to file your taxes this coming spring. The taxes you file in early 2017 will be for tax year 2016 — if you want to look at those numbers, you can find them on the 2016 tax page.

The numbers shown below are for the taxes that you will incur from Jan-Dec 2017, and then file in spring 2018. They can help you now, though, as you plan your finances and income withholdings for the next calendar year.

What are the 2017 marginal tax rates?

As in most years past, the limits have been bumped a bit for 2017, to account for inflation. The effect is minimal, though, and you won’t honestly feel too much of a difference.

Let’s look at the chart:

2017 Federal Income Marginal Tax Rates and Brackets – By Filing Status

| Rate | Single Filers | Married Joint Filers | Head of Household Filers |

|---|---|---|---|

| 0.1 | $0 to $9,325 | $0 to $18,650 | $0 to $13,350 |

| 0.15 | $9,325 to $37,950 | $18,650 to $75,900 | $13,350 to $50,800 |

| 0.25 | $37,950 to $91,900 | $75,900 to $153,100 | $50,800 to $131,200 |

| 0.28 | $91,900 to $191,650 | $153,100 to $233,350 | $131,200 to $212,500 |

| 0.33 | $191,650 to $416,700 | $233,350 to $416,700 | $212,500 to $416,700 |

| 0.35 | $416,700 to $418,400 | $416,700 to $470,700 | $416,700 to $444,500 |

| 0.396 | $418,401 and up | $470,701 and up | $444,501 and up |

New standard deductions and personal exemptions.

The standard deductions have also been bumped up every so slightly. Married individuals filing joint returns can take a $12,700 standard deduction. That means that these filers can reduce their “total income taxed” by this amount. Heads of household have a standard deduction of $9,350. Unmarried taxpayers that don’t file as surviving spouses or heads of household can take a standard deduction of $6,350. Married individuals filing separately can do the same.

The personal exemption amount remains at $4,050 for 2017. Same as the standard deduction, this exemption means you can earn even more money without owing tax on it. This also doesn’t even take into account various qualifying tax credits. Some available are the Child Tax Credit, the Hope Scholarship Credit, the Lifetime Learning Credit, and the Earned Income Credit.

The personal exemption phases out starting with an income of $261,500 for single filers, $287,650 for heads of household, $313,800 for married individuals filing jointly, and $156,900 for married filing separately.

How to calculate your tax

The days of doing our own tax returns by hand is long gone. The IRS still provides a handy table for quick calculations, but these days software such as TurboTax, H&R Block, or your real live accountant, will handle this for you. It’s still good to understand the basic calculation, though.

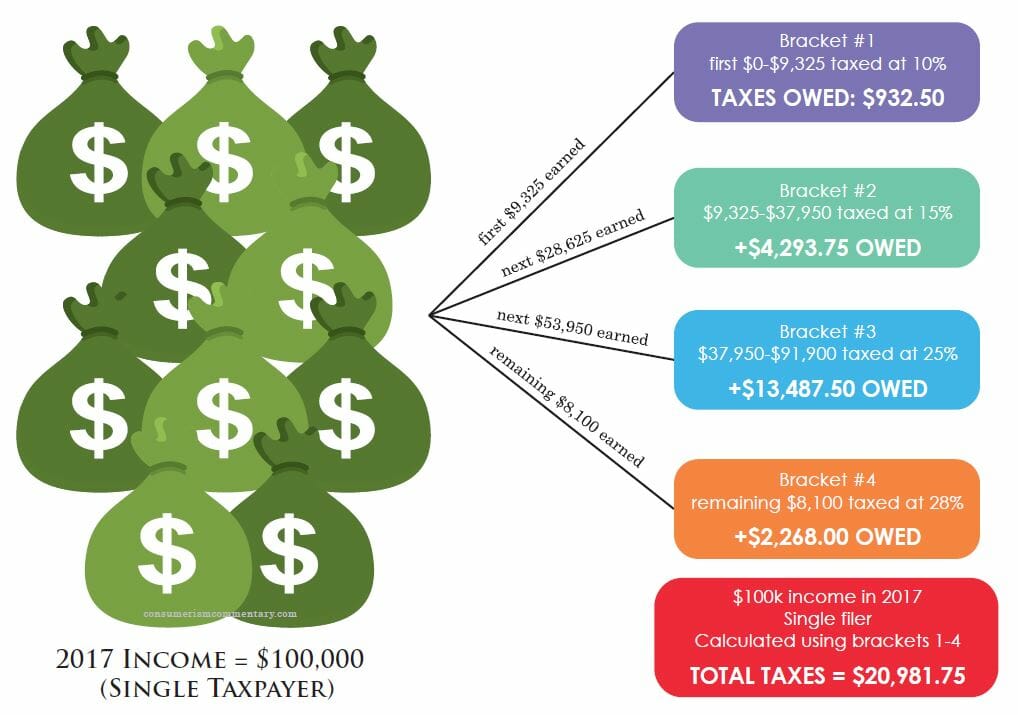

Assume you’re a single filer with a gross income of $110,400, and you have no dependents. You can subtract the personal exemption for a result of $106,300. You can then choose to itemize your deductions, or just take the standard deduction. Choosing the standard deduction of $6,350 reduces your taxable income to $100,000. Now, you apply the marginal tax rates.

With $100,000 in income after the standard deduction, you would owe 10% of $9,325, 15% of $28,625 (the total income covered in the second tax bracket), 25% of $53,950, and 28% of the leftover $8,100 (the fourth tax bracket, which includes the remaining taxable income). You can take a shortcut here, too. You maxed out the first three tax brackets (the first $91,900 of your income), which will add up to $18,713.75 in taxes for everyone.

Now take the remaining income of $8,100 and apply the marginal tax rate of 28%. This adds another $2,268 to your tax bill, bringing the year’s total to $20,981.75. While your marginal tax rate ranged from 10-28%, your effective tax rate comes out to only 19.01% of your gross income (or 20.98% of your taxable income for the year).

Also, note that some investment income could be taxed separately, at a lower interest rate.

What do you think of the 2017 tax brackets? What are your biggest concerns the upcoming year?

Article comments

Do your math backwards to check it.

It I were paying 19.01% effective tax rate on $100,000… That’s easy math; $19,010.00.

Yet you came up with to $20,981.75 tax owed…

So, effective tax rate is 20.98175%.

Giving basically 21% of my money to the government so it can more effectively violate and oppress me… I’d rather be poor.

You’re right, Dustin — if you check the last paragraph before the infographic, you’ll see that it’s 19.01% of gross but 20.98% of taxable income. Definitely a wake up call when you really start to calculate it! It’s a bit disheartening to see in percentages sometimes.

-Stephanie

Where did you get these figures for 2017? This information doesn’t match any tax calculations to date, or the new Trump presidency tax reorganization.

The proposed Trump tax reorganization has neither been approved or implemented, so we aren’t including any of those percentages. If and when they go into effect, we’ll be sure to update the numbers.

These 2017 brackets can be found on IRS.gov or, if you’re looking for an easier read, here on Tax Foundation’s site: http://taxfoundation.org/article/2017-tax-brackets

Also, keep in mind that these are the brackets for the 2017 tax year — meaning, you won’t use these numbers when you file your 2016 taxes in the coming couple of months. For those, you’ll need the 2016 brackets. These numbers shown on these 2017 brackets will be used when you file your taxes in 2018.

–Stephanie