How to Pay Taxes Online - Pay State & Federal Taxes Online

I doubt there’s a person alive who enjoys paying taxes. Whether you are self-employed and file quarterly, owe Uncle Sam a fat check every year, or simply have the occasional balance due after an April 15th filing, forking over earnings to the IRS isn’t much fun.

You can make the process just a little bit easier, though, by paying your owed taxes online. No more writing checks, driving to the post office, or worrying about whether your envelope arrived safely. These days, you can be paid up and worry-free with just a few clicks of your mouse. In many cases, you can even automate the process, taking the work and worry out of your payments.

There is more than one way to send money to the U.S. Treasury. Thanks to a few approved processors, you can easily set up electronic withdrawals, automatic bank transfers, or pay with a debit or credit card online.

Here’s a look at a few of the ways that you can pay your taxes online.

Pay When You File

If you’re filing your taxes online, you’ll be told how much you owe at the end of the filing process. And in almost every case, the filing software that you use will allow you to set up an automatic withdrawal to cover your tax shortage at the same time.

These payments are set up using your bank account, the same as an ACH transfer. You will need both your routing number and account number in order to schedule the withdrawal. You can even pick the date and time that the payment will be taken, as long as it’s completed before the filing deadline (for the 2018 tax year, this will be April 17, 2019).

If you want to pay when you file using a debit or credit card, this is often possible depending on the tax software you use. Some companies will allow you to process card payments, though beware that they typically charge a fee for doing so. Fees vary but are usually between 2-4% of the total payment amount.

IRS Direct Pay

One of the easiest ways to pay your tax bill is through IRS Direct Pay. This system is free and easy for taxpayers to use, offering a payment solution that doesn’t even require registering.

To use IRS Direct Pay, you’ll simply need your routing number and account number for the checking or savings account you want to use. You don’t need to set up an account, and payments can be made 24/7/365 (to avoid penalty, though, you’ll want to be sure that your payments are posted prior to 11:59pm on Tax Day). You’ll also get immediate confirmation of your successful payment as soon as it’s processed.

IRS2Go

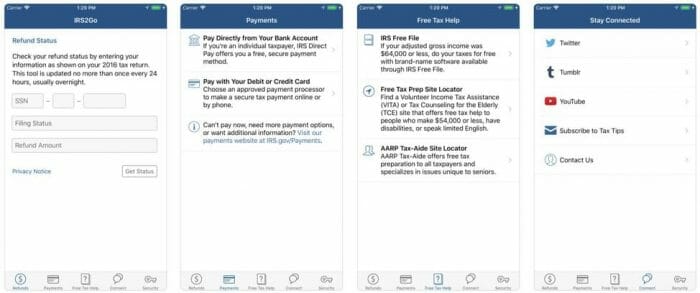

Collecting taxes may be one of the government’s oldest actions, but that doesn’t mean that Uncle Sam can’t also jump into the 21st century. Now, thanks to the IRS2Go app, you can submit tax payments from your mobile device, no matter where you are.

IRS2Go is free and available on Google Play, the App Store, and on Amazon. Simply download IRS2Go to your phone or other mobile device and then use the app to make payments via debit or credit card, or even Direct Pay.

In addition to submitting payments, IRS2Go can also be used to track the status of your federal tax return, get helpful tax tips, and find tax preparation assistance near you.

Approved Third-Party Card Processors

If you want to make a payment via debit or credit card anytime other than when you are e-filing your taxes for the year, you’ll need to do so through an approved third-party processor. These payment processors will allow you to make a payment online, over the phone, or even through your mobile device, and are typically available 24 hours a day, 365 days a year.

When you submit a payment using a debit or credit card through a payment processor, you will be charged a fee. This fee varies depending on which service provider you choose, but typically ranges from about 2% to 4% of the total payment submitted.

This fee does not go to the IRS and is kept by the processing entity. As with tax preparation and filing costs, this fee may be tax deductible, though.

Here are the currently approved payment processor companies that you can utilize when making a debit or credit card payment to the IRS. These are also the same companies that you will choose from if you want to make a card payment through the IRS2Go mobile app.

- Pay1040.com – Debit card payments: $2.59 flat fee, Credit card payments: 1.87% fee (minimum $2.59), Can use digital wallets to process payments (same fees apply)

- PayUSAtax.com – Debit card payments: $2.58 flat fee, Credit card payments 1.97% (minimum $2.69), Can use digital wallets to process payments (same fees apply)

- OfficialPayments.com/Fed – Debit card payments: $2.00 flat fee up to $1,000; $3.59 flat fee for payments over $1,000, credit card payments 1.99% (minimum $2.50), Can use digital wallets to process payments (same fees apply)

If you are using a credit card to pay your tax bill in an effort to rack up rewards or meet a minimum spend requirement, it’s certainly possible with the processors listed here… assuming that you have a credit card offering 2% or higher on all purchases. Just keep in mind that the fees for these payments will eat up most (if not all) of the rewards that you would see.

If you don’t pay your balance in full after the billing cycle ends, you will begin accruing interest, too. Any rewards you might have earned can easily be dwarfed by the finance charges imposed by most credit cards. Only use a credit card to pay off a tax bill if you plan to pay off your statement in full.

Electronic Federal Tax Payment System (EFTPS)

The Electronic Federal Tax Payment System, or EFTPS, has been around for a very long time. This year-round service has been trusted by businesses to handle electronic payments for years. It offers taxpayers a free way to make payments toward their tax bill in a safe and quick way. Plus, you’ll be able to make payments associated with any number of tax forms (more than two dozen of them, in fact!), as well as handle estimated and amended returns.

The only downside to the EFTPS is that you will need to allow some time for registration. In order to enroll, you will need both a personal identification number (PIN) and password, which can take a while to acquire. However, if you aren’t paying your bill at the eleventh hour, EFTPS makes the whole process easy and secure.

If you want to play payments ahead of time, EFTPS can help you with that, too. You can schedule payments as far as 30 days in advance, using both Direct Pay and electronic funds transfers to do so.

Online Payment Agreement

Do you owe more on your tax bill than you’re able to pay at the moment? Then you can apply for an online payment agreement with the IRS and essentially have the option of a payment plan.

Payment arrangements will allow you to pay your tax bill over time. This direct debit installment agreement is automated, drafting your monthly contribution to your tax bill automatically and eliminating the need to physically send in a payment each month.

Payment agreements are not guaranteed, so you will need to apply if you feel that you are unable to manage your full tax bill all at once. You can apply here.

If you owe more than you are able to pay, you can also apply for an Offer in Compromise. This is a type of settlement with the IRS, enabling you to pay less than your debt owed if it would create a financial hardship to fork over the total amount. Not everyone will qualify for an Offer in Compromise, and you will need to apply for consideration.

Another Option: Cash

Writing a check to the IRS can be a hassle, which is why electronic payments have become so popular. However, some taxpayers would rather pay their tax liability with cash, instead of a bank account transfer or debit/credit card payment.

If this is the case and you would like to make a cash payment on your taxes, you do have one option. The IRS recently partnered up with Official Payments and PayNearMe to offer cash payment services at local 7-Eleven locations.

You can choose from 27,000 approved payment locations available across the country. The process is not instantaneous, so keep that in mind when timing your payment. There is a payment limit of $1,000 a day, and payments usually take between 1-2 business days to post to your account after a cash deposit is made at a local gas station. There is also a $3.99 fee per payment, so be aware of that added expense.

Should You Pay Online?

We live in a world of convenience. Gone are the days of mailing in checks, let alone for your tax bill–this makes it easy to understand why so many online IRS bill payment options have cropped up in the last few years.

If you owe Uncle Sam this year, you can utilize a number of different online payment choices to cover your liability. Whether you want to set up an automatic electronic withdrawal, pay with a debit or credit card, or even cover the balance in cash, you have options available to you. Just be aware that paying a tax bill with a card usually results in fees, and not all methods are instantaneous (so don’t wait until 11:50pm on April 17 to initiate your payment).

In order to make this process complete, we urge you to try filing you taxs online. Most of the offered services are simple to operate and offer many helpful features that will save you a tone of time, effort and in some cases money.

How will you pay your 2018 tax bill?

Article comments