Wealthsimple Review - Truly Unique Financial Robo Advisors

There are dozens of robo-advisors on the market, but one that stands out as truly unique is Wealthsimple. The platform offers the usual investment portfolios that robo-advisors provide, but they also add socially responsible investing, as well as a portfolio designed based on Islamic law. In fact, the platform consistently wins awards and positive reviews for its socially responsible investing portfolio. And if any of these options interest you, you can open an account with Wealthsimple with no funds at all.

About Wealthsimple

Wealthsimple is one of the most unique robo-advisors on the market. Based in Canada, and launched in 2014, the platform serves investors in the U.S. and the United Kingdom. Not only do they offer several conventional investment options, but they also offer portfolios for socially responsible investing, and for followers of the Islamic faith.

Wealthsimple raised $165 million in capital from the Power Financial Group, a leading financial holding company with $1.4 trillion in assets under management. Wealthsimple itself has has grown in the last four years to serve 100,000 clients, with more than $2 billion in assets under management. The Better Business Bureau gives Wealthsimple a rating of “A” (on a scale of A+ to F).

Like most all robo-advisors, Wealthsimple invests using modern portfolio theory (MPT), an investment Strategy that favors asset allocation over individual security selection. Most portfolios are constructed of low cost, index-based exchange traded funds (ETFs). The ETFs are invested in a mix of foreign and domestic stocks and bonds.

Wealthsimple Features and Benefits

Minimum Initial Investment. None.

Available Accounts. Individual and joint taxable accounts; traditional, Roth and SEP IRAs; trusts.

Automatic rebalancing. Available on all accounts.

Dividend reinvesting. Available on all accounts, providing even greater compounding of investment returns.

Tax-loss harvesting. Available on all taxable accounts to minimize your tax liability. (This Feature is not available on tax-sheltered retirement plans, since they do not create investment tax liabilities.)

Investment Advice. Though your portfolio enjoys automated investment management, you will have access to human advisors on a regular basis.

Free Portfolio Review. You can take advantage of this service by entering some general information, uploading your financial statements, then setting up a call with a Wealthsimple money expert. The review will focus on your debts and your savings pattern, as well as your investment portfolio.

You’ll be able to set goals and create a plan to reach them. Wealthsimple will also diagnose the fees you’re paying in the investments you have, as well as the structure of your investments to minimize your investment tax bill going forward.

Customer Service. This is available by either email or phone, Monday through Thursday, from 9:00 AM to 8:00 PM, Eastern Time, and Friday’s 9:00 AM to 5:30 PM, Eastern time. The platform also has a Help Center where most of your questions can be answered quickly.

Account Security. Your account is protected by the Securities Investors Protection Corporation (SIPC) for up to $500,000 in cash and securities, including up to $250,000 in cash.

To protect your information, Wealthsimple uses 256-bit secure socket layer (SSL) encryption on all information transmitted between your browser and their web servers. They also back up all information using cloud technology. They adhere to industry standards for protecting your data, securing their web application, and the processing of all transactions.

Get Your Free Financial Plan For The Lifestyle You Strive For

Wealthsimple Investment Methodology

As noted earlier, Wealthsimple invests your portfolio using modern portfolio theory and ETFs comprised of domestic and foreign stocks and bonds.

They currently offer four different portfolio types:

- Wealthsimple Basic

- Wealthsimple Black

- Wealthsimple Socially Responsible Investing (SRI)

- Wealthsimple Halal

Each portfolio uses the same pricing format but is set up in very different ways. Below are the details for each portfolio.

Wealthsimple Basic

This portfolio was designed for investors with accounts of less than $100,000. Depending on your time horizon, risk tolerance, investment goals, you’ll be set up in one of three portfolio allocations (with asset class allocations):

- Conservative (35% stocks, 65% bonds)

- Balanced (50% stocks, 50% bonds)

- Growth (80% stocks, 20% bonds)

Funds held in the portfolios will consist of the following ETFs, depending on whether your allocation is determined to be conservative, balanced, or growth:

| Asset Class | Symbol | ETF | Portfolios |

| US Stocks | VTI | Vanguard Total US Market ETF | All |

| US Mid-Cap Value | VOE | Vanguard Mid-Cap Value ETF | All |

| US Small-Cap Value | VBR | Vanguard Small-Cap Value ETF | All |

| Foreign Stocks | VGK | Vanguard FTSE Europe ETF | All |

| Foreign Stocks (exporter & dividend tilt) | DXJ | WisdomTree Japan Hedged Equity Fund | All |

| Emerging Market Stocks | VWO | Vanguard FTSE Emerging Markets ETF | All |

| Municipal Bonds | MUB | iShares National Muni Bond ETF | All taxable accounts |

| US Inflation Protected (TIPS) Bonds | TIP | iShares TIPS Bond | Conservative, Balanced |

| USD Govt and Corporate IG Bonds (includes EM) | BND | Vanguard Total Bond Market ETF | All |

| High Yield Bonds | ANGL | VanEck Vectors Fallen Angel High Yield Bond ETF | Conservative, Balanced |

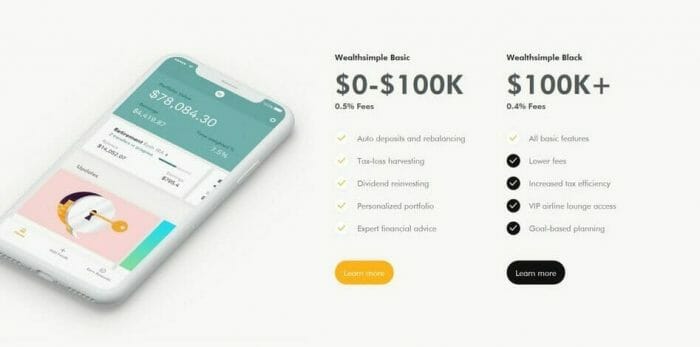

The Wealthsimple Basic Portfolio includes a personalized portfolio, automatic re-balancing, expert financial advice, automatic dividend reinvestment, auto depositing, and tax-loss harvesting.

Wealthsimple Black

This is Wealthsimple’s premium portfolio for accounts of $100,000 or more. You’ll get the benefit of lower fees (0.40% of your account balance, vs. 0.50% on the Basic Portfolio), as well as access to dedicated financial planning and VIP airline lounge access.

Wealthsimple Black offers the same portfolio allocations and benefits as Wealthsimple Basic. Along with the lower annual fee, and access to financial planning, this portfolio offers tax-efficient investing. In addition to tax-loss harvesting, it also provides tax-efficient asset allocation.

This is a strategy that involves holding income generating assets in tax-sheltered plans where they’ll be shielded from income tax. Meanwhile, capital gains generating assets will be held in taxable accounts, where they can take advantage of more favorable long-term capital gains tax rates.

The VIP airline lounge access allows you to use more than 1,000 airline lounges in over 400 cities. You’ll receive a complimentary Priority Pass membership for you, plus one travel companion.

Wealthsimple Socially Responsible Investing (SRI)

This is the portfolio Wealthsimple is perhaps best known for. The portfolio focuses on investing in companies with low carbon emissions that support gender diversity, and promote affordable housing.

The funds included in this portfolio are as follows:

- iShares MSCI ACWI Low Carbon Target (CRBN) – Low Carbon, comprised of global stocks with a lower carbon exposure than the broader market.

- PowerShares Cleantech Portfolio (PZD) – Cleantech, comprised of cleantech innovators in the developed world.

- iShares MSCI KLD 400 Social Index Fund (DSI) – Socially Responsible, comprised of American companies that are socially responsible.

- SPDR Gender Diversity (SHE) – Gender Diversity, comprised of companies with more gender diversity among their leadership.

- PowerShares Build America Bond Portfolio (BAB) – Local Initiatives, comprised of bonds issued by municipalities to support local initiatives.

- iShares GNMA BD ETF (GNMA) – Affordable Housing, comprised of government-issued securities that promote affordable housing.

PowerShares Build America Bond Portfolio and iShares GNMA BD ETF represent the bond allocations in the Socially Responsible Investing Portfolio. The allocations are also divided among Conservative, Balanced, and Growth, in which these two funds will represent the bond allocation, while the remaining four funds will cover the stock portion.

Pricing is determined by status as Basic (under $100,000, 0.50%) or Black (over $100,000, 0.40%). Portfolios of $100,000 or more also come with all the added benefits of the Wealthsimple Black Portfolio.

Wealthsimple Halal

The Wealthsimple Halal Portfolio is designed to provide long-term investing, based on Islamic investing principles. That is, the investments in the portfolio are managed within the scope of Sharia law. In fact, all investments are screened by a third-party committee of Sharia scholars.

The Halal Portfolio excludes investments in companies engaged in the following activities:

- Gambling

- Arms

- Tobacco

- Adult entertainment

- Pork related products

- Businesses that derive significant income from interest on loans

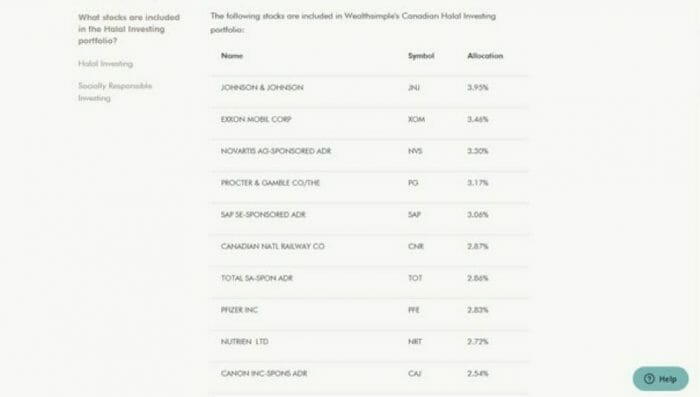

The last restriction is particularly important. It means the portfolio is not invested in bonds, since fixed income securities pay interest. The entire portfolio is invested in stock of 50 different companies, all of which have been considered Sharia-compliant. A list of the top 10 holdings in the portfolio includes the following:

The one disadvantage of the Halal portfolio Is that it can’t be customized based on your own risk tolerance. A single portfolio is used for all investors. It is also considered to be an actively managed portfolio since it does not invest in index-based ETFs.

Fees on the Halal Portfolio are consistent with Wealthsimple portfolios, at 0.50% for portfolios under $100,000, and 0.40% for portfolios above. Portfolios of $100,000 or more also come with all the added benefits of the Wealthsimple Black Portfolio.

Wealthsimple Pricing and Fees

Wealthsimple uses two pricing tiers for all portfolios:

- Balances up to $100,000: 0.50% of account

- Balances greater than $100,000: 0.40% of account

They are currently offering a promotion in which they will cover the transfer fees if you move at least $5,000 from another brokerage account, IRA, or 401(k) over to Wealthsimple.

Wealthsimple Smart Savings

Wealthsimple now offers a savings option, Wealthsimple Smart Savings. If you sign up now, you’ll earn at least 1% before paying any fees.

Wealthsimple charges a fee of 0.25% of your Smart Savings balance–but only to the extent, you earn in excess of 1% on your portfolio. If you earn less, no fee will be charged. When the fee is charged, it will be taken out on a prorated monthly basis.

Benefits of Wealthsimple Smart Savings include:

- No Minimum account size

- No introductory rate

- Unlimited transfers

- Smart Savings are covered by SIPC, which includes protection for up to $250,000 in cash

- Can be included in your total holding toward the $100,000 portfolio size to qualify for Wealthsimple Black

The unlimited transfers feature is particularly important. With most savings type accounts, you are limited to no more than six withdrawals per 30-day statement cycle. This is a federal requirement under Regulation D. But with Smart Savings, your transfers are unlimited, giving you access to your funds at any time.

Get Yourself a Free Private Financial Advisor

How to Open an Account with Wealthsimple

You can open an account with Wealthsimple in just a few minutes, by completing an online application. You’ll start the process by entering your email address, then create a password. You’ll move on to the application, which will involve answering questions about your previous investment experience, as well as completing a risk tolerance questionnaire.

When the application and questionnaire are completed, you will e-sign the Investment Management Agreements, then link your bank account for funding purposes. Once your account is up and running, you can also set up auto depositing, so that you can make regular contributions to your account.

Wealthsimple Advantages & Disadvantages

Advantages:

- There is no minimum initial investment required, making the platform perfect for new and small investors.

- Investors have access to human assisted advice.

- Tax-loss harvesting is available on all taxable accounts.

- The Socially Responsible Investment Portfolio allows you to invest consistent with your beliefs.

- The Halal Portfolio is designed specifically for those of the Islamic faith, who follow Sharia law.

- The Free Portfolio Review. Even if you don’t open an account, you can use this service to review your financial situation, as well as your investment portfolio, to make improvements in both.

- Wealthsimple is one of the very few robo-advisors that actually publishes the investment results of each of its portfolios. You can easily compare their portfolios against other platforms, to help you decide which one to go with.

Disadvantages:

- Wealthsimple’s fee structure is on the high end of the robo-advisor range, which is typically between 0.25% and 0.50%. Wealthsimple’s fee is 0.50% on portfolios below $100,000, though it does fall to 0.40% on portfolios above.

- The monthly fee on the Smart Savings account is a bit complicated. It can be as high as 0.25% per year, but will only be charged if you earn in excess of 1% in investment returns.

- The Halal Portfolio does not include a bond allocation, but that’s only because Sharia law prohibits collection of interest.

FAQs

Question: Is tax-loss harvesting automatic, and do I have to pay extra for that service?

Answer: Tax-loss harvesting is automatic on the Wealthsimple Black Portfolio level ($100,000 or more). For Basic Portfolio amounts (under $100,000) you must activate the tax-loss harvesting feature. This is because tax-loss harvesting isn’t always necessary or desirable for all investors. There is no additional fee for the service.

Question: Since the Halal Portfolio is invested according to Sharia law, where does guidance for the portfolio come from?

Answer: Wealthsimple relies on the expert team at MSCI World Islamic Index (USD) to construct the portfolio.

Question: Even though the Free Portfolio Review is free, does taking advantage of it obligate me to open an account with Wealthsimple?

Answer: No, it’s a truly free, no-obligation service offered by Wealthsimple. But once you complete the Review you just might want to become a Weathsimple investor.

Who Can Benefit by Investing with Wealthsimple?

Wealthsimple isn’t the lowest cost robo-advisor available. The fee of 0.50% on portfolios below $100,000 is well above the 0.25% charged by many other robo-advisors. However, where Wealthsimple excels is in its specialty portfolios. It’s socially responsible investing portfolio is regarded as one of the best in the industry. And its Halal Portfolio is one of the few available anywhere.

You may be drawn to Wealthsimple primarily by one of these two specialty portfolios. However, you may also find yourself diversifying into either the Basic or Black Portfolio as well. Either way, Wealthsimple has rapidly evolved into one of the most popular and highly recommended robo-advisors in the industry.

If you’d like more information, or if you’d like to open an account, visit the Wealthsimple website.

Article comments

Should you use Betterment, and how does it stack up against competing robo advisors? Get the facts about Betterment from our updated review.