H&R Block Online Tax Filing Review

With W-2s and other tax forms now appearing in our mailboxes (or inboxes) daily, chances are that taxes are on your mind. If you believe you’ll owe money to the government, it makes sense to put off filing as long as possible, up to this year’s filing deadline. If you expect to receive a refund, however, file your taxes early to receive your money faster.

Previously, H&R Block offered a product that allowed customers to get their refund even faster than the few weeks the IRS takes to process. However, they no longer offer these (though, you can sign up here to be first in line when they begin offering the Emerald advance lines of credit again). While you can find anticipation loans through third-party companies, these are typically accompanied by high fees. So, as of now, the least expensive and quickest way to receive a refund is to allow the IRS to deposit your refund directly into your bank account.

Regardless of how you receive your refund, you can file online using H&R Block’s system if you’d prefer to not visit a local office in person (buying a software package is one more option you have, too!). Here is what you need to know about filing online.

Different editions available

H&R Block offers three tiers of their online filing system in 2017 (for filing your 2016 taxes).

The More Zero Free Edition should be sufficient for most taxpayers. If you file using a 1040EZ, 1040A or 1040 with Schedule A, H&R Block promises that you’ll pay nothing when you file your taxes online. For my review, I started with the Free Edition to see how far I could proceed before being required to upgrade to a more advanced — and more expensive – version of the software.

I chose to begin entering my tax information without creating an account, which would store my progress on H&R Block’s servers. I knew that if I wanted to save my tax return either to complete at a different time or to finish filing, I would need to create an account.

H&R Block clearly outlines the tax preparation process into three steps.

Income

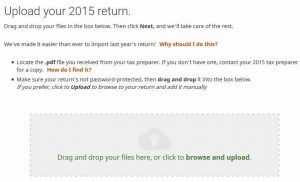

For the first step, H&R Block suggests uploading your 2015 return. You have the option to skip this step and enter everything manually, which I chose to do.

The software then asks about any life-changing events during the past year. I selected “lost a job” because I left my corporate employment at the end of the year. I expected some immediate feedback about my life-changing event, but H&R Block proceeded to ask about my filing status (single) and required me to enter my personal information including Social Security number and dependents.

After verifying my personal information, I began the section pertaining to income. This section begins by reviewing a list of my needed documentation for completing this information including a variety of 1099 forms (1099-G, 1099-INT, 1099-MISC, 1099-B, etc.) and any W-2 forms. I pulled up my W-2 online to verify the numbers my former employer reported to the government.

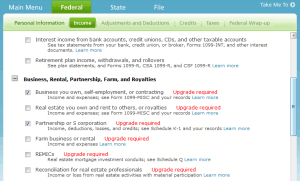

Even before entering any income information, by virtue of the fact I have self-employment and business income, H&R Block informed me an upgrade would be required. Adding gains from the sale of investments to your income would require an upgrade, as well.

Even before entering any income information, by virtue of the fact I have self-employment and business income, H&R Block informed me an upgrade would be required. Adding gains from the sale of investments to your income would require an upgrade, as well.

There is no need to get fancy. If you don’t need hand-holding as you walk through the process, the H&R Block Deluxe Edition — which is the least expensive flavor of the two paid options — is all that’s necessary. Of course, H&R Block will keep suggesting further upgrades, but if the Free Edition doesn’t contain all the features you need, the Deluxe Edition will likely be sufficient.

Adjustments, deductions and credits

I continued through the income section, entering information from my business, and proceeded to the section for adjustments and deductions. After entering the appropriate deductions, H&R Block provided the opportunity to choose to file using my itemized deductions or the standard deduction, with the total effect on my tax return for each.

Following the deductions, I was prompted to select credits for which I might qualify. The credit section moved quickly for me, and I proceeded to the taxes section, where H&R Block checks for additional taxes or penalties I would be required to pay. These include excess contributions to, or early withdrawals, from retirement accounts.

Printing and filing the returns

After finishing all sections and reviewing my federal tax return, H&R Block transferred my information to the state return. I entered the information that applies to New Jersey, such as the renter/homeowner rebate. After finishing the forms, I noticed that I did not enter the estimated tax payments I made throughout the year, so I went back to the pages to enter that information for both my federal return and state return.

At this point, H&R Block suggested upgrading to “H&R Block Basic + Best of Both Worlds,” which is an option where the tax returns are reviewed by a local H&R Block office. H&R Block would be the tax preparer of record, so they would responsible to pay any fees due to mistakes on the returns. This service starts at $79.95 plus $34.95 for the state return.

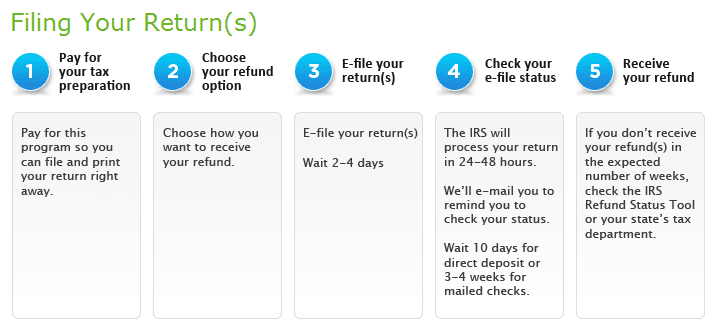

In the final stages of filing, H&R Bock allows me to review the charges. I was required to upgrade from the Free Edition to the Deluxe Edition, so my federal return cost $34.99. The state return cost $36.99. Once filing and providing my banking information for direct deposit, I should receive my refund within ten days.

The first option for paying this fee is H&R Block’s Simple Pay, in which the filing fees are deducted from your refund (if the government owes one to you), for an additional fee. Other options are credit and debit cards, electronic transfer from a bank account, or use a coupon code.

Only after paying for the return does H&R Block offer some of its own options for receiving a refund. The cheapest method to ever receive a return, though, (no matter which company you use to file) is to open a free bank account and get direct deposit. Then, just wait and in less than two weeks, you should have your refund in hand!

Consumerism Commentary is an authorized affiliate of H&R Block. Six giveaway products were provided to Consumerism Commentary free for the benefit of our readers. H&R Block did not compensate Consumerism Commentary for this review.

Photo: socialwoodlands

Article comments

All I want to know is if there is any income tax due on $21,786 with 4 deductions

I usedBlock software for years. This year they finally broke me. A lot of money to pay for a program that’s such a bucket of crap. Next year I’ll reluctantly pay some poor schmuck to deal with next year’s dubious ‘improved’ version.

I normally use H&R Block “Best of Both” for filing on line. I cannot seem to find this option anywhere this year. Has it been discontinued?

Deana,

It is hard to find info about Best of Both, certainly, but it is still alive and well. You can read more about it here, on H&R Block’s blog: http://blogs.hrblock.com/2017/01/24/hr-block-best-of-both/

Warmly,

Stephanie

stephanie@doughroller.net

The sneaky $34.95 is absolutely cheating most of the users. On the UI there is no other options clearly listed, so most of users will be fooled to choose RAC, and then be charged $34.95 as “tax preparation fee” (indeed it is NOT). I doubt this is already illegal.

How can I upgrade from basic to deluxe in the middle of my return?

I have used H&R for the past 4 years have been very satisfied until now. When a problem occurs H&R definitely bails on you, and they do all they can to make it look bad on you and not them. I am very disappointed in their service and will be using a different tax prepare next year.

I just found out that H&R block, did not file my state taxes.. yet they took my 39.95 with no worries.. now I’m facing penalities with the state and no one at H&R block seems to be able to help.. very very disappointed.

If you do the 1040EZ online, is there a way to see the 1040 EZ form?

I’ve used them before and so far so good

My tax situation changed so much in 2010 that I definitely need this to help me out.

I’ve never used H&R Block, but I think this could be really helpful for me!

thanks for the giveaway. will tweet later 🙂

Sign me up! Sounds great! 🙂

Tweeted here:

http://twitter.com/sazzyfrazzy/status/39928871210070016

Left a comment on your FB post!

Please enter me! I usually use TurboTax but I’m willing to try this one!

I’ll give it a shot. Thanks Flexo!

count me out for the contest, but thank you for another great opportunity!

I have used H & R block online for the past two years and I am very satisfied with their product. Very easy and simple to use.

Great piece, thanks!

I have never used H&R block, but I need their guidance.

A RAC or refund anticipation check does not give you the money faster than the IRS. They wait for the IRS to deposit to them, then they cut you a check.

It does if you don’t have a bank account. The IRS would need to send you a check, which takes longer than direct deposit. I’m not advertising for the company, but with a refund anticipation check, the refund from the IRS is directly-deposited into H&R Block’s account, and H&R block produced the check immediately. That’s faster than receiving a check from the IRS.

Then you should qualify your statement in the article. I work for H&R Block, and a lot of my clients choose the direct deposit option with the RAC, which actually takes LONGER than a direct deposit from the IRS.

I usually go to the IRS for a free file, but I would love to try H&R.

I would definitely try it out,

Hi,

I normally use turbotax but I would like to try hr block tax program also.