2020 Federal Income Tax Brackets

Uncle Sam has let us know how much we can expect to pay in taxes for income earned last year.

These 2020 brackets are for the taxes you can expect to pay on any income that you earned in 2020. This means that you’ll use these numbers for the taxes that you prepare in the spring of 2021. Let’s take a look and see what’s new.

In This Article:

Updated Tax Rates

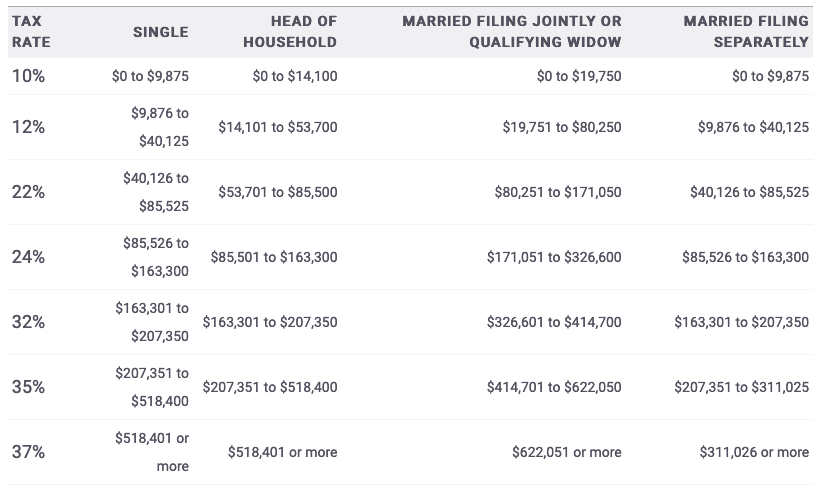

The new brackets below outline the taxes that you can expect to pay on income earned in January through December of 2020, which you’ll then file in the spring of 2021. You can use them to adjust your withholdings and plan your finances next year (especially if you’re a contract employee or freelancer and need to pay quarterly taxes).

- Resource – View the different ways you can file your tax return with H&R Block

2020 Marginal Rates

As you can expect, bracket limits have been bumped for the year. The limits haven’t risen all that much, though, so your impact won’t be too significant.

Here’s a look at the chart:

Standard Deduction

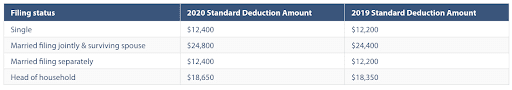

For 2020, the standard deduction is slightly higher than in 2019. This is true for all filing statuses.

If you’re blind, you can take an additional standard deduction of $1,650 when filing as single. For married individuals filing a joint return with a blind spouse, the additional deduction is $1,300. If both you and your spouse are blind, the additional deduction is $2,600.

Personal Exemption

As a result of the Tax Cuts and Jobs Act, more specifically SEC. 11041, the personal exemption for the 2020 tax year is $0. This is a carryover from 2019 when the personal exemption was first eliminated.

How to Calculate Your Taxes

While most of us simply plug our W-2 into TurboTax and let the computer think for us, it’s still important to at least know how tax brackets work.

For example, let’s assume that you’re a single filer with an earned income of $50,000, and you don’t have any dependents. Take your income and subtract your standard deduction ($12,400) and you’re left with $37,600 in taxable income.

Now, apply your marginal tax rates.

Based on your first $9,875 of income, you’ll owe 10% (for a total of $987.50 in taxes). For income dollars $9,876 through $40,125, you’ll owe 12% (for a total of $3,326.88).

For that level of income, your marginal tax rate ranged from 10% to 12%; however, your effective tax rate comes out to 11.47% of your taxable income ($37,600). This is calculated by dividing your total tax liability ($987.50 + $3,326.88 = $4,314.38) by your taxable income ($37,600).

You should also note that investment income can sometimes be taxed separately from, and at a lower interest rate than, earned income.

Next Steps

- Get your tax returns filed quickly, easily, and inexpensively with TurboTax.

Article comments

…and there is no exemption. How was this updated in June 2018? It’s flat out wrong.

These rates and brackets will be made obsolete with the new tax reform act.